At the intersection of the logistics, warehousing, fulfillment, and transportation sectors, you’ll find a massive development in southern Dallas County. It’s where a big business idea traveled a long road filled with potholes, detours, and roadblocks before becoming something so expansive, so special, it requires parts of five cities to hold it all.

It was the late 1990s, and Dallas-Fort Worth developer Mike Rader had a vision for a vast expanse of land south of Interstate 20 flanked by Interstate 35 on the west and Interstate 45 on the east.

“It’s starting to take off and prove itself.”

Mike Rader

His vision, for an intermodal freight transport terminal owned and operated by a major railroad, set the stage for what is today one of the highest-profile industrial developments in the country.

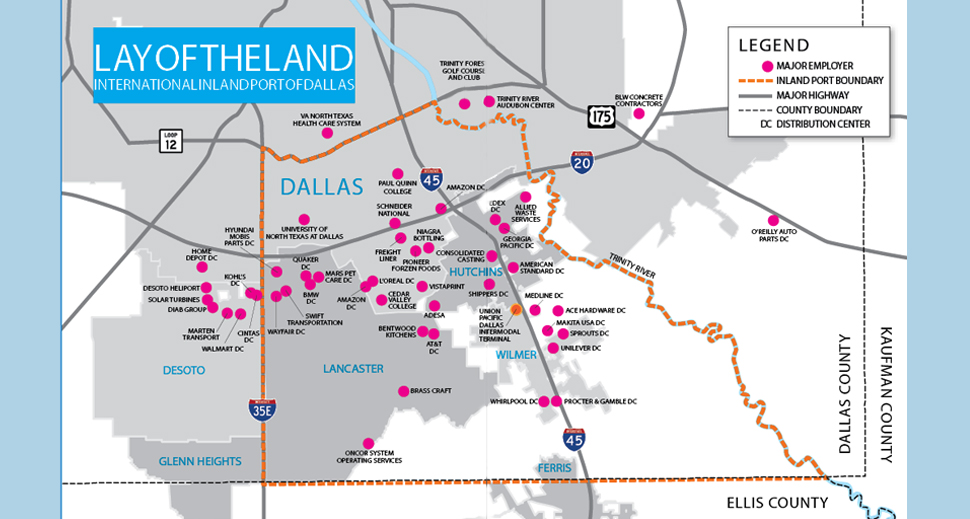

Known as the International Inland Port of Dallas (IIPOD), the 7,500-acre region contains a Union Pacific intermodal facility and ample, affordable land flanked by three interstate highways. The inland port has attracted the nation’s biggest industrial developers along with many of the country’s most recognizable Fortune 500 companies, including Amazon, FedEx, Kohl’s, and Whirlpool.

“It’s starting to take off and prove itself,” Rader says from his nondescript beige metal office building along Wintergreen Road in Hutchins where maps of his and his partners’ land holdings adorn a conference room table and walls. Construction of massive warehouses—some exceeding 1 million square feet—have become routine over the past three years in the IIPOD.

The port and the businesses that operate there are a part of booming economic sectors that are expected to grow even bigger.

According to the industry website Supply Management, the global logistics market will be worth $15.5 trillion by 2023, up from its current value of $8.1 trillion. Figures in an IBISWorld study show that the order fulfillment industry is worth roughly $22 billion, with the U.S. warehousing industry employing roughly 1 million workers. Most of those employees work in fulfillment and distribution centers like the ones at the International Inland Port of Dallas.

After a slow start, the port takes off

It wasn’t always this way. The inland port coalesced slowly, much to the chagrin of developers and economic development officials in the five-city region comprising its boundaries: Dallas, Lancaster, Hutchins, Wilmer, and Ferris.

Rader initially wooed Burlington Northern to build and operate an intermodal facility in southern Dallas County, but the deal fell through days before papers were to be signed when BN and Santa Fe Railway announced a merger.

MIKE RADER (photo: MICHAEL SAMPLES)

It became a moot point because Santa Fe already had a Fort Worth intermodal that the merged railway would use. That intermodal would later become an economic driver for Ross Perot Jr.’s massive Hillwood industrial development at Fort Worth Alliance Airport.

Over in South Dallas, meanwhile, Rader started over from scratch, this time with Union Pacific.

It would take him seven years to convince UP to build an intermodal terminal in the inland port. The facility, which spans a portion of Wilmer and Hutchins, opened in 2005.

Around that time, FedEx — attracted by the confluence of interstates — located a massive ground transportation distribution center in the area. “Because FedEx is such a leader in logistics, it was a real endorsement of us as a location for logistics, warehousing and distribution,” says Guy Brown, economic development director in Hutchins, where FedEx is located and whose entire city limits is within the port’s boundaries.

Soon thereafter, a California developer came calling. The Allen Group was convinced intermodals were the future driver of warehouse growth, but its Bakersfield industrial park was too close to the Port of Los Angeles to interest railroads in building an intermodal there. When it learned of UP’s plans in Dallas County, it bought land near the intermodal, says Richard Allen, CEO of The Allen Group.

1015 Wintergreen in Hutchins

Between 2005 and 2006, The Allen Group bought approximately 6,000 acres of raw land in southern Dallas County. “We understood that the land in and around these intermodals was considered ocean front property,” says Allen, whose development firm would later be selected to develop an intermodal and control development around it on behalf of BNSF in Kansas City.

By 2008, there was approximately 5 million square feet of industrial space either built, under construction, or planned in the inland port with only about 500,000 square feet actually occupied, according to Dallas Mayor Mike Rawlings.

Then the Great Recession intervened in The Allen Group’s grand 6,000-acre vision—which it dubbed the Dallas Logistics Hub—and the group sought out bankruptcy protection. The developer sold the two buildings it had developed and about 1,700 acres before successfully emerging from bankruptcy in 2012.

LAY OF THE LAND International Inland Port of Dallas

Gaining momentum

Today, The Allen Group controls about 1,300 to 1,400 acres of raw land within the inland port’s boundaries and has been selling off parcels to developers. It remains bullish on the inland port’s future.

“It isn’t just the intermodal that’s driving development,” Allen says, “it’s also the interstate highway system. That region is literally surrounded by highways. That was a huge area of vacant land; it was just a perfect spot. Right now that’s the hottest industrial market in the Metroplex.”

Rader, who — with partners — controls about 4,000 acres in the IIPOD, including some land purchased from The Allen Group, points to a Stream Realty study as an indication of the market’s strength.

The Dallas-Fort Worth region delivered 26.8 million square feet of industrial space in 2017, according to the Stream Realty report, which used CoStar Realty Information Inc. data. The Inland Empire in Southern California was second, delivering 20.2 million square feet and Chicago was third with 19.7 million square feet.

“Ten years ago, you saw meaningful development. Now, fast-forward 10 years, and you’ve got half the developers in town building down there.”

Jeff Thornton

Today, Rawlings notes that, according to a recent analysis, more than 32 million square feet of industrial space has been built, is under construction, or is planned in the inland port with over 24 million square feet occupied or under construction with an occupant designated.

The developing port has become a welcome tax base for the cities that occupy its boundaries: Dallas, Lancaster, Hutchins, Wilmer, and Ferris. “In 2007, the taxable value of real property in the Dallas-portion of the inland port was approximately $19 million,” Rawlings said.

“By 2015, the taxable value of real property in the Dallas-portion of the Inland Port had grown to over $135 million. In terms of job creation, the inland port now has over 3,000 direct jobs.”

Duke, an Indianapolis-based publicly traded real estate investment trust (REIT) and S&P 500 company (NYSE: DRE), is one of the most prolific developers in the IIPOD, having developed six buildings totaling 4.5 million square feet – with 2 million square feet of that in the last two years.

It owns all but one of the buildings it developed there. “Starting about 10 years ago, the South Dallas submarket started to gain momentum as the new frontier for industrial development,” says Jeff Thornton, Duke Realty’s regional senior vice president. “Ten years ago, you saw meaningful development. Now, fast-forward 10 years, and you’ve got half the developers in town building down there. It’s the most active submarket with about 12 million square feet of speculative space under construction or on the ground.”

When looking at all industrial markets in Dallas-Fort Worth, those to the north, west, and northwest of Dallas were first to develop and are transitioning to infill markets, says Thornton.

South Dallas, with its abundant land, intermodal facility, confluence of interstates, and available labor pool holds the advantage for future industrial activity in North Texas, he says.

Union Pacific’s Dallas Intermodal terminal (Photo by Michael Samples)

“As an industrial developer and someone who has a vested interest in that area of town, it’s been great to see the city of Dallas and the Dallas Regional Chamber get behind the Southern Sector,” Thornton says. “Mayor Rawlings’ push with his Grow South initiative and the chamber’s attention to promoting that area of town really reinforces the viability of the area and has helped fueled the growth.”

“For the city of Dallas, we’re looking to continue to capitalize on robust market conditions by using strategic investments in infrastructure and incentives to support development of the remaining parcels of land in the Dallas portion of the Inland Port,” Rawlings says.

“We see opportunities to step up our efforts in partnering with employers, nonprofits, local colleges, and other governmental entities such as the Dallas Independent School District and the Dallas County Community College District to support the continued creation of quality employment opportunities for southern Dallas residents through workforce development and job training initiatives.”

One of the city of Dallas’s recent initiatives involved a $1.3 million grant for street construction and a 10-year, 90-percent real property tax abatement to facilitate the construction of the 600,000-square-foot LogistiCenter. Developed by Reno, Nevada-based Dermody and completed in 2017, LogistiCenter offers the potential expansion of up to 1.1 million square feet or a second phase with a separate building of 447,000 square feet. It’s just one of a handful of recent construction projects in the port.

Wayfair’s distribution center in Lancaster

Manufacturing push

Although the inland port, to date, has largely been focused on massive distribution centers served by rail, truck, or both, the region has expressed interest in attracting manufacturing plants.

In June, the city of Dallas announced a major coup: commercial online printer Vistaprint will invest $50 million to establish a manufacturing plant in the IIPOD that will create more than 600 high-paying jobs over a three- to four-year span and 100 annual seasonal jobs.

Vistaprint is the largest business of Netherlands-based printing conglomerate Cimpress, which employs more than 11,000 and operates 20 portfolio brands around the world that serve small businesses with customized printing products. “We need more manufacturing companies coming in, and this might just be the start of manufacturers coming into the inland port,” says Dallas City Council member Tennell Atkins, whose district will include Vistaprint.

Atkins says he’s been a longtime supporter of the inland port, including using economic incentives to attract companies and developers, as he sees the port as a major jobs driver.

The city approved $1.7 million in incentives for Vistaprint with an incentives package that includes a tax abatement and workforce development funds. Although Vistaprint is in the city of Dallas, the plant is near the city limits of Lancaster, which expects its labor force to benefit from the jobs.

Shane Shepard, economic development director for Lancaster, says e-commerce operations such as Vistaprint and Wayfair.com are gaining a foothold in the port. Cities like e-commerce operations because municipalities are able to collect sales tax on the transactions.

Improving the infrastructure

The five cities within the inland port, along with Dallas County, are making a variety of infrastructure improvements to make still-undeveloped land more attractive.

The Loop 9 project, beginning with six lanes of frontage roads, is expected to begin soon and will connect I-45 to I-35, running through portions of Dallas and Ellis counties. A variety of other road, sewer, and water projects are planned or in the works. Lancaster, meanwhile, is building a $2.5 million terminal building at its airport—often the first impression for executives coming into the port for tours. Construction began in the spring and is scheduled to be completed by the end of 2019. The airport’s masterplan includes an eventual extension of the runway from 5,500 feet to 8,000 feet.

Enjoying the fruits

David Miracle, executive director of economic development for the city of Wilmer, which still has thousands of undeveloped acreage available, says brokers, site consultants, the governor’s office, the Dallas Regional Chamber, and others have been calling and providing steady leads.

“Sometimes it’s overwhelming—the number of projects that are looking at us,” Miracle says. “These industrial sites are some of the most looked-at properties in Texas and the United States. It’s one of the hottest markets out there. It’s exciting to have that much interest and activity.”

Managing Editor Lance Murray contributed to this report.

A version of this article appeared in the Dallas-Fort Worth Real Estate Review, Summer 2018.

READ NEXT

Meet the Major Developers of the International Inland Port of Dallas

Some of the biggest players in the warehousing, logistics, and fulfillment sectors call the International Inland Port home. They build, operate, or lease some of the largest buildings in North Texas, all with easy access to intermodal facilties and highways.

Green Building Public & Education LEED-ers in Dallas-Fort Worth

Developers, designers, and cities are pushing sustainability forward in North Texas, creating friendly and beautiful structures.

13 Pioneering DFW Projects In LEED

Developers, designers, and cities are pushing sustainability forward

Placemakers: For Todd Interests, Revitalizing a Downtown Dallas Neighborhood is a Family Affair

East Quarter continues Todd Interests’ track record of investing in properties and turning them into unique landmarks in the city.