In what seems like the blink of a server light, Dallas-Fort Worth has become one of the nation’s most-popular locations for data centers, a very specific type of real estate development that requires the most-advanced technologies, specialized construction techniques, and immense power supplies.

Often shrouded in a veil of secrecy to safeguard its contents, a data center is a mass of blinking lights and rows of powerful servers.

In fact, DFW is a top five market for the multimillion-dollar facilities that are full of blinking and humming racks of computer servers. They’re often shrouded in a veil of secrecy because of their contents. And, almost all of the buildings’ amenities are geared toward keeping their servers comfortably cool and secure.

So, how popular is North Texas for data center projects? North Texas is one of five Tier 1 markets for data centers in the U.S., a list that includes Chicago, Metro New York, Northern California, and Washington D.C., The ranking places Dallas-Fort Worth as a key international data center market, making it a destination for both national and global providers.

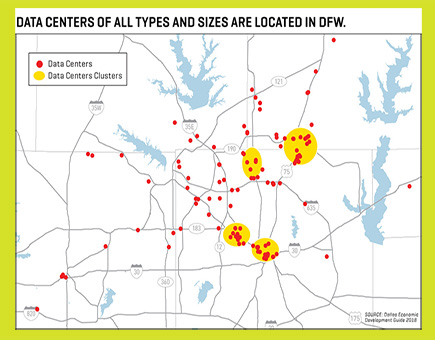

There are more than 115 active data centers in the market with a total of over 4 million square feet and a market estimate of power well over 400 megawatts.

Social media giant Facebook’s north Fort Worth data center has made waves in real estate news, and new data center developments are regularly announced across the entire area. Recent examples include: a $500 million project in Midlothian by tech giant Google, Stream Data Centers announcement of a Garland project in April; last August Digital Realty announcing a $1 billion project in Garland, and early last year, Dallas-based Provision Data Services opened a new data center in the heart of downtown Dallas in a former office tower.

What makes North Texas attractive?

Being a Tier 1 market for data centers is an obvious selling point, but North Texas has a number of elements that make it an attractive location.

“…DFW area is unique because it’s located in a central time zone, is not coastal, and there is technically no seismic activity. Also, this area is not prone to large-scale flooding or weather extremes, which makes it an ideal location for data centers…”

Brion Sargent

“The DFW area is unique because it’s located in a central time zone, is not coastal, and there is technically no seismic activity. Also, this area is not prone to large-scale flooding or weather extremes, which makes it an ideal location for data centers. It’s also supported by the dependable ERCOT power distribution grid serving almost exclusively about 75 percent of the state, offering some of the lowest power costs in the nation,” says Brion Sargent, AIA, Gensler Regional Practice Area Leader for Critical Facilities, neatly summing up what is considered the conventional reasoning of why North Texas is a draw for data centers.

While these attributes are all contributing factors, concentrated population growth might be a more key driver for data center growth says Rick Hughes, Executive Managing Director, Cushman & Wakefield. He has 20 years of experience in the data center space selling data center land for development, selling existing data centers, and representing clients in purchasing and leasing data centers.

Hughes says population growth has also made the ERCOT power grid less of a differentiator because rapid population growth hasn’t been met with the expansion of power generation and the grid now shares the same brown-out risks faced by the rest of the nation.

“Data centers need to be near the things they operate (streaming data, phone apps, smart machinery, etc.), and Texas will be the country’s largest mega-region for these things in the next 10 years,” says Hughes. “Of the state’s large population centers (San Antonio, Austin, Houston, and Dallas-Fort Worth), DFW provides the ideal data center location. Houston is prone to hurricanes, the price of power in Austin is 40 percent to 50 percent higher than North Texas due to the municipal-owned Austin Energy, and San Antonio lacks the connectivity. DFW has it all and is at risk for few natural perils — a tornado being the only one, and North Texas is not in the heart of tornado territory.”

Servers all lined up in rows at the Facebook data center. Servers in the Facebook data center in North Fort Worth. [Photo Copyright 2018 by Chad Davis Photography/Fort Worth Data Center]

Hughes points to another attribute of the area that sets it apart from the other Tier 1 markets—the viability of many great sites that are suitable for data center development. Land costs are higher in other comparable markets around the U.S., and Hughes says this will continue to be the case far into the future.

Data centers are becoming more common in North Texas, and the projects are also good for the real estate industry, says Bob Morris, chairman, Corgan. He says shared colocation data centers have created a thriving real estate business in purchasing land, speculatively building new ground-up data centers and then continually expanding those centers for their tenants. Investors are seeing data centers as quality investments and real estate brokers have a new tech-savvy market.

“Given that data centers are increasingly large and are costlier per square foot than nearly all other types of commercial buildings, North Texas manufacturing, supplier, design, and construction industries also benefit,” Morris says.

The projects are good for business in general, too, he adds. The tax dollars they pay provide support for infrastructure and services such as roads, schools, and police while they have small operations crews who don’t add a lot of stress to these services. Morris says the data center industry is also driving the development of new renewable power and reusable waste technologies that benefit all businesses and communities over time.

Hughes also emphasizes the tax impact of data centers.

“Being a Tier I market, data centers are a major economic driver and taxpayer in Dallas-Fort Worth,” he says. “Data centers are assessed at tax values that far exceed office, residential, and other real estate uses. Data centers have become an asset class of their own and are no longer considered industrial real estate.”

The Facebook effect

Cloud data centers are also known as “hyperscale” data centers with companies including Facebook, Alibaba, Baidu, Tencent, Apple, and other noted cloud, social media, and e-commerce companies falling under the hyperscale moniker. According to Synergy Research Group, up to 24 global brands are considered hyperscale, depending on the exact determining criteria.

The Facebook data center in north Fort Worth was significant because it was the first hypescale development in North Texas, says Hughes.

What does hyperscale mean?

Hyperscale computing is an architecture that contracts and expands based on the immediate needs of a business, producing seamless scalability via a system of flexible memory, storage, and networking capabilities. Hyperscale servers are customized for the particular needs of a data center and intended to meet the needs of millions — perhaps billions — of computer users.

“Given that data centers are increasingly large and are costlier per square foot than nearly all other types of commercial buildings, North Texas manufacturing, supplier, design, and construction industries also benefit.”

Bob Morris

“The presence of the hyperscale providers draws many other data center users that utilize parts of the hyperscale’s platform. Many applications needed for business, commerce, industry, and social media are all of the compute from these platforms,” he says. “Much like when a large corporation relocates a major headquarters or manufacturing operation to the region, other companies that supply to, and benefit from, the presence of the large installation are lured here as well.”

Hughes adds, “What’s more, major hyperscale users signify a ‘seal of approval,’ as data centers cluster together.

They think, ‘If Facebook or Google is here, then it’s safe for my corporate data center facility to be here, too.’”

A closer look at data centers

Corgan founded its Critical Facilities practice almost 40 years ago, and has completed around 1,100 data projects totaling 70 million square feet and more than 3 billion watts of computer power, Morris says.

The biggest challenge in a data center project is the “mission critical” nature of the facility to the daily functions of government, business, and even individuals, he says.

While uptime was once the main concern with data centers, improvements in computing hardware and software is easing those concerns. The new challenge in the industry, Morris says, is scaling both physical size and infrastructure capacity, and designing data centers with built-in flexibility to adapt to future emerging technologies.

A part of the infrastructure at Facebook’s Fort Worth DataCenter. Servers in the Facebook data center in North Fort Worth. [Photo Copyright 2018 by Chad Davis Photography/Fort Worth Data Center]

Outlining the key attributes for a data center development, Morris lists reliability, redundancy, maintainability, threat resistance, and then future proofing through the scalability and adaptability of the building and its critical infrastructure systems.

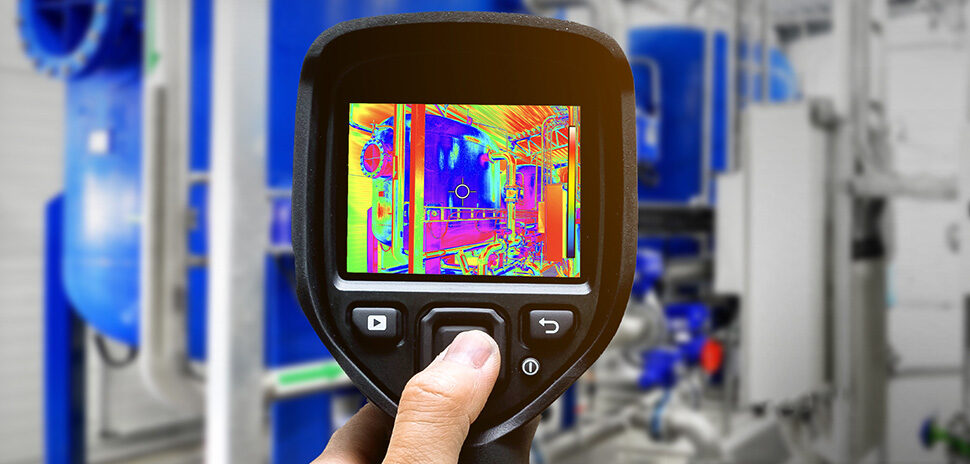

Trends include modular buildings and MEP systems to lower the up-front costs with the option to later ramp up the space and load capacity, along with ongoing improvements in power and cooling systems.

Examples of these improvements include new technologies in air and liquid cooling systems to keep the server racks cool. Power efficiencies have also made a difference.

Source: Dallas economic Development Guide 2018

“Not too many years ago, data centers required two to three watts of electrical power coming into the building in order to finally deliver just one watt of power to the power cord on the computer itself. Today, that incoming power requirement has been reduced 40 to 50 percent by more efficient power and cooling equipment and system designs,” says Morris.

Another consideration with data center projects is simply determining how the building type s recognized, Sargent says. He says Gensler has “become an expert at assisting local authorities in determining how this unique building type is to be recognized.” This is important because the term “data center” isn’t found in building code, there’s no specific occupancy type defined, and it’s not typically found in zoning ordinances.

Looking toward the future

The continuing growth of the hyperscalers, along with more corporations moving their data centers off-premises and out of the office campus to retail or wholesale colocations and the cloud, are two data center trends, Cushman & Wakefield’s Hughes cites.

What might be an even more significant trend is that data center pricing is coming down due to three factors, according to Hughes: data center infrastructure has dropped precipitously over the last few years, falling from $9 million per megawatt of infrastructure to $4 or $5 million per megawatt; most of the large wholesale providers are now publicly traded and not facing the aggressive returns of private equity investors, allowing projects to become profitable faster; and the playing field has more competition with multiple major global providers fighting for the same business.

Corgan’s Morris also sees the future of data centers as an interesting topic and points to the coming impact of the Internet of Things (IoT) and initiatives such as Toyota’s vision for autonomous ground vehicles and Uber Elevate’s vision for drone electric short-haul passenger aircrafts. These developments will be dependent on data processing, storage, and communication largely powered by data centers.

Looking at the future of data centers from a more practical real estate perspective, Morris says another trend is the development of ground-up multistory data centers in the U.S. as the projects become larger or are built in areas with high land costs or in places that don’t have the space for large single-story buildings.

“Manufacturers and designers are developing better multistory power and cooling solutions with users becoming more comfortable with multistory designs,” Morris says. “More ground-up multistory data centers have been built in other countries where high quality data center land is dearer, such as the UK and parts of Asia, but often with less-efficient cooling systems than we prefer to use in the U.S. New and more efficient cooling system designs that work well in multistory data centers will generate more multistory data centers in the U.S. in the near future.”

A version of this article previously appeared in the Dallas-Fort Worth Real Estate Review.

DATA CENTERS INCLUDE 5 BASIC TYPES:

![]()

READ NEXT

Green Building Public & Education LEED-ers in Dallas-Fort Worth

Developers, designers, and cities are pushing sustainability forward in North Texas, creating friendly and beautiful structures.

13 Pioneering DFW Projects In LEED

Developers, designers, and cities are pushing sustainability forward

Placemakers: For Todd Interests, Revitalizing a Downtown Dallas Neighborhood is a Family Affair

East Quarter continues Todd Interests’ track record of investing in properties and turning them into unique landmarks in the city.