From startup investments and exits to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money.

![]()

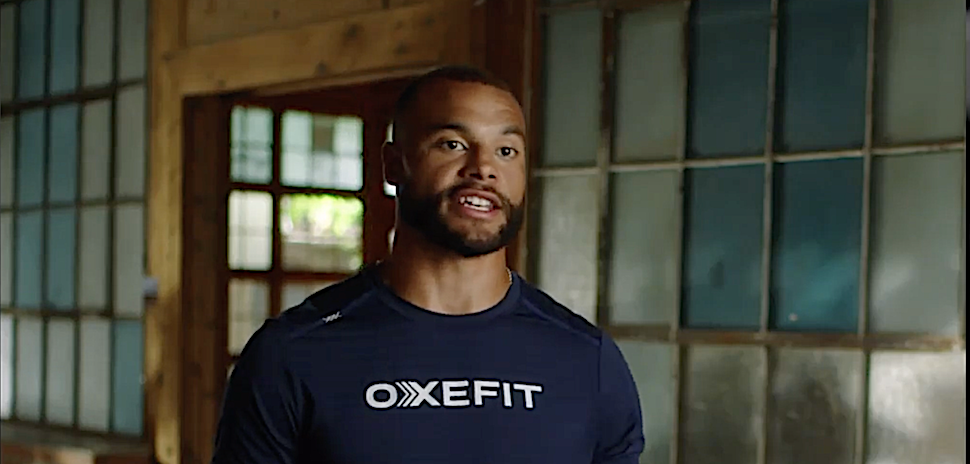

Plano fitness system startup lands more professional athlete backers

Plano-based digital fitness systems company OxeFit has announced new funding from backers including PGA golfer Dustin Johnson and Los Angeles Rams cornerback Jalen Ramsey.

While not disclosing the specific amount, OxeFit said the new funding brings its total to more than $35 million, following a $12.5 million Series A round led by Plano- and Florida-based Lydia Partners last February. With the new funding, Johnson and Ramsey join a list of other celebrity athletes backing OxeFit, including current and former Dallas Cowboys players Dak Prescott, Jason Witten, Dez Bryant, and Blake Jarwin.

Smart gym OxeFit brings “advanced robotics and artificial intelligence to the world of strength training.” [Courtesy OxeFit]

Combining artificial intelligence and robotics, OxeFit’s tech offers users different strength training and cardio workout options. In addition to providing workout video content, the company’s software is able to track user motions to provide feedback, customize training, and track fitness goals.

PLUS

The DOSE Therapeutics team, left to right: Founder Steve McKnight; Director Deepak Nijhawan; and President/COO Michael “Mick” Bakes [Photos: DOSE Therapeutics]

Dallas biotech startup DOSE Therapeutics raises $10M to fight cancer

⟫ Dallas-based early-stage biotech startup DOSE Therapeutics reported raising $10 million in equity funding from 20 investors, per an SEC filing. Formed last year and named after Dr. Donald Seldin, who DOSE calls the “father” of UT Southwestern Medical Center, the company is focused on developing a protein-based therapeutic targeting neuroblastoma, a form of cancer that largely affects children.

DOSE was founded by Steven McKnight, distinguished chair in basic biomedical research at UT Southwestern Medical Center, and Dr. Deepak Nijhawan, an associate professor of biochemistry and internal medicine at UT Southwestern. The company is led by President and CEO Michael Bakes, a former executive director of clinical operations for Merck and former data protection officer for Instil Bio.

—

Left to right: HireLogic CEO Anirban Chakrabarti; co-founders and board members Umesh Ramakrishnan, Buster Houchins, and Nancy Albertini [Photos: LinkedIn]

HR tech startup HireLogic lands $4M seed round

⟫ HireLogic CEO Anirban Chakrabarti says one of the most pressing challenges in the human resources space is filling open positions.

His company, a Dallas-based software startup with a goal of improving the job interview process, aims to do just that with the help of a $4 million seed funding round from a handful of individual investors—including former Motorola CEO Edward Zander, Guidepost Growth Equity Partner Mike Pehl, and Ritchie Bros. CEO Ann Fandozzi.

HireLogic’s platform helps HR professionals assess applicants across their hard and soft skills—as well as their fit within the company culture—by incorporating artificial intelligence and machine learning to help automate the screening process.

—

Dallas-based STEMuli lands funding to expand educational metaverse

⟫ Having used Dallas ISD—the second-largest school district in the state—to help develop its technology, a local startup is looking to create a digital world to help students learn.

STEMuli, a Dallas-based company developing an “educational metaverse,” is looking to expand nationwide, after landing a $3.25 million seed funding round co-led by venture capital firms Slauson & Co and Valor Ventures and joined by Draper Associates.

With the new funding, STEMuli said it is looking to expand its reach to New York, California, Illinois, Georgia, and Washington, D.C.

—

[Image: Wink]

Plano authentication startup Wink raises oversubscribed seed round

⟫ A recently formed Plano startup is looking to help people make payments with their faces and voices.

Wink, a biometric authentication and payment platform, announced landing an $2.85 million pre-seed funding round led by early-stage venture capital firm Cerracap Ventures and advisory firm Carneros Bay. The raise was nearly $2 million more than the $1 million the company initially targeted. The new funding round, which was joined by Tntra Ventures and a handful of tech entrepreneurs, will help Wink launch its product to the public later this year.

Wink, which bills itself as the “first zero-click camera checkout,” used voice and facial recognition technology to create a multi-factor authentication payment acceptance process.

—

Illustration: Saltinsure.com

Insurance startup SALT lands $2M Series A

⟫ SALT, a Grapevine-based insurance technology startup, announced landing a $2 million Series A round led by Southlake- and Switzerland-based Eagle Venture Fund. The company, which focuses on helping independent home and auto insurance agents move prospective clients through the sales pipeline, said it plans to use the funding to build its sales and distribution team, in addition to helping with product development. SALT was formed in 2021 by Dustin Parker and Jonathan Simmons, who also serves as CEO.

—

[Image: chaunpis/istockphoto]

Fort Worth-based AyuVis receives NIH grant funding to fuel clinical trials

⟫ A Fort Worth-based health care startup has landed fresh funding to fuel upcoming clinical trials to combat a deadly disease affecting pre-term babies.

AyuVis, a pre-clinical microphage immunotherapy company, announced that it’s set to receive a $1.8 million National Institute of Health Small Business Innovation Research grant from the Eunice Kennedy Shriver National Institute of Child Health and Human Development to tackle a chronic lung disease that’s the second-leading cause of death in premature babies.

Funding for the SBIR grant will go to support the company’s pre-clinical research into its drug candidate for bronchopulmonary dysplasia (BPD), ahead of human clinical trials set for this summer. The company first received orphan drug designation for the candidate, called AVR-48, from the FDA in early 2021.

The NIH/SBIR grant is the third that AyuVis has received since its founding in 2014, bringing total non-dilutive funding to $2.1 million.

—

Frisco Blockchain investor Altfund Management raising new fund-of-funds

⟫ Frisco-based Altfund Management has raised $1.06 million in equity from 14 investors. Aiming to invest in opportunities in the blockchain space, Altfund says it plans to operate as a fund-of-funds. Altfund was formed earlier this year by Ed Gillen, the former co-founder and COO of Plano-based Vivify Health, which was acquired by UnitedHealth Group’s Optum division in 2019. Its website lists Bobby McFarland, a director at Twitter, as a founding investor and advisor.

—

[Photo: Buff City Soap]

General Atlantic continues to fuel Dallas soap maker Buff City’s growth

⟫ Following up on its investment last June, General Atlantic has funneled additional funding to Dallas-based bath and shower products company Buff City Soap. The company, which relocated from Memphis to Dallas in 2020, did not disclose the funding amount. Since General Atlantic initially invested in Buff City last year, the company has added 130 new brick-and-mortar stores, bringing its total to more than 215 across 30 states.

—

Online investigation company LeadsOnline lands growth investment

⟫ Plano-based LeadsOnline, a company helping law enforcement with online investigations, announced landing a “strategic growth investment” from private equity firm TA Associates, making the firm its first institutional investor. As part of the deal, TA Director Amara Suebsaeng will join LeadsOnline’s board of directors. Earlier this month, LeadsOnline acquired Florida’s Business Watch International, which helps investigators track stolen item sales, expanding its coverage in the U.S. and Canada.

—

PE firm Pharos Capital Group invests in dialysis, renal telehealth company

⟫ Dallas- and Nashville-based mid-market private equity firm Pharos Capital Group made a “significant investment” in Sanderling Renal Services, a provider of dialysis and renal telehealth services largely in rural areas, marking the third investment from the firm’s fourth fund. The funding will help the 10-year-old Nashville-based company grow its operations and geographic reach via acquisitions and de novo startups. As part of the move, co-founder Dr. Jerome Tannenbaum will continue to lead the company as its chairman and CEO.

—

truMED co-founder & CEO Kelly Ladner

Telehealth platform truMED raises $110K

⟫ Southlake-based truMED, a telehealth platform focused on bariatric patients, reported raising $110,000 in equity from two investors out of a $750,000 offering. truMED is led by co-founder and CEO Kelly Ladner, a former global director of market development at TransEnterix. The company counts Teladoc founder Michael Gorton and Carel Le Roux, chairman of the Stratification of Obese Phenotypes to Optimize Future Obesity Therapy project.

—

Dallas homebuilding material supplier Builders FirstSource acquires two firms for $180.5M

⟫ Dallas’ Builders FirstSource, one of the country’s largest suppliers of materials to the homebuilding industry, unveiled last week that it had scooped up two truss manufacturers—Panel Truss and Valley Truss—in April for around $180.5 million, collectively. According to The Dallas Morning News, Builders is planning to spend about $500 million on M&A deals this year, less than half of what it invested in deals last year when it made seven new acquisitions.

—

Fort Worth mineral management company MineralWare acquired for $18M

⟫ Earlier this month, Dallas Innovates reported that Fort Worth-based mineral management software platform MineralWare was sold to an undisclosed buyer. Now, there’s more information about the deal. The nearly 10-year-old company was acquired by Connecticut-based financial technology company SS&C Technologies Holdings for $18 million in cash. SS&C said the deal, which will see MineralWare operate under SS&C’s financial accounting and reporting business, will provide it with 350 institutional and individual clients, in addition to $5.5 million in annual recurring revenue.

—

Allen-based Brass Roots Technologies acquired by California company

⟫ After moving into a new Allen headquarters last year, the assets of optics- and electronics-focused consulting and engineering design firm Brass Roots Technologies have been acquired by California audio-visual solutions company Christie Digital. The terms of the deal were not disclosed. As part of the move, Brass Roots employees will remain in Allen, working under the Christie name. Christie said the acquisition will help it enhance the company’s engineering and design expertise.

Data analytics firm’s acquisition helps tech consulting firm expand to Texas

⟫Marking its fourth and largest acquisition in the past three years, Indianapolis technology consulting firm Resultant has acquired local data analytics company Teknion Data Solutions, as it expands into the Lone Star State. The deal will add 60 employees to Resultants team, bringing its total headcount to 450. Resultant will maintain Teknion’s Irving office under its name, making it the company’s seventh across the country.

—

EverAg acquires agricultural risk management solutions company

⟫ EverAg, a Frisco-based formed in February through Dairy.com’s merger with ever.ag and EFC Systems, announced acquiring Iowa-based Partners for Production Agriculture, an agricultural risk management solutions provider. EverAg, which focuses on supply chain and risk management solutions, said the move will help it expand in the cattle and swine industry.

—

Ryan acquires property tax consulting firm

G. Brint Ryan

⟫ Following its acquisition of Marvin F. Poer and Company, Dallas-based global tax services and software provider Ryan has scooped up Boston property tax consulting firm Greystone Property Tax Advisors. Chairman and CEO G. Brint Ryan said the move will bolster its property tax consulting business across the country. As part of the deal, William Quigley, principal and founder of Greystone, will join Ryan as a principal in its property tax practice.

—

PE firm ups stake in Plano car wash operator

⟫ New York private equity firm Atlantic Street Capital is upping its stake in Plano-based car wash operator Zips Car Wash to accelerate Zips’ subscription model-based business and acquisition strategy. Atlantic said that since it first invested in Zips in 2020, the company’s EBITDA has increased more than six-fold, and it’s opened about 50 new locations.

—

Stream Data Centers launches new investment vehicle

⟫ Stream Data Centers, the subsidiary of Dallas-based commercial real estate firm Stream Realty Partners, announced launching a new investment vehicle to focus on “stabilized and modest value-add opportunities” in major U.S. markets. Leading the investment practice at Managing Directors Mike Armstrong and Michael Wong. The firm said that the vehicle is backed by a “leading public pension plan.”

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

Image: dobackflip.com and AlenaMozhjer/iStock

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.