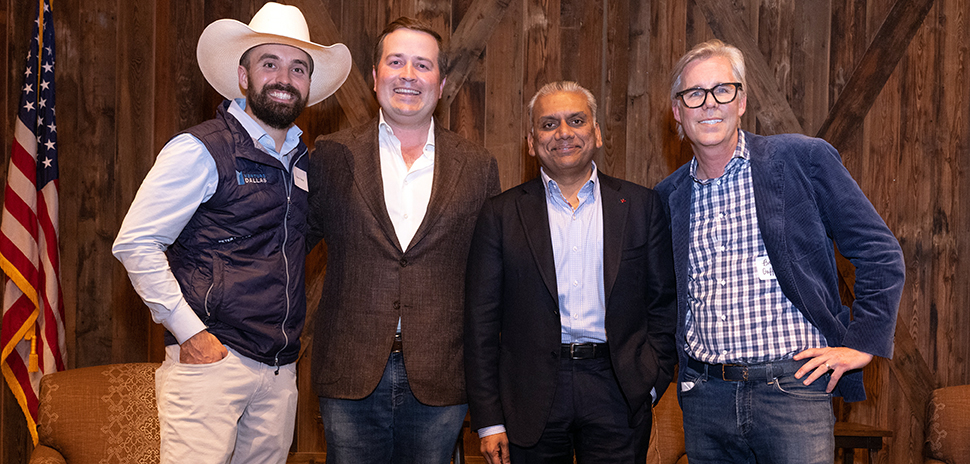

Circle T Ranch in Westlake recently opened its gates to an elite group of more than 200 investors, innovators, and business leaders. The private reception at Ross Perot Jr.’s scenic ranch at AllianceTexas has become an annual tradition for the Venture Dallas franchise—and a coveted invitation for founders and funders alike.

Even a downpour couldn’t dampen spirits. “It was a 10 out of 10,” one guest said.

“When you put great founders and investors together, magic happens,” said Aaron Pierce, Venture Dallas Chair and a partner at Perot Jain. The setting—Circle T’s one-of-a-kind development blending business with a working cattle ranch—is part of the alchemy.

Pierce said it’s a draw that brings some of the best investors in the nation to Dallas. The reception—now in its fourth year—at the rustic Texas Barn on Oct. 24 anchored the Venture Dallas conference with “high-impact” conversation and connections the night before the main event in Dallas. “When investors come here from out of town, their eyes are opened to what’s happening in Dallas,” he said. “It sets the stage for partnerships.”

Following a Texas gulleywasher, the sky was a dramatic backdrop to the Texas Barn at Circle T Ranch. [Photo: Grant Miller Photography/Venture Dallas]

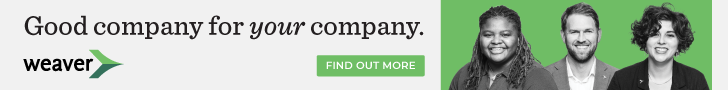

Investors from coast to coast

Getting together in a social setting, especially one as unique as Circle T Ranch, builds relationships that “lead to the exchange of deal flow and co-investment,” said Bryan Chambers, a founding board member of Venture Dallas. Judging by the roster of VCs, angels, family offices, and corporate venture investors at the ranch, that formula is working.

This year’s Circle T Ranch event drew more funders nationwide, including Evan Baehr, managing partner of Austin-based Learn; Kevin King, partner at Boston’s General Catalyst; and Atlanta-based Anant Patel, director at Koch Disruptive Technologies.

Others making the trip to Dallas included Keith Bank of KB Partners in Highland Park, Illinois; Cyrus Sigari of UP.Partners in California; Amy Kruse of Satori Neuro in Washington, D.C.; and representatives from funds like LiveOak Venture Partners, NextCoast Ventures, and more.

[Photo: Grant Miller Photography/Venture Dallas]

EP Golf Fund, golf tech demos

Earlier in the day, investors and leaders celebrated the launch of the EP Golf Fund, a partnership between the PGA and Elysian Park Ventures aimed at supporting startups in the golf space. The fund’s inaugural portfolio companies were on hand, including Golf+, a VR golf game that allows people to play on real-world courses with “true-to-golf” physics, and Dryvebox, a mobile golf simulator that can be rented.

Pierce said the event focuses on real investment opportunities in the ecosystem. And that translates to more capital for Dallas entrepreneurs. Leaders of million- and billion-dollar businesses said the event hosted a group you can’t find anywhere else in one room. And more than one entrepreneur told us they cleared their calendar for the event.

But Michael Ulwelling, who flew in from Oregon, may have said it best: “If you are a founder, inside or outside of Dallas, who had an invitation to the VIP event and did not attend the event—that was a major mistake.”

Startups from stealth to exit

The event rounded up successful North Texas startup founders, including Scott Harper of Dialexa, who successfully exited to IBM last year. Others were serial entrepreneurs like Mizzen+Main co-founder Kevin LaValle, currently pursuing his next venture in stealth; Linear Labs’ Brad Hunstable; ByteTrails’ Brenda Stoner; and Power To Pitch’s Kat Weaver.

Venture Dallas Startup of the Year winners were also on hand: CollateralEdge’s Joe Beard, a VC-turned-entrepreneur, as well as Firehawk’s Will Edwards, on the cusp of a major test-launch site deal, and Testfit’s Clifton Harness, who compared notes on computer vision with Spacee’s Skip Howard.

Aaron Pierce on stage at the Texas Barn at Circle T Ranch [Photo: Grant Miller Photography/Venture Dallas]

Fireside chat: Sizing up the Dallas-Fort Worth ecosystem

Dealmakers and disruptors came for the connection and the conversation. One of the most important conversations focused attention on advancing Dallas-Fort Worth’s venture ecosystem to the next level. In a fireside chat, the spotlight shifted to another C-word—collaboration.

On stage at the Texas Barn, Pierce highlighted the region’s assets—capital, corporations, and talent. “As an ecosystem, Dallas-Fort Worth has a lot going for it,” he said. About a year ago, Anurag Jain and the Perot Jain team saw even more potential: “We did a lot of work around that, talking to leadership in the region and beyond,” Pierce added. “Tonight’s program is sharing a little bit of that.”

Jain, chairman and founding partner of Perot Jain, sat down with Hillwood’s Henry Ross Perot III and McKinsey’s Brendan Gaffey to explore the state of the ecosystem and plot what happens next.

Jain looked back on progress. “Look around—these are the movers and shakers of Dallas,” he said. “At this event three and a half years ago, we had a [fraction] of the audience in the room today. But we got together and said, ‘We’ve got to make Dallas relevant; we’ve got to put it on the map.’”

And we did, he said. Now he wants all those movers and shakers to help put it even more on the map.

Anurag Jain, Hill Perot, and Brendan Gaffey [Photo: Grant Miller Photography/Venture Dallas]

“Dallas is a unique ecosystem”

Working alongside Perot Jain, Gaffey, head of McKinsey’s venture business, saw potential to expand Dallas’ presence. “Dallas is a great spot to do much more than it’s currently doing in the startup and innovation world,” he said. Through extensive interviews with founders and investors, locally and beyond, Gaffey and Perot Jain formed a panoramic view of the ecosystem here.

They heard, “Dallas is a unique ecosystem,” Gaffey said, which is both a challenge and an opportunity. In terms of venture capital, Dallas has a “lot of the components that would make it a tier-one venture city.” He drew comparisons to Los Angeles’ VC growth from tier two status around 15 years ago. Dallas now has the chance to “step up.”

“There are a lot of ways of doing [that],” he said. “Venture is not the only measure of success,” nodding to Dallas’ business diversity and well-noted strengths.

Jain ticked off a few, highlighting the financial capacity of the city: Dallas has a lot of money, family offices, corporates, capital, and later-stage companies. But, he asked Gaffey, “Where do you see the innovation in the city?”

Logistics, biotech, defense, SaaS strengths

“Where innovation is going, and where it’s coming from … play stronger in Dallas,” Gaffey said.

He sees a strong foundation in B2B innovation like logistics tech, biotech, defense, and enterprise SaaS. “With things that have transpired over the last two years, I’m bullish on the capabilities that reside in Dallas,” he said.

However, the local VC landscape doesn’t yet “fully reinforce” that potential, he said. Gaffey recommended shifting more private capital from real estate toward funding startups and venture.

“There’s a ton of private capital that doesn’t always flow into the VC sector,” Gaffey said, pointing to a key opportunity in the region. We also need more big successful exits to reinforce the “looping” of VC capital and exits, he said.

Not surprisingly, “Dallas has a unique way of building its startups,” he said. Dallas is a pioneering place that celebrates risk, but “the tech founder pathway needs more recognition and support,” similar to what you might find in a Silicon Valley, he said.

Gaffey stressed that real change requires the collective action of the community. “We have to pull at the same time to radically change the trajectory,” he urged.

Jain agreed that Dallas has ingredients like B2B expertise in place. And more big, successful founder exits are a key for success: “We need a few more Scotts.” Jain said, pointing to Dallas-based Dialexa founder Scott Harper, noting his successful exit to IBM last year. The acquisition was IBM Consulting’s first in the digital product engineering services market, which it estimated as a $700 billion market by 2026. Those kinds of success stories cycle resources, talent, experience, and credibility, he said.

From left: Anurag Jain, Hill Perot, and Brendan Gaffey [Photo: Grant Miller Photography/Venture Dallas]

Perot: a “ringside view” of Dallas-Fort Worth

Shifting the focus to Henry Ross Perot III, or Hill, Jain said Perot has had a “ringside view” of the region for about four decades. As the son of Henry Ross Perot Jr. and the grandson of H. Ross Perot Sr., he brings a unique third-generation perspective on the region. And as vice president of Hillwood, Perot has been instrumental in overseeing industrial and warehousing interests within AllianceTexas.

Perot recalled the transformation he’s seen firsthand. “As a native growing up here, it’s amazing what I’ve seen in my lifetime, growing from around 5 million people to about 8 million today.” he said. “Houston and Chicago are ahead of us—depending on how you count it—but in the next 10 to 15 years, we’ll be the third-largest metropolitan area in the United States.”

We “really are all grown up,” Perot said, attributing much of the region’s maturity to Dallas Fort Worth International Airport.

In comparing Dallas to Austin, he said: “Austin is great, but if you’re going to build your business and you’re traveling around the world or the U.S., it’s not easy to do if you’re flying in and out of Austin.”

“I’m going to say Dallas-Fort Worth and North Texas a lot tonight.”

Talking about Dallas, Perot reinforces the regional perspective. “In our business,” Perot said, “We always say Dallas-Fort Worth. And I’m going to say Dallas-Fort Worth and North Texas a lot tonight.”

Perot is proud of the economic powerhouse the region has become. “We’ve come a long way since the 1980s with the savings and loan crisis,” Perot said. At the time, “we were really just banks, cattle, real estate, oil, and gas—and they all crashed at the same time.”

Today Perot sees a “diverse DFW,” leading in sectors that play to its strengths. Our current—and future—success owes to the historic foresight of the region’s business leaders, he said. While acknowledging Gaffey’s point that DFW is not necessarily known for its consumer tech, Perot, like Jain, sees advantage in the region’s B2B expertise. And he highlighted a key sector where Dallas excels: logistics tech.

“Our firm is very involved in mobility innovation,” Perot said, noting Hillwood’s strategic AllianceTexas location. The 27,000-acre development has been part of the company’s vision since the ’80s, which took a long view to regional growth, he said. Circle T Ranch itself is part of that vision, with its master plan for multiple corporate campuses surrounding acres of lakes, parkland, and range land.

Perot pointed to innovative endeavors happening at AllianceTexas, which recently hosted the invitation-only UP.Summit on rethinking the future of transportation, which brought more than 250 of “the world’s most innovative minds” in the sector to North Texas. Those visionaries represent over $1 trillion worth of investable capital, according to the UP.Partners group.

Ross Perot Jr., left, on stage with Texas Governor Greg Abbott at UP.Summit 2023, hosted at Circle T Ranch in October. [Photo: Office of the Governor]

Perot is working to “position North Texas to be the mobility innovation zone in the entire world,” he said. Alliance Airport’s own Mobility Innovation Zone makes the region a frontrunner already. “We’re testing drone delivery, autonomous trucks, drone delivery to people’s front doors,” Perot said.

He emphasized the region’s advantage in supporting new businesses, particularly through proactive efforts and resources. “We’re getting regulatory approval and political resources people need right now here in North Texas,” he said.

Comparing Texas to California, Perot highlighted the Lone Star State’s low-tax, low-regulation, pro-business environment. “There’s no reason Texas should beat California in business development,” he said, “but we do it because of our culture, because of our people.”

“As I look at the population growth, the economic growth, the political and regulatory environment,” Perot said, “whether you’re a fund or a founder, this is a really good place to do business.”

Hill Perot, left, and Brendan Gaffey [Photo: Grant Dallas Innovates]

“No silver bullet,” but models of success

Jain shifted the spotlight to how other cities are progressing and what Dallas can learn from their strategies. As Gaffey put it, “There’s no silver bullet.” But he sees interesting models for success around the country:

Chicago, for example, has “a great network” and a solid startup ecosystem supported by families and individuals with the “means and the will” to invest, both politically and financially, he said.

In Houston, the city is embracing a “fund the funds” strategy and has initiated a “reverse pitch” concept to galvanize local investment, encouraging venture capitalists to bring their money and expertise to the table.

Miami is utilizing the clout of “two or three very high-profile investors,” creating a buzz that could potentially transform its business landscape, he said. Its PR efforts have been turning heads and shifting perspectives about Miami’s role in the tech and entrepreneurial landscape, he said, adding that “fundamentally, the PR … was pretty transformational.”

And in Atlanta, Gaffey sees some “great things” in startup mentoring and incubation.

Boosting the Dallas’ “metabolic rate”

To accelerate Dallas’ “metabolic rate,” it needs to pursue multiple strategies simultaneously, Gaffey said. Dallas can do “four or five of those things” at the same time,” he said.

The key is compounding efforts, rather than operating in isolation. Collaboration can “stitch them together in parallel.” He described the flywheel effect, where enough synchronized components reach critical mass and feed ongoing growth.

We have a lot to work with. Dallas, he said, is an “unbelievable and vibrant ecosystem.” Among our innovation advantages are its strength in B2B tech, calling out logistics and biotech as key sectors, noting the rise of life science hub Pegasus Park in Dallas.

Anurag Jain, Hill Perot, and Brendan Gaffey [Photo: Dallas Innovates]

“Good things will happen”

Jain advocates a focus on building on our strengths. “Good things will happen,” Jain said. “It will all work.” He discouraged preoccupation with classifications such as “tier one or tier two.”

Referencing entrepreneur Steve Case’s recent visit to Dallas, Jain highlighted Case’s Rise of the Rest fund that invests in companies outside major coastal hubs. Jain explained that Case’s strategy recognizes the potential of entrepreneurs “connected to their local economy.” That mindset can generate outsized impact like that of “Bill Gates in Seattle, the Kaiser Family in Tulsa, [and] the Waltons in North Arkansas.”

In Dallas, Jain said, “Ross Perot Sr. comes to mind whenever I’m talking about business.”

The Perot legacy in Dallas

Hill Perot traced origins of his family’s legacy in Dallas, recalling how his grandparents arrived with all their possessions in the trunk of a car.” His grandfather, Ross Perot Sr., had been in the Navy and worked at IBM as a salesman for a couple of years, he said. And “despite neither of them being from Dallas, or even having been there before,” the Perots chose to launch their business—EDS—and plant roots in the city.

“That welcoming spirit and culture in the city of Dallas has enabled us to grow on the business side,” Perot said. “There’s not a lot of ‘native vs. outsider’ mentality that I’ve seen.

“When Dad (Ross Perot Jr.) and I talk with people who moved their businesses here,” Perot said, “people are shocked by how welcoming the city of Dallas is.” We go out of their way to make companies of all sizes feel welcome, he said.

“We’re on a supercharged path of growth right now,” he said. “I think that will translate well to the venture side, as well as what we see in business.”

Perot spotlighted the “entrepreneurial spirit” drawing VC to Dallas. He attributed this partly to the welcoming culture embracing founders and funds relocating to the city.

But Perot has seen the influx of new “financial firepower” in Dallas over the last five years, starting pre-pandemic but accelerating since. He cited the interest from hedge funds and private equity funds from Wall Street, Chicago, and Los Angeles. “They’ve all been here,” he said.

He urged everyone—from natives to newcomers—to contribute to Dallas’ prosperity. “There’s a lot of ways to give back, a lot of ways to serve,” Perot said. It extends to all, whether lifelong residents or recent arrivals, to support the region’s growth and community.

“Dallas did so much for our family. We’re always trying to give back to this great city that gave us everything,” he said, describing the ethos that drives the Perot family’s community involvement.

Hill Perot [Photo: Dallas Innovates]

Collectively beat the drums: A five-part strategy

After discussing the Perot legacy, Jain prompted next steps for the movers and shakers in the audience. Progress has been made, but he called on leaders to capitalize on the region’s momentum to ensure sustained growth.

“I want to get serious for a second,” Jain said, asking Gaffey: “What do you want them to start doing tomorrow? The day after tomorrow, next year?”

Collectively, Gaffey said, Dallas can “beat the drums.” He emphasized the need for a comprehensive, strategic approach to accelerate the startup and venture ecosystem.

Gaffey advocated a five-part strategy: mentorship for early founders, targeted capital investment, supporting maturing startups, shaping an effective narrative, and attracting experienced talent.

Diving into specifics, he said, individuals can help founders, through mentorship. “Founders say it’s very hard to find great mentors, and it’s hard to find advisors,” Gaffey said. “When we see these great early-stage founders … we can help them stand up. That’s number one.”

People with capital should invest some locally, particularly at the seed stage. Gaffey prompted funneling more dollars to strengthen Dallas’ base, stressing both early- and later-stage funding’s significance.

Dallas already has a strength in Series B and C, which can help “shift the odds.” A few “extra hits” could significantly stimulate the startup environment as “they feed other entrepreneurs.”

Dallas is a great place to start a business and a leader in specific industries like logistics and biotech: “There are three, four, five areas of investment that are growing fast,” he said. “This is the place” to start a company in those verticals; Dallas can share the “home runs.”As a prime location, he said, Dallas can attract seasoned entrepreneurs from other places. Veteran founders ready to start again are ideal targets: If the city can attract even a handful of these “proven winners,” it can further accelerate Dallas’ rise.

“Not everyone will move, but enough will,” Gaffey said.

From left: Anurag Jain, Hill Perot, and Brendan Gaffey [Photo: Grant Miller Photography/Venture Dallas]

Charting the course ahead

“Dallas has transformed over the past 15 years,” Gaffey said. “It’s a place that knows growth and development.” While he and Jain acknowledge there are “holes to fill,” both see the region’s “skill sets” aligned with the needs of the time.

“I’m confident that the areas we need to innovate in are rooted in things Dallas does well,” Gaffey said. “This will be a phenomenal 10 to 15 years, if we do some of the things we talked about.”

Giving back to the company drives meaningful change

Perot credits the rate of growth in Dallas-Fort Worth in large part to “business leaders, leading families, politicians, and philanthropic-minded people” working together.

“There has always been a great sense of collaboration here in Dallas and North Texas,” he said. He pointed to cross-sector groups in the region, such as the Dallas Citizens Council, Dallas Regional Chamber, and North Texas Council of Governments, that work together on issues facing the region rather than waiting on state or federal action.

That spirit of cooperation has benefited the area, Perot said, citing “the infrastructure investment, the billions of dollars in improvements over the last 10 years” in Dallas-Fort Worth.

He called upon every stakeholder in Dallas to “unlock that cooperative spirit” to drive progress. Similar coordination among business leaders, founders, family offices, and policymakers can further boost the region’s startup ecosystem, Perot said: “If [we] get everybody working together, it’s a way to really move the venture ball down the road.”

Perot expressed optimism in the region’s outlook. “It’s easy to be worried about the future,” he said. “I’m not sure there’s a better place to be in the next five to 10 years than the state of Texas, and specifically North Texas. We are in a very good area to ride out a storm politically, geopolitically, and economically.”

Perot left the audience with a call to action: “Venture is going to be a key player that’s going to solve a lot of our state’s problems, and our country’s problems, and maybe our world’s problems.” His parting message was clear: the people in the room are key players in making that happen.

“We’ll take that as the last word,” Jain said.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.