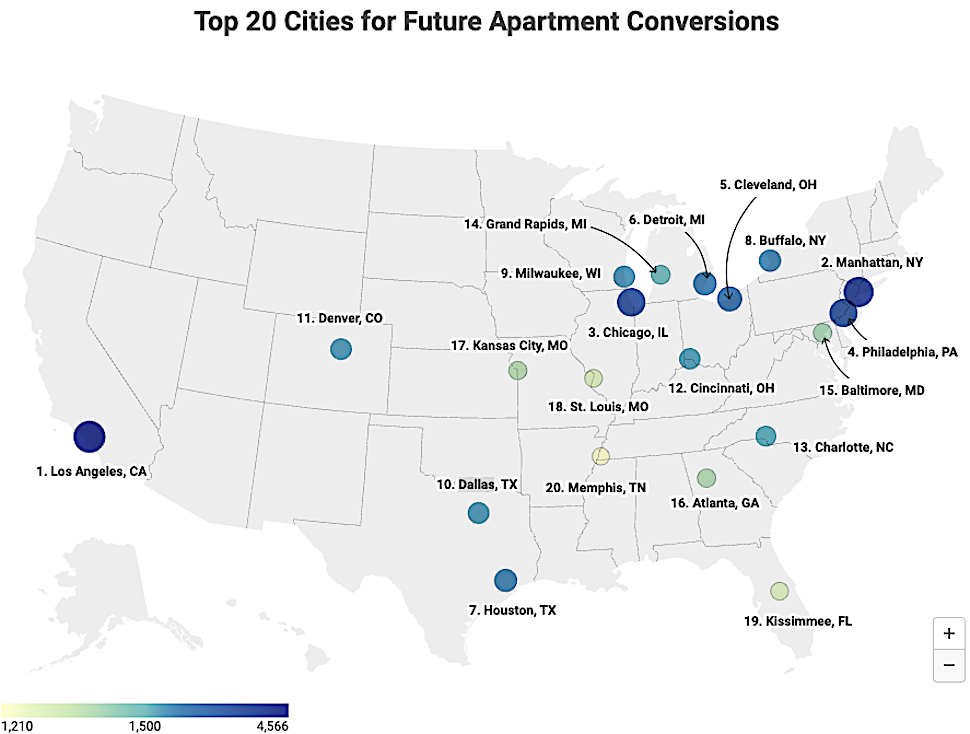

Dallas has been in the vanguard at turning office towers and old buildings into apartments, either by converting whole buildings or transforming floors in a downtown tower. That trend will continue for years to come, according to a new report by RentCafe—which puts Dallas in the Top 10 of U.S. Cities for future apartment conversions.

According to the report, Dallas is on track to add 1,912 additional apartment conversions in coming years, placing it No. 10 in the U.S. in the category. Houston is the only other Texas city in the Top 10, ranking No. 7 with 2,205 apartment conversions slated to happen.

Los Angeles topped the list with 4,566 future apartment conversions, followed by New York with 3,987 and Chicago with 3,519.

[Graphic: RentCafe]

Apartment conversions have declined since their 2020 peak, but outlook remains strong

Known as “adaptive reuse” projects, apartment conversions peaked in 2020, a natural reaction to the nationwide flood of empty office towers caused by the pandemic, and uncertainty about whether the very idea of the office would be changed forever.

Still, “interest in converting older buildings into residences remains high,” the report says, citing Yardi Matrix data that shows adaptive reuse apartments are “poised for impressive growth in the upcoming years.”

“A whopping 122,000 rental apartments are currently undergoing conversion,” the report states, “45,000 of which are the result of office repurposing.”

Dallas Surpasses L.A., New York, and Chicago in this statistic

While other cities are converting a wide range of buildings to apartments, from warehouses to hotels and more, Dallas is mainly focused on converting office buildings, like the 50-story downtown Santander Tower, which will see existing office space on 11 floors converted into 288 apartment units. Even Dallas’ second-tallest buildling, Comerica Bank Tower, is getting in on the act, with as many as 20 of its office-space floors converted into apartments and a luxury hotel. (Both conversions are projects from Dallas-based Woods Capital.)

Nearly 80% of the future Dallas apartment conversions will be repurposed office spaces, the RentCafe report says, exceeding the share in L.A., New York City or Chicago.

Some more facts about the trend in Dallas shared by RentCafe:

:: Dallas has 1,912 adaptive reuse units in the pipeline. The city’s projected conversions backlog grew by nearly 60% since 2021, when future projects totaled 1,213.

:: The great majority—1,498 apartments—will be retrofitted office buildings. Almost half of these upcoming units will replace historic office buildings along Elm Street alone, “bringing new life to the area.”

:: Offices aren’t the only source of future conversions in Dallas. Hotels are anticipated to account for 314 rental apartments and factories for 100, RentCafe said.

:: Less than 20% of the forthcoming projects in Dallas are already undergoing construction, as the majority of them remain in the planning stage.

Although “a remarkable surge” in adaptive reuse projects is slated for Dallas’ future, Dallas saw no transformed units in 2022, RentCafe noted. As the projects come to fruition, downtown Dallas could become more and more of a real, lived-in neighborhood for a growing list of urban residential pioneers.

You can read the full RentCafe report by going here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.