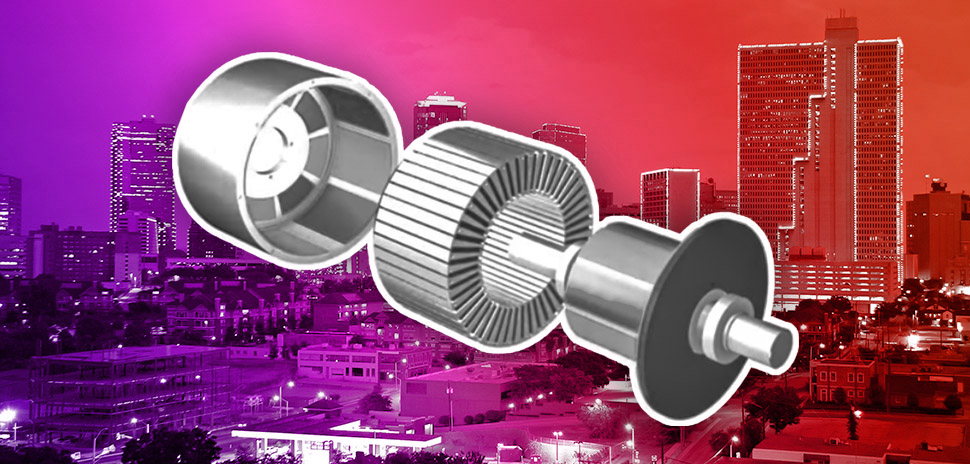

AllianceTexas in Fort Worth is getting a new magnet manufacturing facility that could ultimately power some 500,000 EV motors every year and restore a “full integrated U.S. supply chain.”

Las Vegas-based MP Materials today announced that it will build a new 200,000-square-foot rare earth metal, alloy, and magnet manufacturing facility in Hillwood’s development that’s home to the Mobility Innovation Zone, known as the MIZ. The new site will serve as the business and engineering headquarters for the company’s growing magnetics division, MP Magnetics, it said.

The company also said it has entered into a “binding, long-term agreement with General Motors” (NYSE: GM). GM will supply U.S.-sourced and manufactured rare earth materials, alloy, and finished magnets for electric motors in dozens of models using GM’s Ultium Platform.

Magnets in demand

The NdFeB permanent magnets the facility will make are essential to the electric motors and generators that run EVs, robots, wind turbines, drones, defense systems, and other technologies. The magnets, which transform electricity into motion and motion into electricity, are linked to almost every aspect of life, the company says. Similar to semiconductors, they are “fundamental building blocks in modern technologies.”

The AllianceTexas site is being readied for construction. The new facility—planned for an initial capacity of 1,000 tons of finished NdFeB magnets for EV motors, as well as the support of key markets such as clean energy, electronics, and defense—will create more than 100 skilled jobs, the company said in the announcement. Production, which could begin in 2023, will ramp gradually.

The magnets are in demand and will “increase in importance as the global economy electrifies and decarbonizes,” MP said. The company cites Adamas Intelligence statistics: The independent research firm says global NdFeB demand is expected to “double by 2030 driven largely by increased production of EVs.”

And while the development of permanent magnets began in the United States, we have “virtually no capacity to produce sintered NdFeB magnets today,” MP said.

Reshoring the American supply chain

MP plans to supply NdFeB alloy flake to other magnet producers to help develop a diverse and resilient U.S. magnet supply chain.

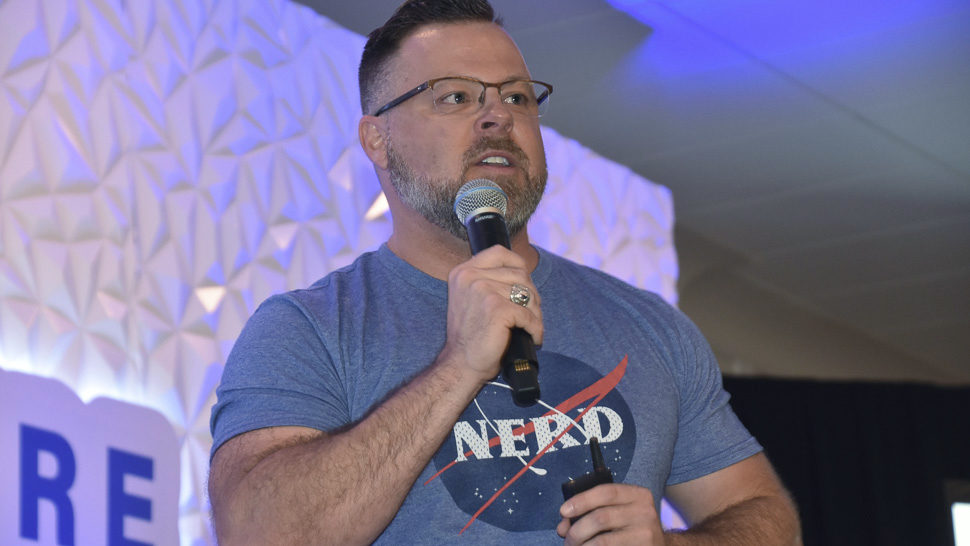

“MP Materials has built an exceptional magnetics team and important commercial relationships that will accelerate our mission to restore the full rare earth supply chain to the United States,” said MP Materials Chairman and CEO James Litinsky in a statement. “This is a momentous occasion for the reshoring of the American supply chain, and we are grateful for GM’s confidence, commitment, and leadership.”

Applied learning and smart scaling

MP envisions building capacity in the future for alloy and magnets to consume a greater percentage of its primary production and supply growing U.S. demand.

The company’s initial metal and magnet facility in Fort Worth is “deliberately sized to achieve commercial economics at the minimum required scale.” It called the plan a “measured approach” that lets MP Materials refine its processes and tech, and also later apply its learnings to more high volume facilities.

Vertical integration and recycling pathways

MP Materials’ operations in Texas and California can provide “certainty of provenance and sustainability,” the company said.

MP, which says it’s the largest producer of rare earth materials in the Western hemisphere, owns and operates the Mountain Pass Rare Earth Mine and Processing Facility in Mountain View, California.

As the “only rare earth mining and processing site of scale in North America,” MP Materials claims about 15% of the rare earth content consumed worldwide in 2020.

The company’s vertical integration means it can optimize recycling pathways, MP said. The company says waste generated during the production process will be recycled and end-of-life magnets can also be re-processed into purified RE oxides. Those oxides can then be refined into metal and made into high-performance magnets.

MP also says it’s developing circular recycling concepts with “significant commercial entities.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![MP’s new magnetics facility in Fort Worth's AllianceTexas development will source materials from Mountain Pass, California and aims to help restore a fully integrated U.S. supply chain. [Rendering: MP Materials]](https://s24806.pcdn.co/wp-content/uploads/2021/12/MP-Materials-Fort-Worth-Magnet-Manufacturing-Facility.jpg)