WiNGS, which offers robust solutions that empower women in the Dallas community, has been awarded a $100,000 grant from JPMorgan Chase to help fund the nonprofit organization’s Southern Dallas Initiative.

WiNGS will use the funding to pair women in Southern Dallas with trained financial coaches who can assist them in achieving monetary security and meeting their long-term goals. A portion will also be used to build an online portal dedicated to reducing barriers to reaching these in-person coaching opportunities.

“We believe in what WiNGS is doing to empower women and create long-term change in the Dallas community,” Terri Thomas, community manager of Chase, said in a statement. “We are proud to collaborate with WiNGS to support its Southern Dallas Initiative and invest in tailored programs that ensure everyone has an equal opportunity to learn financial skills, achieve their goals, and build a sustainable life for them and their families.”

The Southern Dallas Initiative was initially launched by WiNGS to generate more possibilities for women to earn financial stability. It provides placed-based programming as an integrated economic advancement collaborative within multiple sites across South Dallas.

The program is the paradigm of what WiNGS has been doing for decades.

The 113-year-old nonprofit was founded with the mission to empower women, fight poverty, and impact generations—and through its tailored suite of services, the team has helped them start new chapters, businesses, or families.

WiNGS, which was formerly the Dallas YWCA, today is notorious in the region for its long history of lifting women out of poverty and adversity. Its resources have evolved to meet women’s changing needs, and today, they include financial literacy, one-on-one financial coaching, and the Nurse-Family Partnership.

During the pandemic, WiNGS says its clients have better understood their finances, decreased debt, and increased savings and credit scores.

The following outcomes, according to the nonprofit, were: 55 percent of women with a savings goal increased their savings by an average of $1,404, 64 percent with a credit goal increased their score by an average of 46 points, and 46 percent with a debt goal decreased their debt by an average of $10,079.

More on the Southern Dallas Initiative

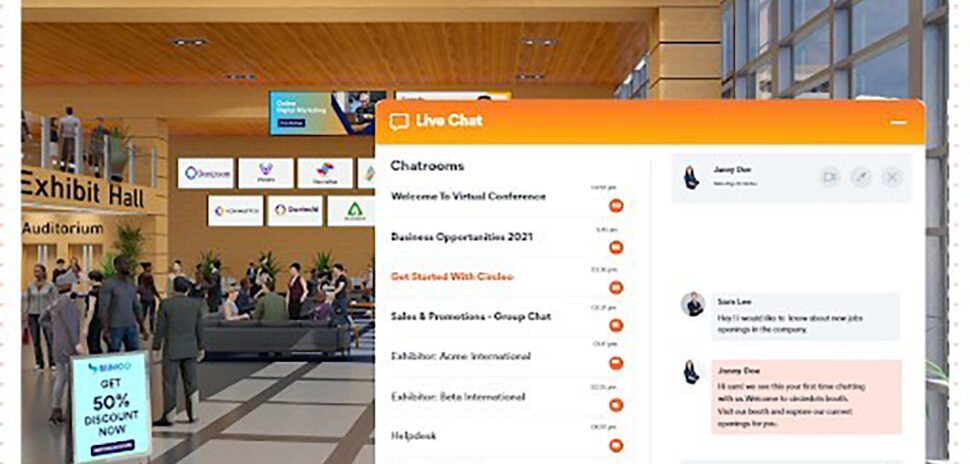

Female users of the new WiNGS’ portal will be able to view available service opportunities, register for classes, attend live and recorded classes, create coaching appointments, and complete assessments to measure growth.

It will also capture critical data, like what courses are most sought after, searched for, or least popular. WiNGS said this will allow the team to tailor content most relevant to its clients.

The WiNGS team also outlined other specific focuses the initiative will work on:

• Hire dedicated staff to establish relationships, focus efforts, and ensure relevant programming in Southern Dallas communities;

• Organize a Steering Coalition comprised of local stakeholders to offer guidance and create awareness of the collaborative;

• Identify and engage partners committed to a holistic and targeted approach for anti-poverty efforts; and

• Leverage technology for client engagement and partner collaborations to address access barriers and build upon learnings through the COVID-19 pandemic.

“Thanks to support from organizations like JPMorgan Chase, we are able to continue our work and advance our mission in communities that need our services,” WiNGS CEO Kate Rose Marquez said in a statement. “Through this initiative, we are committed to making our services more accessible to our South Dallas neighbors and advancing a collaborative service-delivery model.”

This isn’t the first time JPMorgan, the global financial services firm that has assets of $3.7 trillion, has invested in the area.

Its PRO Neighborhoods planning program previously awarded The Real Estate Council (TREC) Community Fund a $400,000 grant to work with partners in three Dallas-area neighborhoods that were identified as the most vulnerable to rapid transition: the Forest District in Southern Dallas/Fair Park, “The Bottom” neighborhood in East Oak Cliff, and West Dallas.

And, in March, in an effort to make financial services and education more accessible for the people of Oak Cliff and Southern Dallas, JPMorgan Chase opened its first Community Center branch in Texas.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.