What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

Biopharmaceutical Actuate Therapeutics raises $11.2M to fight cancer

Actuate Therapeutics president and CEO Daniel Schmitt

⟫ Fort Worth-based Actuate Therapeutics, a biopharmaceutical company focused on cancer, reported raising nearly $11.2 million in equity from 30 investors out of a $50 million offering.

According to its website, Actuate is developing a therapy that “has shown tremendous potential in the treatment of many different cancers when used alone or in combination with other types of cancer therapies.”

Formed in 2015 and led by president and CEO Daniel Schmitt, Actuate has raised at least $61 million based on previous SEC filings.

PLUS

Fort Worth’s Sinclair Digital Services aims to raise $5M

Farukh Aslam

⟫ Sinclair Digital Services, a Fort Worth-based design, build, and integration firm focused on sustainable and smart building systems, reported raising $3 million in equity and debt funding from a single investor out of a $5 million offering.

Founded in 2020, the company is led by Farukh Aslam, CEO of Sinclair Holdings and developer of the Sinclair Hotel in Fort Worth.

—

Illustration: Baks via iStock

Cybersecurity company Third Wave Innovations gets funding, new name

⟫ Looking to build out its tech and its team, a Frisco company has new funding and a new name. Cybersecurity firm Third Wave Innovations—formerly RSC Secure—announced landing Series A funding le by Socii Capital. Terms of the deal were not disclosed. Providing managed security, data, and IT services, Third Wave said the new funding will help it invest in its technology offerings and team as it looks to grow its client base.

—

Video still: STRAFFR

STRAFFR raises nearly $100K in first week of crowdfunding effort

⟫ Just seven days after launching a crowdfunding campaign on SeedMatch, STRAFFR has garnered €100,000 (nearly $98,000) in support. The Germany-based company—a member of the inaugural cohort of the Techstars Physical Health Fort Worth Accelerator program—has developed a smart fitness bad that connects with an app to provide real-time workout assistance, along with workout sessions and progress tracking. This isn’t the first time STRAFFR has gone the crowdfunding route. After forming in 2018, the company launched a Kickstarter campaign that landed it nearly €41,000 in funding.

—

[Image: TPG.com]

TPG Real Estate closes on $6.8B-plus fund

⟫ According to TPG Real Estate Partner and Co-Head Avi Banyasz, the real estate platform of Fort Worth- and San Francisco-based alternative asset giant TPG has “more dry powder than at any other time” in its history, with the closing of its $6.8 billion-plus TPG Real Estate Partners IV fund. With the new opportunistic fund, the firm says it will continue its strategic focus of investing in primarily property-rich platforms and strategic portfolio aggregations in the U.S. and Europe. Banyasz added that TPG Real Estate is “focused on investing behind themes backed by either long term secular trends or dislocations caused by capital market volatility.” Since its inception, TPG Real Estate says it has invested and committed around $9.1 billion of equity.

—

Trinity Hunt Partners raises $618M continuation fund for local portfolio companies

⟫ Dallas private equity firm Trinity Hunt Partners announced closing on its first continuation fund, raising $618 million in commitments led by StepStone Group and Schroders Capital to continue the expansion of its local portfolio companies Argano, a digital consultancy, and Improving, a digital services firm. The firm—which has $1.2 billion in assets under its management—said the fund will help continue its growth strategy for the two companies through organic growth and add-on acquisitions. According to Trinity Hunt Managing Partner Blake Apel, “there is additional value at these companies that can be unlocked with additional time and capital.”

—

Improving acquisition expected to add $250M in annualized revenue

⟫ Speaking of Improving, the Dallas-based technology consulting and custom software solutions firm is expanding its reach in the Canadian market with the acquisition of Vancouver’s Bit Quill, a cloud and data software development company. While not disclosing the terms of the deal, Improving said the move is expected to increase its annualized revenue by more than $250 million, adding that the deal continues its strategy of “merging technology service companies that share a commitment to building trust.” Bit Quill’s leadership will remain intact.

—

Dallas’ Energy Spectrum Capital helps launch new energy firm

⟫ Dallas-based investment firm Energy Spectrum Capital is helping with the formation of California’s Nightpeak Energy, a company focused on developing, owning, and operating energy projects, with equity funding of up to $200 million from its eighth fund. The funding, along with that of a “major U.S.-based lender,” will help Nightpeak focus on developing projects in Texas and other parts of the West, where it says the growth of intermittent renewable energy resources has created a need for “flexible, dispatch generation assets.” The firm says those could include utility-scale batteries.

—

RS2 Ventures looks to raise $14.5M for new fund

⟫ Dallas-based fintech Firm RS2 Ventures, which focuses on acquiring payment solutions under the name BankWORKS, reported raising $10.2 million from 36 investors out of a $14.5 million offering for a new private equity fund titled RS2 Ventures, LP – SP Series B. According to its website, RS2 was founded in 1988 as a banking software provider in Germany. It expanded to the U.S. in 2018 about a decade after listing on the Malta Stock Exchange.

—

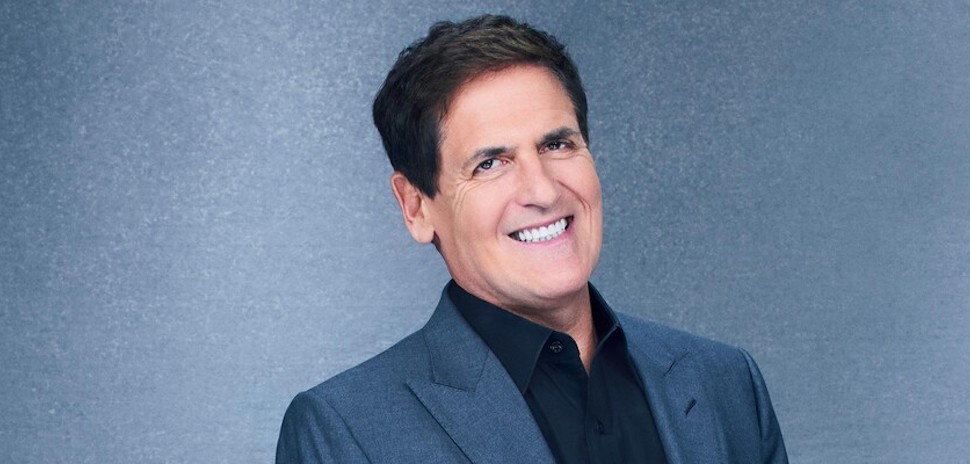

Mark Cuban [Photo: ABC]

Mark Cuban backs Storage Scholars on ‘Shark Tank’

⟫ In what could be his penultimate season on “Shark Tank,” Dallas billionaire and serial entrepreneur Mark Cuban invested $250,000 in North Carolina-based Storage Scholars in exchange for a 10% stake in the company. Founded in 2017, Storage Scholars is a moving and storage company focused on college students. Operating across nearly 50 schools, the company has generated about $1.86 million in revenue this year. On the episode, Cuban told Storage Scholars co-founders Sam Chason and Matt Gronberg that if he gets “out there starting to talk about it…the phone’s going to ring” for the company to open in new schools.

—

Darling Ingredients chairman and CEO Randall Stuewe. [Video still: Darling Ingredients]

Darling Ingredients acquires Brazilian firm for $1.2B

⟫ Irving-based Darling Ingredients, a company turning food waste into sustainable products and renewable energy, announced plans to acquire Brazilian collagen product producer Gelnex for $1.2 billion in cash. Across its South American and U.S. facilities, Gelnex produces about 46,000 metric tons of collagen products annually and employs around 1,200 workers. Through its health brand Rousselot, Darling Ingredients said collagen produced by Gelnex will be used in applications from powder blends, nutritional bars, and confectionary. The deal is expected to close in the first quarter of next year.

—

Vidro still: The Devhouse Agency

Software development studio The Devhouse Agency acquired by recently formed consultancy

⟫ After forming earlier this year, New York design and innovation consultancy Journey has acquired The Devhouse Agency, a Dallas-based software development studio—marking its fourth acquisition in the past 10 months. Journey said the move will expand the development and engineering talent of its Metaverse Studio, which offers strategic and technical services like game development. As it looks to “scale up” its offering, Journey teased more acquisitions in the near future. Journey was formed in January via the merger of ICRAVE, Skilled Creative, and Future Intelligence Group.

—

GuideCap Partners sells its valuation division

⟫ Dallas investment bank GuideCap Partners has sold off its valuation division to Utah-based financial services firm Scalar for an undisclosed amount. As part of the deal, Scalar is planning to set up a Dallas office and retain the division’s existing employees, per the Dallas Business Journal. GuideCap founder and Managing Partner Kevin Ainsworth said the move will allow the middle market-focused firm to focus on its core investment banking business.

—

Dallas Cowboys’ offical accounting firm merges with BKM Sowan Horan

⟫ Dallas public accounting firm BKM Sowan Horan is combining with the official accounting firm of the Dallas Cowboys. In a deal expected to close at the beginning of next month, BKM will merge with CohnReznick, the 15th largest accounting firm in the country, according to The Dallas Morning News. With the deal, CohnReznick will have 86 professionals in the Dallas area. And according to CEO David Kessler, the firm is looking to expand its Texas workforce by at least 20% over the next year. Terms of the deal were not disclosed.

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

[Illustration: ImagePixel via iStock]

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.