Between 2020 and 2022, Dallas-Fort Worth was No. 2 in the U.S. in the growth of its share of national digital services jobs, edged slightly by Metro Austin. That’s according to a Brookings Institution analysis of Lightcast data—part of a new Brookings report that takes a deeper dive into how tech jobs have spread beyond Silicon Valley.

The report shows that the Dallas-Fort Worth-Arlington metro had 142,951 tech jobs in 2022 representing a 3.6% U.S. share, reflecting a 0.3% change over 2020. Metro Austin had fewer tech jobs at 82,560, and a lower 2.1% U.S. share, but a slightly higher change over 2020 of 0.4%.

Denver came in at No. 3 in the growth of its share of national digital services jobs, with 82,839 2022 tech jobs and 2.1% U.S. share, with a change from 2020 of 0.1%.

Dallas leads a new list of tech job ‘rising star’ metros

For the first time in more than a decade, the report states, digital activity seems to be spreading out from the “Big Tech meccas” to “rising star” metro areas including Dallas, Denver, Miami, and Salt Lake City.

The emergence of “rising star” metros like Dallas offers a “stark contrast” to the decade prior to the pandemic, the Brookings reports states. During that decade, “the list of metro areas that grew their share of the nation’s digital services sector was commanded by the usual Big Tech towns: San Francisco; San Jose, Calif.; Austin, Texas; and Seattle. New York, Boston, and Los Angeles were also growing briskly,” the report added.

Once the pandemic hit in 2020, the ” vibrant rising star” metros took off with tech jobs growth. Meanwhile, “San Francisco and San Jose disappeared from the list of metro areas gaining the highest shares of digital employment,” the Brookings report states.

The other cities that round out the Top 10 list of 2020-2022 metro areas for growth in digital services employment share are “relative tech newcomers” including Provo, Utah; Nashville, Tenn.; Houston; and Jacksonville, Fla.

‘A moment of reorientation’

The report calls what’s currently happening “a moment of reorientation—and opportunity for new places and the country as a whole.”

While it notes that the generative AI “gold rush” is “highly concentrated” in a few Big Tech towns, “AI employment remains small in comparison to the rest of the digital sector.”

The report attributes the tech job boom in places like DFW partly to a “big build of private investment—some ‘reshored’ or ‘localized’ from abroad, which swept the U.S. in 2021.”

“Since then, the new funding surge has yielded more than $230 billion in private semiconductor and electronics manufacturing investments as well as tech and digital services spending—much of it distributed widely across the county,” the report adds.

Federal funding has been another tech job booster for “rising star” metros like Dallas.

Beyond the private investment boom, sizable portions of the $3.8 billion in landmark economic development legislation from the last Congress will channel billions of additional government (and also private) investment into new and “rising star” metro areas in the heartland, South, and Mountain West.

“Most notably, the $250 billion CHIPS and Science Act will promote the “rise of the rest” given its focus on tech activation, including through ‘place-based’ industrial policy focused explicitly on areas that haven’t fully participated in the nation’s superstar-based technology boom,” the report noted.

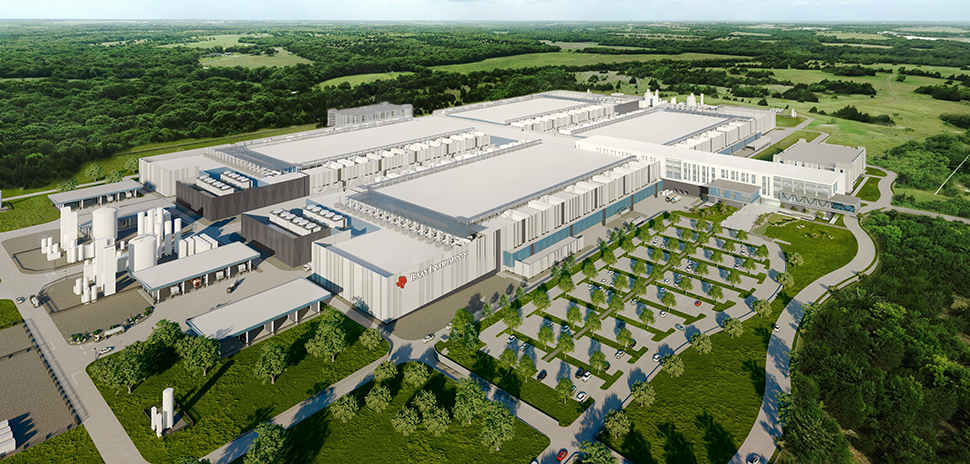

Rendering of TI’s new 300-mm semiconductor wafer fabrication plants in Sherman. [Image: Texas Instruments]

That includes two big wins North Texas landed in 2023, including the Texoma Semiconductor Tech Hub landing here as part of 31 nationwide tech hubs designated by the Biden-Harris administration, and Texas being chosen for one of three federal Advanced Research Projects Agency for Health (ARPA-H) hubs, with the Customer Experience hub to be physically located at Dallas’ Pegasus Park.

Those two game-changing hubs—and multi-billion-dollar semiconductor wafer fabrication plants being built in Sherman by Texas Instruments and GlobiTech—are just some of the reasons why North Texas looks poised to be a tech jobs “rising star” for years to come.

You can read the full Brookings report by going here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.