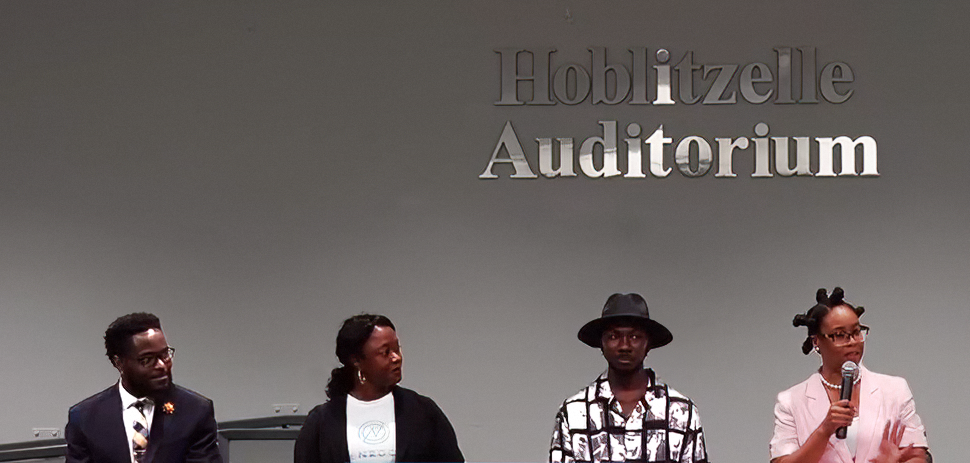

At the recent Entrepreneur Showcase in Dallas—presented by Dallas College, the Small Business Administration, and The DEC Network—the stage was set for a celebration of startups. A panel put the spotlight on four North Texas startups that grew with the support of the SBA’s Community Navigator Pilot program.

SBA Administrator Isabella Casillas Guzman, visiting North Texas to promote small business programs, underscored the program’s significance in her keynote at the July 26 showcase. Guzman, a voice for America’s 33 million small businesses in President Biden’s cabinet, emphasized a core message: Nurturing entrepreneurial talent in every community is key to a robust economy.

SBA Administrator Isabella Casillas Guzman speaking at the Bill J. Priest Institute in Dallas. [Photo: The DEC Network]

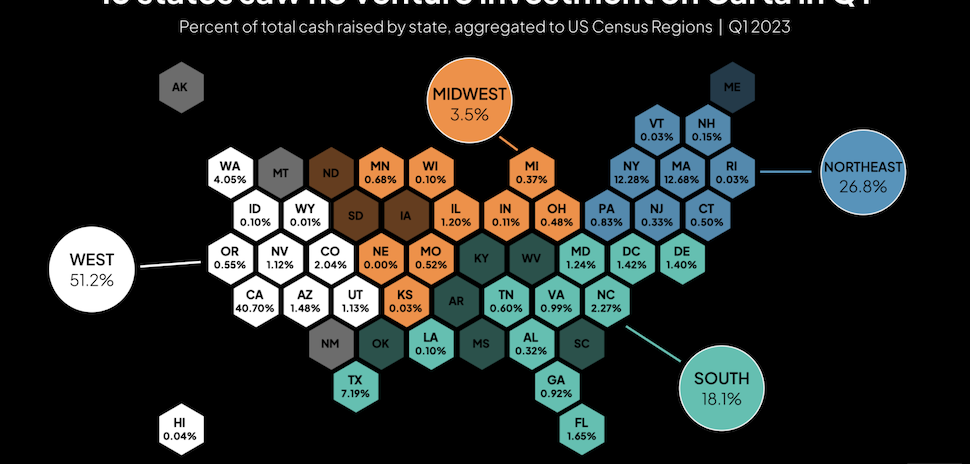

Tarsha Hearns of The DEC Network shed light on the SBA’s navigator initiative, conceived as part of the American Rescue Plan Act of 2021. Out of $100 million allocated to 51 organizations across the country, The DEC Network stood out as one of only two recipients in Texas.

The recipients, referred to as “navigators,” were selected to provide outreach to underserved businesses with a community-centric approach. The idea was to create a grassroots network to bridge the gap between local entrepreneurs and the resources offered by the SBA—and serve as eyes and ears on the ground for the agency.

$4.5M distributed among over 600 unique small business clients

As the Dallas navigator, The DEC Network distributed $4.5 million among over 600 unique clients and trained more than a thousand entrepreneurs, said Hearns, the former director of LiftFund DFW and the DEC’s senior director of the Southern Dallas ecosystem.

Hearns pointed to a collective effort behind the numbers. With several Community Development Financial Institutions, known as CDFIs, attending the Entrepreneur Showcase, their contribution, alongside “spoke partners” like WINGS and the Veteran Women’s Enterprise Center, was on full display. Together, they provided over 1,600 counseling hours, playing a role in creating or preserving 561 jobs, she said.

But the spirit of the Community Navigator Pilot Program transcends numbers like those, Hearns noted. While programs and statistics are informative, she stressed the real focus: the entrepreneurs who have benefited. At the event, Hearns spoke with four founders who shared challenges, victories, and the program’s transformative impact on their journeys.

The startup panel included Ezi Negus, Okigwe Creations; Greer Christian, PureNRG Cycle; Awah Chai, Offworld Coffee; Kimberly Matthews, Holy Rollie Pastry Shop [Photo: The DEC Network]

Meet the entrepreneurs

Kimberly Matthews: Sweet Success with Holy Rollie Pastry Shop

Kimberly Matthews

Kimberly Matthews, the founder and CEO of Holy Rollie Pastry Shop in Irving, is not your ordinary baker. Though she started her career as a formulation chemist, Matthews took an unexpected turn into the world of pastries in 2020, adding her own unique twist to cinnamon rolls.

“We have cinnamon rolls in different sizes and flavors, from strawberry to peach cobbler to Red Velvet,” Matthews said. “We also have the classic traditional one for you purists out there.” Based in Las Colinas, her treats are also available online and have snagged attention on social platforms like Instagram and Facebook.

While Matthews may have entered the bakery business by chance, it wasn’t an overnight success. “I am not a restaurateur. I wasn’t even a baker to be honest,” she said. The concept of cinnamon rolls landed in her lap during the pandemic, offering her and her family ample time to experiment with recipes and introduce them to local farmer markets.

Leveraging her MBA background, Matthews sought guidance in running her own business. “I took my sister’s advice and signed up for mentorship,” she said. Advisors from LiftFund and the Women’s Business Center were instrumental in streamlining her business journey. They helped complete “my business plan and advised me on other resources within DFW.”

Matthews tapped free resources—like the Small Business Development Center and community navigator—to fortify her venture. Her SBDC advisor “got me in front of a lot of banks,” she said. “He believed in me. That’s the thing about these advisors: They’re your biggest supporters.” The advisors also gave her the push she needed when doubts clouded her path.

“Whenever I didn’t think I was ready for a store,” Matthews recalled, “My advisor said ‘You’re ready. Your numbers look good, your sales look good. Let’s go forward.’ With his encouragement, I took that leap of faith.” Matthews opened her first brick-and-mortar store in April 2023.

Still, it wasn’t all smooth sailing. Matthews met with numerous banks, but the fit was never right. “We decided to bootstrap, liquidate some of our assets, and budget to open our first brick and mortar.” Matthews had a head start in a sense: “I was already a bakery, so we didn’t have the white box. I literally just needed to slap some pink on the walls, and we were good to go.”

The store meant expanding her team, and with it came the weight of responsibility. “We hired six employees,” Matthews said, “I was responsible for their income, y’all.” The founder opened on April 1, and by the end of the month, “we were funded for the loan. It gave us that working capital and buffer.”

But she wished she had been told ahead of time: “Your cash is going to go real fast. Get somebody else’s money.”

“LiftFund worked with me to get my application right,” she said. They helped with the cash flow. “It felt really good to have that safety net,” Matthews said, adding that the startup has more than broken even. “We are profitable.”

Matthews stresses the importance of networking and seeking guidance: “You don’t know what you don’t know. These people know, and they want to help you,” she said, acknowledging her advisors’ instrumental roles. And along the way, connecting with others opens up opportunities. It may take getting out of your comfort zone, but it’s worth it: “Just start with handing out a business card, and make that personal connection,” she said. “You’ll see the return for sure.”

Matthews also advocates for the power of persistence. Whether it’s enduring 104-degree heat at farmers’ markets or networking events, resilience can’t be underestimated. “Just keep showing up for yourself,” she advised fellow entrepreneurs.

Awah Chai: From first coffee to first pitch

Awah Chai

Awah Chai, the Roanoke-based founder and CEO of Offworld Coffee, arrived in the U.S. in 2019 with goals familiar to many international students: Get a degree, secure a job, and live the American dream. Those plans shifted dramatically during his junior year in Waco when the computer engineering student sipped his first-ever cup of coffee.

“It was not that impressive,” he said. “I thought, ‘I could definitely improve upon this.'”

Today Chai’s startup, Offworld Coffee, is crafting a niche, specializing in coffee concentrates he calls “infused refreshes.”

Born and raised in Cameroon—where tea is the norm—Chai found the taste of coffee too bitter. His taste assessment, based on a tea-drinking background, led the entrepreneur on a journey to enhance the coffee experience by infusing it with tea and fruit flavors, including watermelon, pineapple, and apple.

After working on improving coffee for about six months, Chai decided to drop out of college. Moving to Dallas to make his coffee infusion shelf-stable, he navigated common entrepreneurs’ challenges: bringing a product to market and building community connections. He officially launched his LLC in October 2022 and began seeking resources to bolster the business side of his endeavor.

Chai, a newcomer to the beverage scene, faced the daunting task of establishing himself in a competitive market.

“It’s really difficult to break into that market,” Awah said. “I didn’t have any connections at all.”

The pursuit brought him to Dallas College, where he met mentors who played an instrumental role in his venture. “I got into the Start Pivot Grow program,” he said. His experience in the program was not just educational; it helped him establish vital connections. He says the interactions with mentors, especially Cynthia Nevels, fostered a collaborative spirit in his journey.

Nevels, a fractional COO for growth ventures and startup founder of Integrality Consulting and vegan food truck Soulgood, is a business strategist and mentor. They connected instantly, and her wisdom became a beacon for Awah’s ambitions, he says.

“She educated me on what I was getting into,” Awah said, “how the beverage industry works, what I needed to do, and insights to the road of profitability. She told me straight you will not see any results in the first year—or even the second year—but you have to put that time in and you have to create those connections.”

Chai won the Start Pivot Grow micro accelerator’s 2023 Pitch It Texas competition hosted by Nevels’ foundation and Dallas College. “Everybody was a winner, but I took the trophy home,” the founder said.

“Starting out,” he said, “it gave me resources I would not have gotten just from searching online.” Chai is grateful for the mentorship and guidance he received, especially from individuals like Nevels.

“It’s really encouraging associating yourself with other business owners,” the founder said. “Get to Dallas College, meet people with the business mindset network.”

Chai now attends area CPG meetings in Dallas-Fort Worth, where he’s gotten more information about steps to break through in the beverage industry, he said. “The connections I’ve made along the way have helped me push forward with the business, and it’s led to growth, he said.”

Greer Christian: Pedaling Passion and Purpose at PureNRG Cycle

Greer Christian

Greer Christian’s indoor cycling studio is the first of its kind west of the Trinity. PureNRG Cycle in West Dallas caters to communities like Kessler Park, Bishop Arts, Steven Park, and more. Christian’s studio, however, isn’t just about cycling. “I know when you think about indoor cycling, you think about all the crazy people on the bikes.”

The studio’s strength training isn’t just any ordinary routine, Christian says. The training is computer-controlled and data-driven, using a technology from Frisco-based pioneer Oxefit, which ensures both personal and group training is optimized based on collected data.

The power of PureNRG lies not just in its state-of-the-art training but in its philosophy. “Our goal is to ensure that everyone is included,” Christian said, emphasizing inclusivity. There’s a place for both novice and advanced cyclists at PureNRG.

Christian joined forces with her co-founder, Janelle “JJ” Wright, around four years ago. Both were indoor cycling instructors, with Greer joining the ranks to understand the class side of things better.

And, she says, “We needed the money.”

Then, “the pandemic hit,” she recalled, noting how the co-founders grappled with understanding the financial intricacies of setting up a studio. With a banking background, Greer was adept at analyzing the financial health of businesses, but being on the entrepreneurial side was a new challenge. Financing became a pivotal issue, especially when setting up a cycling studio. “Your bikes are roughly around $2,000 to $3,000” each, she pointed out, highlighting the sizable investment required to buy 30 bikes.

BCL and LiftFund were pivotal in helping the co-founders structure their business financially. Christian recalls the back-and-forth, adjusting and fine-tuning financial strategies. “BCL was our first infusion,” Greer said. “After we had gotten some traction [with BCL], we went to LiftFund.”

Greer detailed the impact of the financial boost. “We had to have at least 20% of the total budget in the game. With that secured, we could buy our bikes and some other essential items.” But really, she says, “what helped us was just being able to secure our rent.”

Once the credit was lined up, “our landlord was like ‘Okay, yes. We believe in you. We understand what you guys are doing.’”

Greer says her strategic insight pairs well with JJ’s background in engineering and operations—and was necessary. “We didn’t move into a facility that was built out; we built out that entire facility,” she said.

The results speak for themselves: “We planned for eight months and built our location in four months,” Greer said.

The support from BCL and LiftFund was significant, Greer said. “They basically gave us the power that we needed to move forward. And now, we’re exploring opportunities from an operational standpoint because it takes money to make money.”

Greer has broader horizons: “We’re actually going to franchise this.” The co-founder plans to use her community development background to provide fitness opportunities in underserved communities.

On a parting note, Greer had a universal message for entrepreneurs everywhere: “Don’t be afraid to ask. Closed mouths don’t get fed,” she said, emphasizing the importance of reaching out and seeking help. “And then also, be careful how you treat people. That’s just life, period.”

Building her business, Greer reached out to people she’s known for decades. “Some I hadn’t talked to in 10 or 15 years, and they opened their arms to help us.”

Greer says persistence is key. “You just never know what someone may say. You know the ‘nos’ are going to come, but you keep pushing. Never stop, even when the money is dry. If you believe in your passion, if God hasn’t told you to stop, just keep moving.”

Ezi Negus: Championing small businesses with Okigwe Creations

Eki Negus

Ezi Negus calls himself the co-chief problem solver of Okigwe Creations, a digital platform committed to amplifying the online presence of small businesses. Negus wants to ensure smaller enterprises aren’t left behind in the digital age by offering web traffic solutions, social media strategies, and custom software development.

The founder’s extensive background in enterprise technology, especially custom software, fuels Negus’ mission to scale globally-implemented solutions for small businesses.

But his vision extends beyond just providing tech solutions.

“Seeing the barrier of entry for people that look like me was what got me galvanized to start the business,” Negus said.

Okigwe Creations has a “two-foot solution”—helping small businesses thrive online while providing opportunities to a diverse array of talented engineers and developers. Negus emphasizes hiring a diverse team of engineers, developers, and other technocrats, ensuring talents that might otherwise be overlooked.

While Okigwe Creations has made a name for itself in building websites for small businesses, it’s gearing up for more. Working with TruFund led to a revamp of the company’s services.

Negus transitioned from a “big tech” background to the plate-spinning world of a small business owner. “With enterprise software, things are done for you. I’d fly to meet the client, wine and dine, nurture the relationship, and close the deal.” The new reality? You essentially do everything as a founder, Negus says.

Navigating that transition isn’t always easy. For Negus, the challenges of building technology and solutions were familiar territory, but “going from vision and strategy to actual execution” is another thing altogether.

“Just because you have a great idea doesn’t mean you’ll have an easy execution, Negus said.

Like other entrepreneurs, Negus grapples with the frustrations inherent in running a small business. There’s research, of course, but often the solutions that work for others don’t necessarily fit one’s own situation. It was here that TruFund stepped in. Its assistance wasn’t limited to just financial literacy or funding. It helped the founder establish sound business practices, run a team of engineers, and identify market-fit solutions.

Negus also gave the nod to others in the startup ecosytem that made his small biz journey smoother: “I’m going to give a big shout out to Comerica HQ and their business center. I’ve been to multiple events at RedBird and The DEC Network, and these have been lifelines for me,” he said.

When some days inevitably feel “as a small business owner, the world’s against you,” it’s vital to focus on who’s validating you, the founder said.

For Negus, business development and networking go hand-in-hand. The entrepreneur emphasizes the unparalleled value of face-to-face interactions. “Nothing beats boots on the ground. Introduce yourself to people,” he said, attributing his company’s growth to a personal touch.

In an age of constant digital connection, the founder and tech expert boiled down the essence of communication, “Sometimes I think communication is, ‘Are you picking up what they’re putting down?’ It’s not as cut and dried as it may sound.”

Negus’ extensive background in digital outreach frames his perspective. Behind metrics, Google Analytics, and ad campaigns, the real aim is genuine human connection. “You’re going to run all these campaigns and get Google Analytics on your site. But it’s all leading you back to square one, which is to meet a person,” Negus said.

But making that genuine connection isn’t always easy. “You may send an email and not get a response two or three times. It’s not personal.” It’s a reflection of a busy world, he says. “These people are busy and soon you’ll be busy as well.”

The founder’s journey in the tech world has led to unexpected avenues of learning. “A lot of our clients are in the beauty industry,” Okigwe said. “I’ve had to learn about concealer and contour, which blew my mind.”

Okigwee advises, “You can’t just stay in your lane. Some of your biggest learning opportunities come when you spread your wings.”

Building on the founder’s passion for new ventures and a desire to “ease the path” for other small businesses, Okigwee is kicking off “Das Printers,” a bi-monthly newsletter for Texas’s small business community. Packed with events and funding info, he says it will be a free resource to help transform challenges into opportunities.

Mark Madrid, associate administrator of the U.S. Small Business Administration, speaking in Dallas at the Bill J. Priest Institute on July 26. [Photo: The DEC Network]

SBA’s head of Office of Entrepreneurial Development on Texas roots and the essence of entrepreneurship

“I feel like I’ve just been to a TED talk with these entrepreneurs’ words of wisdom,” said Mark Madrid, associate administrator of the U.S. Small Business Administration, a stage partner at the event.

That spirit, he says, is what energizes him daily.

The SBA leader pointed to Holy Rollie Pastry Shop founder Kimberly Matthews, whose optimism particularly resonated with him. Matthews’ perspective on capital rejection isn’t a “no,” but a “not yet.” And, he noted, the founder is growing an impressive social media presence with more than 6,000 followers.

Serving small business owners is more than just a job for Madrid, he says: “This is the most honorable thing that I could ever do in a profession.” His commitment is deeply intertwined with his personal history and Lone Star State upbringing.

“Yes, I do have these boots on because I was raised in Texas,” he said. Madrid grew up in Freon, a farming community he fondly called the “cheeseburger capital of Texas.” He also claims he could “easily run a 5K” in his boots if he had to, alluding to the “boots on the ground” ethos that defines his approach to business.

Madrid’s SBA role is also a tribute to his late father, a long-time welding business owner, who passed away from COVID-19 in 2020, and to all small businesses across the country.

Madrid shared the story of his parents, who began their journey in the cotton fields. With limited formal education—his father only completed junior high and his mother finished at the fourth grade—they met as migrant farmworkers. Despite their humble beginnings and limited resources, they dreamed of building wealth and providing a better life for their family. That dream materialized as a welding business his father started from scratch with zero revenues.

That entrepreneurial venture, Madrid says, was the very reason he could pursue higher education at prestigious institutions like UT Austin and Notre Dame—ultimately realizing his childhood dream of representing America itself.

He hopes the story can serve as a beacon of hope and inspiration for other small business owners who are also starting from ground zero.

Since taking the helm of the Office of Entrepreneurial Development (OED) in 2021, Madrid has advocated for the success of small businesses, according to Kara Lehnert of The DEC Network, who introduced the SBA leader to the stage. The OED has advanced critical initiatives through his leadership, including the Small Business Development Centers, Women’s Business Centers, and SCORE.

Echoing the power of dreams and hard work

Madrid echoed the power of dreams, hard work, and the indomitable spirit of entrepreneurship he heard from the panelists. “I love what [Ezi Negus, founder of Okigwe Creations] said about ‘feeling like you’re being jumped by life,” Madrid said. Negus, who advises entrepreneurs to “use what they can as far as resources,” is a “solution generator,” Madrid said. “I have all the optimism that you are going to keep on flying, my brother.”

Madrid, who heads one of the largest offices at the SBA, detailed the organization’s solutions and emphasized the multifaceted approach it’s taking to empower businesses. Beyond access to capital, Madrid championed the broader support the SBA is providing, including “access to networks, rolodexes, and people.”

In an era where confidence can sometimes be in short supply, Madrid points out the need for “access to confidence,” recognizing the myriad concerns small business owners face. He says Administrator Guzman’s directive for the agency is focused on being more customer-centric, technology-forward, and advancing equity.

“We don’t want anybody left behind. That’s the bottom line,” he said.

Madrid emphasized the importance of supporting all players in the small business sector, from the women who have been making significant strides to men and non-binary entrepreneurs to rural entrepreneurs and communities of color.

“Words are one thing, but it doesn’t mean a thing if you’re not acting,” Madrid said, outlining the various actions being undertaken to bolster the small-business community.

‘Access to capital is critical’

“Access to capital is critical,” he acknowledges. But that doesn’t end once the capital is secured; the nuances of loan repayments, action plans, debt leverage, and more weave into the tapestry of business growth. Madrid sees the critical need for continuity and education for small businesses in capital management.

Madrid gave credence to the steps being taken by the administration to streamline processes and remove barriers. Citing Administrator Guzman’s initiative to cut red tape, he highlighted the transfer of the veteran certification program from the VA to the SBA. He says the move wasn’t just administrative—it had tangible benefits.

As one veteran business owner told him, “Mark, we were able to get certified in three and a half weeks.” He said that rapid turnaround marks a significant improvement in support for veteran-owned businesses.

Madrid drew parallels between capital and certifications: Both represent a first step in the journey of a business. Whether woman-owned, veteran-owned, or any other type of business, the subsequent steps are crucial. A “pathway of continuity, education, and support” must follow, ensuring businesses aren’t left navigating the complexities on their own.

His focus extended to government contracting. While a recent scorecard showed surpassing federal procurement goals, Madrid was candid about enhancing this area. “We surpassed our goal of 23.5% procurement dollars. But that’s not going to be enough,” he said.

Madrid reflected on the economic landscape and the challenges small business owners face. There’s “over $36 million in funding requested. So, yes, there is an appetite,” he said.

The DEC Network’s Tarsha Hearns and SBA Associate Administrator Mark Madrid. [Photo: The DEC Network]

He also praised the supportive network working with the SBA and its partners, like The DEC Network and Dallas College, emphasizing the significance of resource partners, SBDCs, women’s business centers, and SCORE chapters. “I’m very, very optimistic as you can tell,” Madrid said. Still, he tempers his optimism with a sense of realism, acknowledging the challenging times that small businesses are navigating.

Madrid then shared a personal story, drawing on his own family’s experience with his late father’s welding business. He described how his late father’s tools, welders, and even the lawn chair from their family ranch in Abilene, Texas, were auctioned off for a fraction of their value. The memory, especially its impact on his mother, is a stark reminder of the hardships many small business owners face.

The SBA leader wants to prevent such losses for other business owners. He champions the continued support and resources from organizations like The DEC Network, he said. He believes showing up, networking, and leveraging available resources can make a monumental difference in the trajectory of a small business.

“What would have been the case if my dad and that welding business would have had the things that you’re supporting and accessing here? I think we would have franchised the business,” he said.

MORE COVERAGE OF THE EVENT

SBA Administrator Isabella Casillas Guzman and stage partner SBA Associate Administrator Mark Madrid spoke at the Bill J. Priest Institute in Dallas on July 26. [Photos: The DEC Network]

SBA Chief in Dallas: ‘We Are Becoming the Startup Nation’

Since January 2021, a record 12.2 million new business applications have been filed nationwide—with Texas alone contributing 1.1 million. Speaking at a Dallas event, Administrator Isabella Casillas Guzman emphasized ongoing efforts to support Americans in realizing their entrepreneurial dreams.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![From left: Ezi Negus, Okigwe Creations; Greer Christian, PureNRG Cycle; Awah Chai, Offworld Coffee; Kimberly Matthews, Holy Rollie Pastry Shop; and moderator Tarsha Hearns, The DEC Network. [Photo: The DEC Network]](https://s24806.pcdn.co/wp-content/uploads/2023/08/Panel.jpg)