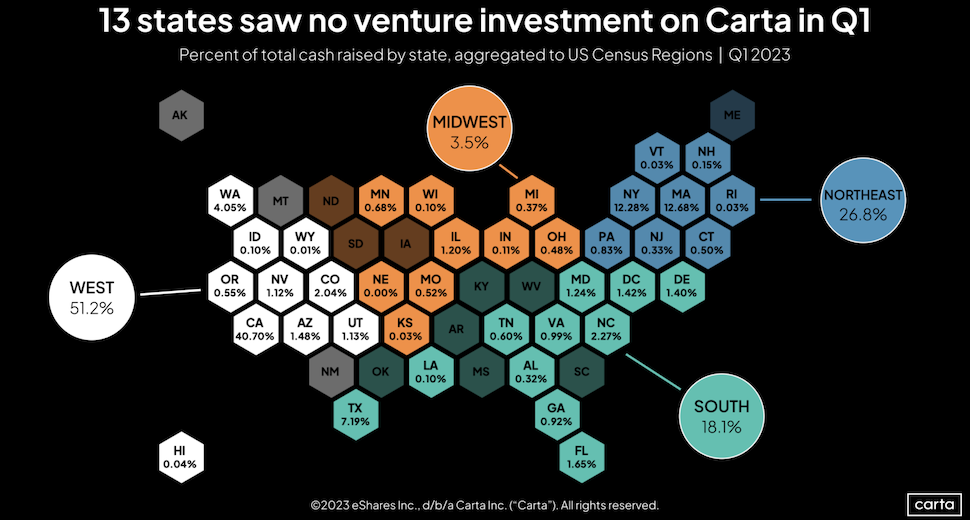

Carta—a San Francisco-based cloud platform that offers cap table management and valuation solutions for over 2.4 million equity owners—has released a report on VC activity on its platform in Q1 2023 . The big news for Texas: The Lone Star State “claimed nearly 7.2% of all VC capital raised” on the platform in Q1, “a huge leap from its 3.2% share during 2022.”

Meanwhile, longtime VC activity leader California saw its share of venture dollars slip to 40.7% on the platform in Q1, down from a high of 51% in both 2018 and 2019.

Carta reported tracking over $2.5T in equity as of August 2022

Carta reported tracking over $2.5 trillion in company equity as of August 2022 and said it had facilitated $13 billion in secondary-market sales. So it should have a good handle on how VC activity is going across the country. The company noted that in Q1, 13 states showed no venture investment at all on its platform.

Texas ranks No. 4 among all states in capital raised on the platform

While the trend is up for VC investment in Texas on Carta, the state still has a long hill to climb to threaten California’s Silicon Valley-led supremacy on the platform. With its gains in Q1, Texas now ranks fourth among all states in terms of capital raised on Carta, trailing only Massachusetts (12.7% of capital raised in Q1) and New York (12.3%) behind California, Carta noted.

That shift is making Carta rethink its lexicon. “It’s beginning to look like the recent growth of Texas could have a lasting impact on the VC ecosystem,” Carta said in the report. “In the recent past, California, Massachusetts, and New York formed an unofficial Big Three states for startup investors. Thanks to Texas, it’s now looking more like a Big Four.”

Corporate relos from California to Texas

After detailing the population shift from California to Texas, Carta noted that the same thing has been happening on a corporate level. The Hoover Institution at Stanford University identified 265 companies that moved their HQ’s out of California between 2018 and 2021, Carta noted, and of all those, 114 found a new home in Texas.

“One factor drawing some former California tech workers to Texas is the lower cost of living, which allows the typical startup salary to go much further than in other locales. Another attraction for both tech executives and rank-and-file workers is taxes. While they say that everything’s bigger in Texas, that’s often not true when it comes to your personal income tax bill,” Carta’s report states.

You can read Carta’s full report by going here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.