What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

Plano Telehealth Startup Raises $14.1M

As the adoption of remote health care continues, a Plano-based startup is looking to expand in the space.

VitalTech, a digital health platform for remote patient care and monitoring, reported raising $14.1 million in equity from 18 investors. According to its SEC filing, the company is aiming to raise a total of about $16.2 million.

Based on previous filings and reporting, the new funding brings VitalTech’s total to nearly $30 million since it was launched in late 2018. Last year, former PointRight CEO Steven Scott took over the top position at VitalTech from co-founder James Hamilton, who moved to serve as a board member.

PLUS

Bishop Cider buys two local brewers

Bishop Cider buys two local brewers

⟫ Dallas’ Bishop Cider has large expansion plans, starting with the acquisition of two local brewers.

The company announced acquiring Fort Worth’s Wild Acre Brewing and Arlington-based Legal Draft Beer Co. Since Bishop acquired the latter of the two for its equipment, it won’t be continuing to make Legal Draft beer. However, it will be opening one of its Cidercade entertainment concepts at Legal’s Arlington space and will use the equipment to bolster Wild Acre’s capacity, in addition to giving Wild Acre a brand and recipe update under the leadership of former Revolver Brewing co-founder and brewmaster Grant Wood. Wild Acre’s facility will also be part of Bishop-owned co-packing company TexBev.

In addition to the acquisitions, Bishop is expanding its Cidercade concept, which combines dining with an arcade, from its current three locations in Dallas, Houston, and Austin. A new Cidercade is currently under construction in Fort Worth.

Bishop Cider is also in the process of relocating its Dallas location to a new space that it says will be 10 times larger and feature concepts that “aren’t offered anywhere else in Texas.”

—

U.S. DoE Funds Denton Composite Material Maker

⟫ The U.S. Department of Energy announced distributing $53 million in funding to help fuel clean energy and climate solutions, with Denton-based Z&S Tech named as one of the 259 recipients. While it didn’t specify how much each company landed, the funding will help Z&S develop a “bio-based composite material” that will reduce the amount of carbon used in vehicle manufacturing.

—

CBRE Ups Its Investment in Hybrid Office Solutions firm

CBRE Ups Its Investment in Hybrid Office Solutions firm

⟫ In a sign that the look of the traditional office is changing, CBRE Group is upping its investment in a flex-space solutions provider.

The Dallas-based commercial real estate giant announced a new $100 million investment in New York flexible office and suites company Industrious, adding to around $230 million that CBRE has previously poured into the company in past years, as it sees more clients looking for hybrid office solutions.

The new funding, which comes in the form of a convertible preferred-equity security, will help Industrious continue the international expansion it embarked on earlier this month with new spaces in Singapore, Belgium, and France. Industrious, which operates three spaces in Dallas and one in Plano, said the funding would also help it hit “strategic growth initiatives.”

—

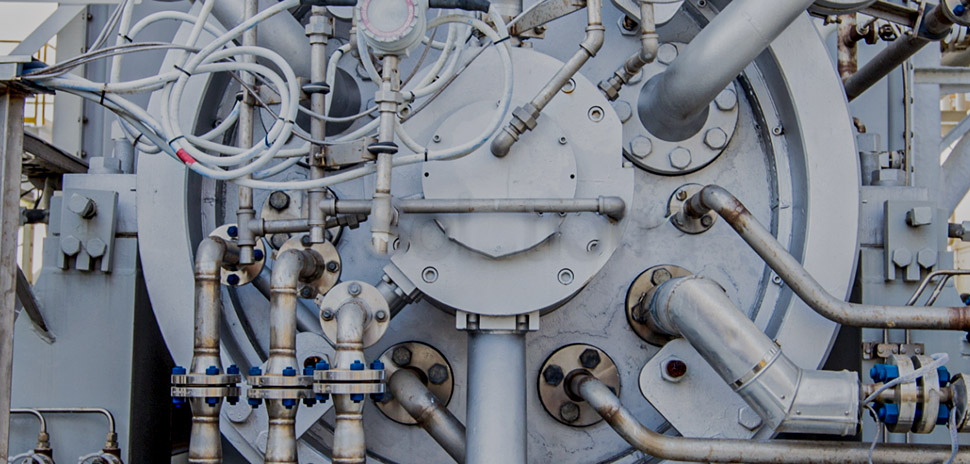

Photo: Service Compression

Fort Worth Investor Lends $215M to Natural Gas Compression Firm

⟫ Lubbock natural gas compression company Service Compression announced receiving a $215 million first lien senior credit facility from Fort Worth-based alternative investment management firm Crestline Investors. Service Compression plans to use the credit to fund an acquisition of “incremental wellhead compression” in the Permian Basin area, in addition to helping it build an electric wellhead compression program.

—

Rosewood Corporation Raising New Fund

⟫ The Rosewood Corporation, the Dallas-based holding company behind multiple Rosewood subsidiaries, reported raising nearly $68 million in equity and pooled investment fund interests from 55 investors for a new investment fund titled “Fortress Magnolia, LLC.” Rosewood is owned by the Caroline Hunt Trust Estate, per the Dallas Business Journal.

—

Southlake VC Raising Two New Funds

⟫ Eagle Venture Fund, a Southlake- and Switzerland-based early-stage venture capital firm, is raising two new funds—Eagle City Fund Dallas, LP and Eagle Venture Fund III, LP. The firm, founded in 2017, hasn’t raised any money for the funds yet and did not specify how much it aims to raise for each. According to its website, Eagle invests in seed and Series A funding rounds in U.S. and European companies in areas like fintech, SaaS, infrastructure, energy, and health products. Earlier this month, Eagle led a $2 million Series A round for Grapevine-based insurance technology startup SALT to help the company build its sales and distribution teams.

—

Report: Unleashed Brands Is Looking for a Buyer

Report: Unleashed Brands Is Looking for a Buyer

⟫ Bedford’s Unleashed Brands, the parent company of entertainment franchises like Urban Air Adventure Park and Snapology, is courting buyers, founder and CEO Michael Browning told Axios. The news comes as the company is planning to make four new acquisitions this year in the areas of arts and sports, in addition to adding 235 brick-and-mortar locations in 2022 to its current lineup of 800. Browning said Unleashed expects to see $160 million in revenue this year.

—

Dallas VCs Invest in Major League Cricket

Dallas VCs Invest in Major League Cricket

⟫ Ross Perot Jr. and Anurag Jain, the founders of local venture capital firm Perot Jain, joined a $44 million Series A and A1 funding round for Major League Cricket, which included a pledge to invest an additional $76 million in the franchise. Looking to launch next year, MLC said the funding, led by Microsoft CEO Satya Nadella, will mostly be used for stadium infrastructure projects.

MLC is sanctioned by USA Cricket partner American Cricket Enterprises, which signed a 15-year lease in 2020 for Grand Prairie’s AirHogs Stadium, the former home of the now-defunct Texas AirHogs pro baseball team. When renovated, the stadium will become the home of a new MLC franchise, ESPN reports.

Read more about cricket’s North Texas future in our story here.

—

Dallas PE firm to Merge With Boston-Based SPAC

Luke Brandenberg

⟫ Dallas oil and gas-focused private equity firm Grey Rock Investment Partners in merging with Boston-based blank check company Executive Network Partnering Corporation to create Granite Ridge Resources Inc. in a $1.3 billion deal that’s expected to close later this year, the Dallas Business Journal reports. Planning to list on the NYSE under the ticker GRNT, the combined exploration and production company is expecting EBITDA of around $425 million in 2022. Granite will be led by CEO Luke Brandenberg, a former managing director at Fort Worth PE firm Vortus Investment Advisors, who previously worked with Grey Rock to launch a “special situations initiative.”

—

Illustration: Baks via iStock

Dallas Cybersecurity Startup Merges with Pathlock

⟫ New York governance solutions startup Pathlock has merged with Dallas-based ERP data security solutions provider Appsian and Utah’s Security Weaver, a compliance management software provider. At the same time, the combined company announced acquiring CSI Tools and SAST SOLUTIONS, two European tech firms, in addition to landing a $200 million investment from Vertica Capital Partners.

—

Worksoft Acquires New Jersey Digital App Testing Platform

⟫ Worksoft, an Addison-based test automation platform owned by Marlin Equity Partners, acquired New Jersey’s eureQa, a digital assurance platform for application testing. Terms of the deal were not disclosed. Worksoft said the move will boost its tech capabilities and offerings to clients.

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

PGA star Dustin Johnson and NFL linebacker Jalen Ramsey have joined current investors like Dak Prescott (above) as investors in OxeFit. [Video still: OxeFit]

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.