What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

Book.io Aims to Put E-books on the Blockchain with New Seed Funding

⟫ Book.io, a McKinney startup developing an NFT e-book platform on the blockchain, announced closing a seed funding round led by book distributor Ingram Content Group for an undisclosed amount.

The money will help Book.io build out its platform, which turns e-book purchases into digital ownership via NFTs. The company says that opens up a new secondary market for publishers and authors, while also enabling an author-to-reader direct engagement channel.

As part of the deal, Book.io says it will work with Ingram to create NFTs of e-books and audio books from its authors and publishers. In addition, working with Ingram’s print-on-demand service, NFT owners will be able to get physical copies of their digital purchase printed and delivered directly.

The company says that within 60 days of launching its technology, it generated more than $250,000 in net sales revenue. It added that it’s in discussions with various authors and publishers to schedule titles for release later this fall.

PLUS

The Form Bio leadership team includes (from left) Andrew Busey, co-CEO; Brandi Cantarel, director of bioinformatics; Kent Wakeford, co-CEO; Claire Aldridge, chief strategy officer; and Ben Lamm, co-founder. [Photo: John Davidson/Form Bio]

Form Bio spins out of Colossal Bioscience to offer scientists the ‘missing piece’

⟫ With $30 million in fresh funding, Form Bio is launching out of local de-extinction startup Colossal Biosciences as an independent company focused on “empowering scientists to reach discoveries and breakthroughs in less time and with less effort.”

The computational life sciences platform uses “deep learning AI algorithms and an ‘intuitive’ user interface to manage large data sets, workflows, and results visualization.” That can help businesses, labs, and universities streamline new discoveries and breakthroughs in areas ranging from drug discovery to the ancient DNA analysis that Colossal is working on.

Colossal’s first spinout likely won’t be its last. The company’s strategy includes commercializing scientific innovations through new, independently operating companies, with the company’s co-founder and CEO Ben Lamm previously saying that Colossal will “look to create IP that can be monetized” along its journey.

Form Bio’s launch is aided by the $30 million Series A round that was led by San Francisco’s JAZZ Venture Partners and joined by Colossal lead investor Thomas Tull, a billionaire entrepreneur who founded investment holding company Tulco LLC and has produced Hollywood films like “The Dark Knight” and “Inception.”

—

Image: Sonara Health

Opioid-focused telehealth platform Sonara Health raises $1.26M

⟫ Sonara Health, a Dallas-based telehealth platform focused on the treatment of opioid addiction, reported raising more than $1.26 million from 19 investors, per an SEC filing.

The Mark Cuban-backed company was formed in 2020 by CEO Dr. Michael Giles while he was working on his psychiatric residency at the Dallas VA hospital. Its platform helps to guide patients through their recovery, in addition to providing data to a patient’s care team, in the hopes of allowing patients to access methadone sooner.

Sonara has raised a total of $5 million, according to the San Francisco Standard.

—

Will Edwards, co-founder and CEO of Firehawk Aerospace [Photo: Firehawk]

Firehawk Aerospace looks to raise $17M as it plans new HQ

⟫ After finishing up engine tests under NASA’s supervision, Firehawk Aerospace is looking to put its technology into orbit as it nears the closing of an expected $17 million Series B fundraising effort and plans a headquarters move.

As Firehawk gears up to put its technology into the hands of customers, the company is moving its headquarters from Dallas to Addison. According to CEO Will Edwards, the new HQ’s space of around 40,000 square feet will house 3D printers, CNC machines, and test setups. In addition, the new headquarters will employ at least 55 workers, as part of a grant and tax incentive package from the city of Addison that includes Firehawk making $1.3 million in investments in the facility.

Firehawk’s growth is being fueled by a Series B funding round led by Fort Worth’s Star Castle VC. In addition to local firms Capital Factory and Goff Capital, other investors on the round include Draper & Associates, Cathexis Ventures, Plains VC, and others. According to TechCrunch, Firehawk has raised $15.5 million out of its expected closing goal of $17 million.

Along with helping Firehawk make new hires and purchase equipment for its new Addison headquarters, the new funding—which will bring its total to nearly $20 million—allows the company to do further R&D work as it does more testing and looks to ramp up production of its engines.

—

Photo: markborbely/iStock

Crowdfunding platform Harvest Returns lands $2.5M round led by food-focused accelerator

⟫ New York-based food- and beverage-focused accelerator FoodFutureCo announced that it led a $2.5 million investment in Fort Worth’s Harvest Returns, a crowdfunding investment platform focused on agricultural technology and innovative practices, earlier this year. That adds to $100,000 the accelerator invested in Harvest Returns in 2019, per Crunchbase. FoodFutureCo says it focuses on organizations with annual sales between $2 million and $10 million.

Harvest Returns also reported raising $655,000 in equity from 80 investors out of a $1 million offering for a new fund titled Harvest Invest-044 LLC, according to an SEC filing. Harvest Returns says it has a pool of more than 8,000 investors that has provided more than $17 million in funding to early-stage businesses in the industry since launching in 2016.

—

Stealthy tech startup Kalpa aims to raise $1M

⟫ Kalpa, Inc., a Dallas-based tech startup formed this year that’s still in stealth, reported raising $150,000 in equity from a single investor out of a $1 million offering. The SEC filing lists Alykhan Rehmatullah, whose LinkedIn profile says he is “building something new,” as an executive. Rehmatullah previously helped found and lead Altru, a video-based recruitment platform that was acquired by iCIMS in a $60 million cash and stock deal in 2020.

—

Wellacy Health joins Northwestern Mutual’s Black Founder Accelerator with $100K investment

⟫ As it plans to relocate from its Dallas headquarters to a new one in Milwaukee, personalized health care startup Wellacy Health has landed a $100,000 investment as part of its acceptance into Northwestern Mutual’s Black Founder Accelerator, the Dallas Business Journal reports. The three-person company is planning to launch a patient engagement pilot in the first quarter of 2023.

—

‘Strategic investment’ helps InterCool USA open new facility

⟫ Carrollton-based commercial and industrial refrigeration design-build contractor InterCool USA landed a “strategic investment” from New York private equity firm FR Investment Partners, which first invested in the local company in 2019. Formed more than 70 years ago, InterCool said that since RF’s initial platform investment, it has doubled its revenue and employee base. While terms of the deal were not disclosed, RF says its investments typically range between $5 million and $30 million. Its most recent investment in InterCool has helped the North Texas company expand its nationwide footprint with the opening of a new fabrication-compressor repair facility in Pennsylvania earlier this year.

—

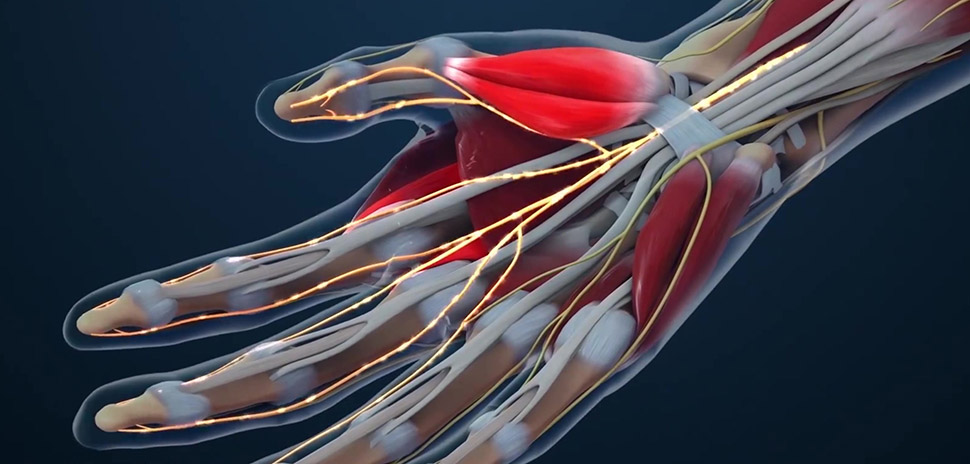

Illustration: Ozgu Arslan/iStock

DFW Neuropathy eyes ‘significant growth’ with new investment

⟫ DFW Neuropathy, a local treatment company focused on neuropathy, landed a new investment led by Dallas private equity firm Baymark Partners and California firm HCAP Partners. Terms of the deal were not disclosed. With four locations across North Texas, the more than decade-old company said the new investment positions it for “significant growth” as it looks to expand its footprint. HCAP focuses on lower-middle market companies that are generating between $10 million and $100 million in revenue with investments ranging between $3 million and $25 million.

—

The Cypress Growth Capital team, left to right: Barton Goodwin, Pat McCaffrey, Ed Mello, Vik Thapar, and Ryan Wallace (Not pictured: Vincent Hsieh, CFA) [Photo: Cypress Growth Capital]

Cypress Growth Capital invests $3.2M in Houston immersive learning platform

⟫ Houston-based immersive learning platform HTX Labs has taken on its first outside investment since launching in 2017 from Dallas investor Cypress Growth Capital. The $3.2 million in royalty-based funding will help HTX expand its revenue team, identify new expansion opportunities in “key commercial markets,” prepare for increased customer adoption, and further build out its EMPACT platform, which allows organizations to create virtual, immersive training programs. HTX co-founder and CEO Scott Schneider said the company chose Cypress due to the experience of the firm’s team and its non-dilutive funding model.

—

Photo: Supply

Supply, a men’s grooming product company of ‘Shark Tank’ fame, acquired by Foundry Brands

⟫ The search for a better shave led a husband-wife team to build a successful direct-to-consumer brand that now has a new owner.

Fort Worth’s Supply, a men’s grooming product company that garnered national attention and an investment on “Shark Tank” with its single-blade razor, has been acquired by Dallas-based acquisition platform Foundry Brands. It’s a move that founder and CEO Patrick Coddou says will help Supply enter “a new phase of growth.” Terms of the deal weren’t disclosed.

With the Foundry Brands acquisition, Coddou said in a Twitter thread that the entire Supply team “is sticking around,” adding that “nothing is changing except that we’re going to move faster, grow quicker, and get better.” Coddou also said the Supply journey has been “a rollercoaster,” adding that his “strengths lend themselves more to starting, as opposed to scaling” a company. On Twitter, he wrote that the decision to sell now is due to the co-founders’ “personal risk tolerance, personal stress tolerance, market timing, and business timing.”

—

Tri Global Energy Chairman and CEO John Billingsley. [Photo: TGE]

Renewable energy provider Tri Global Energy acquired by public Canadian firm

⟫ Dallas-based renewable energy provider Tri Global Energy has been acquired by Enbridge, one of Canada’s largest energy infrastructure firms, in a $270 million deal that will see the publicly traded firm assume Tri Global’s debt. Founded in 2009, Tri Global has developed 8.7 gigawatts of power form 37 wind and solar projects across Texas and six other states. According to Tri Global CEO and Chairman John Billingsley, the deal with Enbridge “allows for continued robust growth to meet the challenge of our lifetime—the transition to a low-carbon economy.”

—

RealPage headquarters in Richardson [Photo: Michael Samples]

RealPage acquires multifamily-focused tech firm

⟫ Richardson-based real estate and property management software giant RealPage announced plans to acquire Knock CRM, a Seattle-based customer relationship management and front office technology firm focused on the multifamily industry. Terms of the deal, which is expected to close in the coming days, were not disclosed. RealPage CEO Dana Jones said the move was “as much about the team as it is the technology.” RealPage said that together with Knock, the companies will “create a next-generation operating platform to maximize net operating income.

—

[Photo: NTT Data/Business Wire]

NTT DATA adds to its digital design and engineering abilities with new acquisition

⟫ NTT DATA, a global digital business and IT services company with its U.S. headquarters in Plano, has inked a definitive agreement to acquire Mexico City-based digital design and engineering firm Umvel. Terms of the deal were not disclosed. As part of the move, Umvel’s 140-person team joins other recent NTT DATA acquisitions in the digital design and engineering space, including Nexient, Vectorform, and Postlight. Expected to close in the coming weeks, the acquisition will help NTT DATA expand its footprint in Mexico, while enhancing its digital products across North America.

—

[Illustration: mrgao/iStock]

Report: Sabre looking to sell off hospitality division

⟫ Southlake’s Sabre, a global distribution systems provider for the travel industry, is looking for potential buyers for its hospitality division, Skift reports, citing external sources familiar with the matter. The report calls it a “surprise move” given that Sabre has previously “pushed back” on talks of divestiture and has increased its spending in the division, which it notes is smaller than the company’s main division that focuses on airline distribution and operational software. There’s no word on which companies Sabre has approached or how much it aims to sell the hospitality division for.

—

KERA looks to acquire Denton Record-Chronicle to ‘preserve local journalism’

KERA looks to acquire Denton Record-Chronicle to ‘preserve local journalism’

⟫ In a move to “preserve local journalism,” local public radio station KERA is looking to acquire the Denton Record-Chronicle. The move, which is expected to close next year, is being facilitated by The National Trust for Local News. While still working through the details, KERA said that a focus of the acquisition will be to keep Denton County’s largest newspaper “local and hyper-focused on the issues and people” of the region. The announcement comes after KERA took over classical radio station WRR 101.1 FM earlier this year.

—

Publicly traded CECO Environmental Corp. acquires South Korean design, manufacturing firm

⟫ Dallas-based CECO Environmental Corp., a publicly traded company that makes air pollution control equipment and technology, acquired water- and wastewater-focused South Korean design and manufacturing firm DS21 Co. Terms of the deal were not disclosed. CECO said that by adding the company to its industrial water portfolio, it will now have an operational base in Asia, where it aims to further expand. CECO also said the acquisition is part of its year-long programmatic M&A program, which represents more than $30 million in pro-forma annualized revenue when combined.

—

Moss Adams acquires local CPA firm Kurtz & Company, P.C.

⟫ Accounting, consulting, and wealth management giant Moss Adams acquired Dallas CPA firm Kurtz & Company, P.C. As part of the asset purchase agreement, Kurtz & Company leader David Kurtz, along with 18 employees of the local firm, will join Moss Adams, which generated $955 million in net revenue last fiscal year, according to Inside Public Accounting. Kurtz & Company’s clients will also be transferred to Moss Adams. According to Moss Adams chairman and CEO Eric Miles, the firm has experienced “significant growth” since it entered the Dallas market in 2015, adding that the move will strengthen its presence in the region.

—

Rackmount Solutions acquires Colorado power systems service provider

⟫ Plano’s Rackmount Solutions, a provider of IT hardware and services, acquired Colorado-based power systems service provider Challenge Technology—a deal facilitated by Richardson-based M&A advisory firm Generational Equity. Terms of the deal, which closed on August 31 but was recently announced, were not disclosed.

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

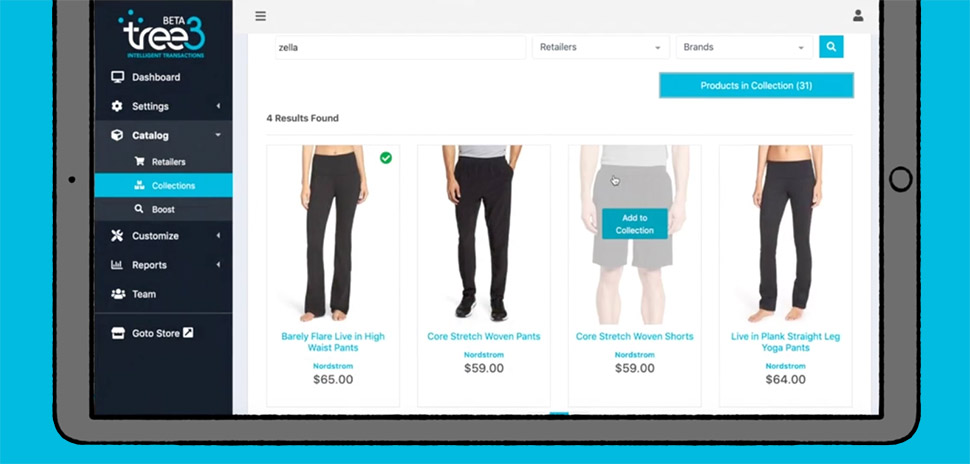

Video still: tree3.com

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.