The nondescript exterior of USAA’s complex near the Shops of Legacy in Plano conveys little of what goes on inside.

A robot rolls about, sometimes dressed in ribbons, interviewing job candidates, zooming in to catch verbal and visual cues. A virtual reality lab simulates life on board warships. There are even warship bunks in an innovation lab down the hall, where employees are encouraged to crawl in, to get a feel for what servicemen and women experience.

The roughly 900 USAA employees in the Plano office — many of them developers — live the military life, just short of enlistment. Once a year, many undergoing pre-dawn basic training, complete with shouting drill sergeants. Most walls in the building have images of soldiers, historical photos of deployed troops, and other inspirational messages to remind team members that they serve those in service to the U.S.

USAA employees are encouraged to explore these military ship’s bunks, to immerse themselves in the lives of deployed soldiers, and to encourage empathy among them.

This is USAA’s approach to encourage its workers to walk a mile in the shoes (and boots) of the 12.3 million members of current or former military and their families, who make up the organization’s member base. In that immersion, USAA is hoping to encourage researchers to feel empathy for clients who might be deployed for years at a time away from their families, or who are solo parenting, while their spouse is serving overseas.

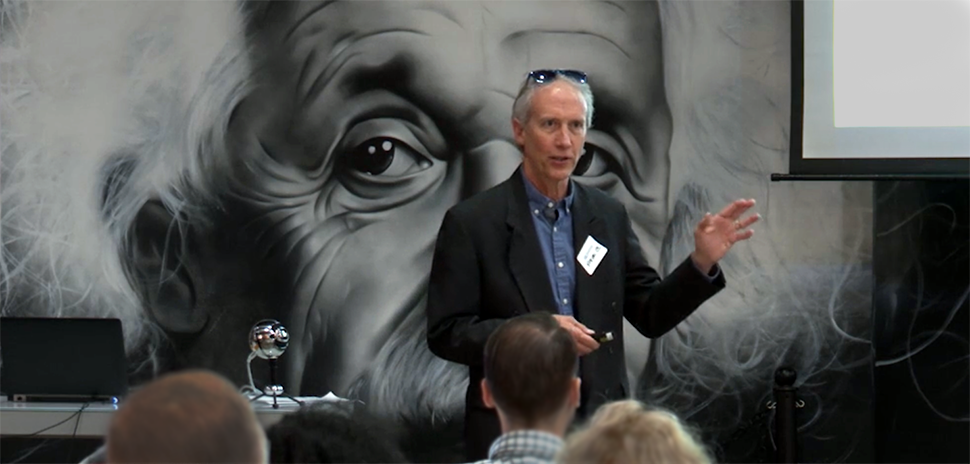

“It was more a client service, to make sure our members have the ability to think about what’s ahead.”

Nick Wheeler

“Lots of companies now, they actually are trying to do this,” said Dalia Soliman-Powers, division chief information officer and executive lead of USAA’s Plano facility. “It’s understanding our customers. But we’re lucky here, that this has been the core of what we have done since 1922. Our founders were officers and [individuals] in the military, and everything that we do is focused on our members.”

That means whatever service USAA provides must withstand extreme conditions — even battlefield conditions — to pass muster. To meet that challenge, the developers — and even general employees — are constantly thinking about ways to anticipate member needs, whether it’s checking account balances, setting up automatic deposits and bill-pay, or looking at their life-insurance policies.

For example, when Hurricane Harvey rocked the Gulf Coast last fall, the USAA innovation team immediately started putting themselves in the places of clients with properties there.

Within 24 hours of the hurricane making landfall, the company’s innovation team, digital developers, and design workers launched a website that allowed USAA members to check on storm damage to their homes, via photos taken by camera-equipped drones USAA had already developed. (Previous drones were used to inspect for hail damage, reducing the need for an insurance adjuster risking life and limb to climb onto roofs.)

USAA has received more than 800 patents since it began operations.

“It was more a client service, to make sure our members have the ability to think about what’s ahead,” said Nick Wheeler, information technology senior manager at USAA.

Aside from the use of drones to identify hurricane damage, USAA has received more than 800 patents since it began operations. The often-dispersed locations of USAA members spurred the organization to pioneer mobile banking. Perhaps the USAA tech innovation people are most acquainted with is mobile deposit, which allows people to deposit checks directly via their smartphones. They were also among the first financial institutions to offer vehicle purchases by phone, and mobile payments via Apple Pay or Android pay.

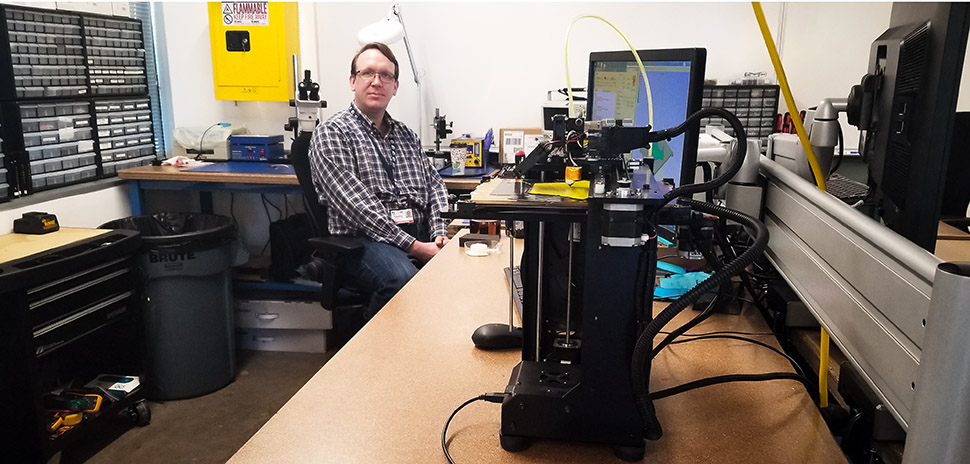

The Plano office of USAA includes a fabrication lab, in which full stack developer Tim Czerlinsky helps build the hardware that accompanies developers’ breakthroughs.

THREE DECADES OF DATA COLLECTION

This anticipatory approach shows itself in subtle ways to USAA members, who might be contacted when their retirement approaches, a daughter or son near driving age, or when members are transitioning out of the military. USAA has been compiling data on their members since roughly 1988, according to Eric Smith, USAA’s chief data and analytics officer.

“Roughly 10 years ago, we developed the concept of life events where we used data and analytics to predict a potential life event [clients] might be experiencing, with a goal to help them through those events,” Smith wrote in an email to Dallas Innovates.

When members call USAA, a data cache and data analysis appears before call-takers’ eyes.

“Calls come in with a complete view of the member profile, and a predictive set of applications that are called up automatically, in anticipation of why the member might be contacting us,” Smith said.

When the USAA website proved too clunky for members who needed to take care of financial matters in short order while under duress (even in a battlefield), developers retooled the site to streamline its operations.

“Just imagine if you’re in a war zone and you have a few minutes to get something done,” said Soliman-Powers. “You don’t have time to go in and actually spend 10 minutes or 15 minutes trying to do something online.”

That line of thinking even translates to a different way of working remotely.

ROBOT HELPS USAA IN REMOTE WORK

USAA is using robots to patch in its human employees remotely. It looks like a remote-controlled Roomba with a motorized base, and a flat screen mounted roughly at eye-level

“My name is Daniel Davidson, and I’m a robot. Kind of,” the robot intoned after rolling into the USAA lunch room.

“The main advantage [to working remotely via robot is] I have full control of audiovisual of what I’m doing,” said Davidson, a USAA senior software developer and integrator speaking through a headset from his home office in Rexburg, Idaho.

“I can walk around the building. Or roll around the building, so to speak. I can also zoom in on things, so if I need to see something at closer range. Being able to have that control, allows me to choose what I’m seeing and hearing. And that facilitates me picking up on non-verbal cues (body language). Things like that are very important, especially during interviews or conferences with the team. Or ad hoc meetings. All those things are facilitated by being on the robot, being ‘here,’ 100 percent of the time.”

Of course, there’s always the gee-whiz factor.

“I have interviews with [job] candidates, and a lot of times, our candidates won’t have had that experience,” Davidson said. “They’ll say, can I take a picture? Because my wife will never believe I had an interview with a robot.”

Robo-Daniel Davidson is a microcosm of USAA’s effort to keep its far-flung ventures and its diverse professionals on the same page. Even those busted down alongside the road.

Mission-centric images and themes are located throughout the Plano office of USAA. [Photo: Dave Moore]

EVA APP CAN HELP CUSTOMERS IN TIMES OF NEED

“One of my employees was at an airport and he came in and he found his (car) battery was dead,” Soliman-Powers said. “Our app actually started searching for a car service.”

The notion behind the EVA app is to use member data gleaned from voice and text, to guide them to solutions without the need for contacting USAA call centers.

The EVA app uses virtual intelligence to speed things along. In the case of the stranded USAA employee, it absorbed the information of his plight, and auto-completed his request for assistance on the USAA website.

“He didn’t have to call anyone,” she said. “He just clicked on [his device], and within 15 minutes there was a car service coming to help him with his car.”

Roughly 1.2 million USAA members launched the EVA app in a 90-day period in 2017, according to company stats.

USAA PULLS EMPLOYEES ACROSS INDUSTRY SECTORS

Aside from its headquarters in San Antonio and its operation in Plano, USAA has offices in Chesapeake, Virginia as well as Phoenix, Tampa, Austin, Colorado Springs, London, and Frankfurt, Germany. USAA’s technology teams are based in Plano, San Antonio, Austin, and Phoenix. Like many tech-leaning companies, USAA pulls from a vast swath of industries including companies such as Pizza Hut, Fidelity, and Regions Bank.

USAA CIO Dalia Soliman-Powers, for example, was vice president of software engineering at Capital One’s Plano facility not far away until November 2017. Before that, she was senior director of software engineering at the data-storage behemoth EMC, which was purchased by Dell for a record $67 billion in 2015.

“Diversity of background is going to enable us to move and innovate faster.”

Dalia Soliman-Powers

“We believe that pulling from different industries will open our eyes to different experiences,” Soliman-Powers said. “So, we intentionally recruit from outside of our own industry, because we feel like this a diversity of thought. Diversity of background is going to enable us to move and innovate faster.”

USAA uses a combination of Skype, Smart Boards, and shared experiences such as hackathons to pull together professionals who are separated by geography and professional backgrounds. Not to mention that a quarter of all USAA employees are military veterans or military spouses.

The secret ingredient that makes this work, according to Soliman-Powers: USAA’s mission of service to men and women in the military and their families, as well as to veterans. That sense of duty and mission has served to boost retention rates of both members and employees, she said.

“When people know what we’re doing and our mission — doing something for the greater good — this is a very good message that energizes people that want to join,” she said. “Certainly that was one of the things that attracted me.”

Get on the list.

Dallas Innovates, every day.

Sign up here to get what’s new and next in Dallas-Fort Worth.