Irving-based Penhall Company, North America’s largest provider of specialty concrete services, has been acquired by an affiliate of Miami-based H.I.G. Capital, a global alternative investment firm with $59 billion of capital under management.

Penhall has a network of more than 40 branch and service locations throughout the U.S. and Canada. Financial terms of the deal were not disclosed.

“Penhall has a long track record of continuously delivering high-quality solutions to customers across both small local jobs and larger national projects alike, while successfully expanding the company’s geographic footprint and portfolio of services and continuing to reinforce the strong organizational culture that is foundational to our success,” Penhall CEO Greg Rice said in a statement.

“We’re excited to work with H.I.G, which will enable us to further grow our offerings for our customers,” Rice added.

Since its founding in 1957, Penhall has served more than 160,000 clients across a broad range of end markets including commercial, residential, industrial, and infrastructure.

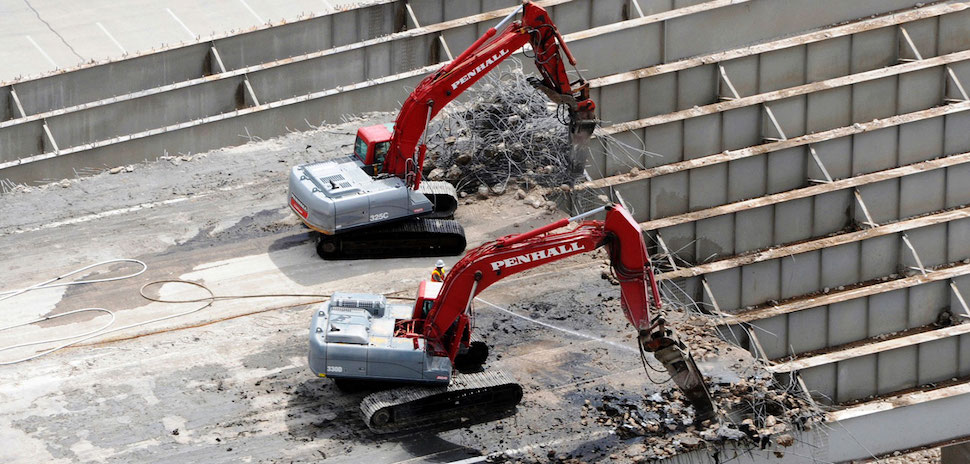

Penhall offers a full range of concrete services, including cutting and coring, specialized demolition, GPR concrete scanning, digital X-ray, utility locating, fiber-reinforced polymer, grinding and grooving, and bridge services.

More on H.I.G. Capital

H.I.G. said that it’s partnering with Penhall’s current management team to accelerate Penhall’s growth opportunities.

“We believe Penhall represents a compelling opportunity to invest in a differentiated provider of specialty concrete services,” H.I.G. Managing Director John Von Bargen said in a statement. “The company’s long history, industry-leading scale, and focus on quality, innovation, and service have increasingly positioned the company as a value-added partner to its customers. We look forward to working with the team to build upon their success and support continued growth initiatives.”

H.I.G. Capital also has offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco, Atlanta, and Stamford in the U.S., as well as international affiliate offices in London, Hamburg, Madrid, Milan, Paris, Luxembourg, Bogotá, Rio de Janeiro, São Paulo, and Dubai. It specializes in providing both debt and equity capital to middle market companies, utilizing a flexible and operationally focused/ value-added approach.

H.I.G. said its equity funds invest in management buyouts, recapitalizations, and corporate carve-outs of both profitable as well as underperforming manufacturing and service businesses.

Since its founding in 1993, H.I.G. said it has invested in and managed more than 400 companies worldwide. Its portfolio includes more than 100 companies with combined sales in excess of $53 billion.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.