According to a new report from Dallas-based JLL, society is accelerating the volume of data it creates at a rapid rate—and that data is foundational to how we work, live, and play.

The firm said that if data centers are the bricks holding society together, then the power that operates them is the mortar, according to JLL’s new H2 2023 North American Data Center Report.

The report said that data center demand remained strong throughout the year, but the search for power and land among limited supply is forcing a shift toward secondary and new, emerging markets.

JLL said that data center demand shows no sign of slowing and that power availability and delivery timelines continue to damper absorption.

For primary markets, JLL said that most of the net leasing in H2 2023 occurred in under-construction or planned product, rather than existing inventory. JLL said it expects pre-leasing will continue to accelerate as construction and power delivery timelines are not likely to slow over the next 12 months.

“Demand continues to be at all-time highs, and data center growth is rapidly expanding from core markets in search of power,” Andy Cvengros, managing director, data center markets, JLL, said in a statement. “Given almost all of the capacity coming online this year is already pre-leased, data center users must plan further ahead in their IT strategy and commit to space and power on accelerated timelines to find capacity to fit their requirements.”

North Texas highlights

The report offered some key DFW insights, including:

Supply

- Given the scarcity of supply, securing suitable data center space in the region has become a significant challenge for businesses, leading to a competitive landscape among providers and potentially driving up the cost of data center services.

Demand

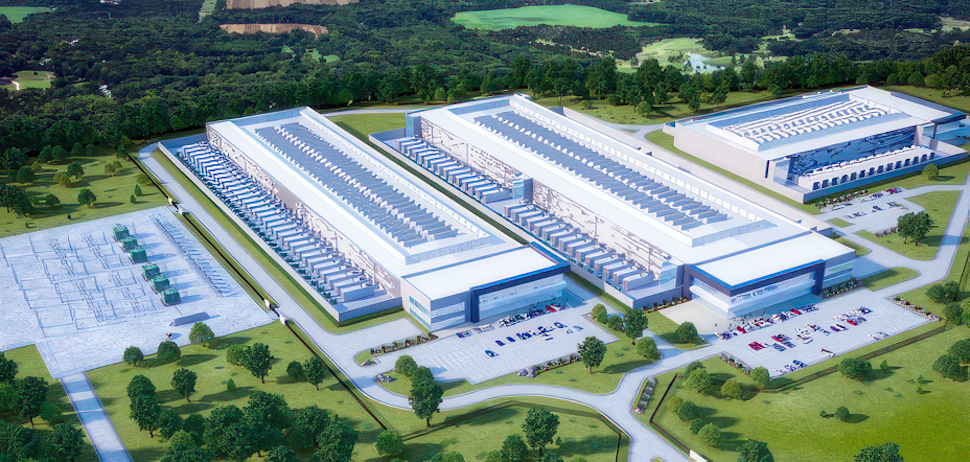

- DFW has witnessed a considerable surge in data center demand, attracting numerous providers who are acquiring land with the intention of developing large-scale campuses.

- Enterprise demand has remained steady, with new campus builds targeting a mix of enterprise and wholesale hyperscale customers.

Market Trends

- Large blocks of available capacity are becoming increasingly scarce in the current market. To ensure they secure the space they need, users are actively preleasing capacity at upcoming builds.

- The primary utility company, Oncor, has received power study requests adding up to multiple gigawatts of power capacity.

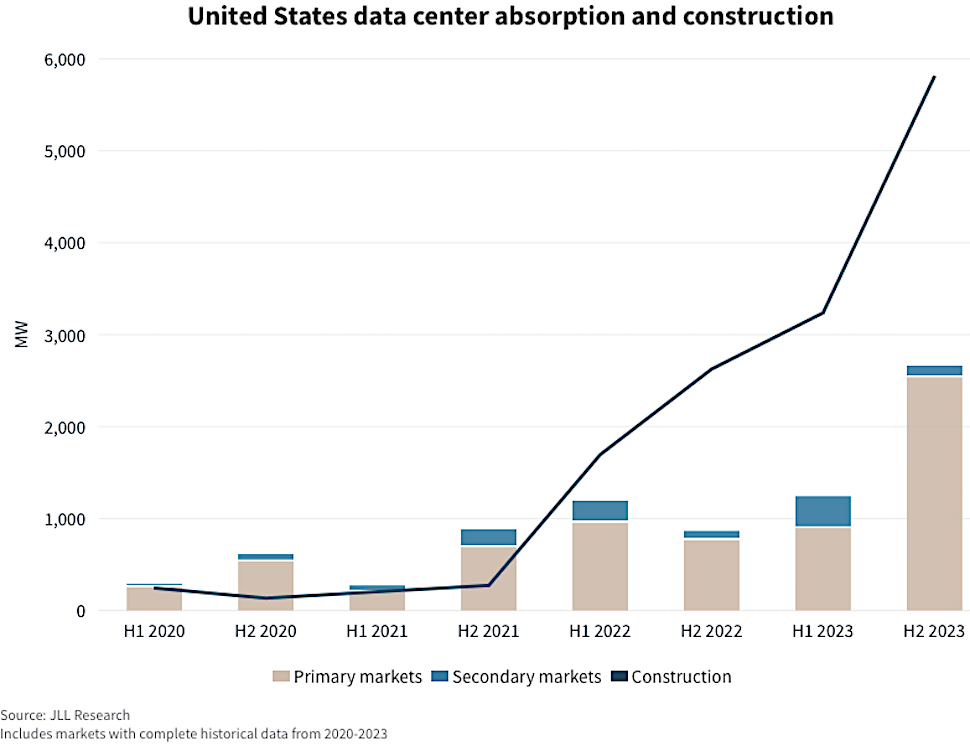

U.S. data center absorption and construction is on an upward trend The sharp upward line represents construction. [Graphic: JLL Research]

Other markets and impact of AI

JLL said that though secondary and emerging markets are critical to countering supply challenges, primary data center markets are still king, with 3.4GW of transactions signed, bringing the full year total to a record 4.3GW.

Northern Virginia was the largest data center market, with 1.6GW of transactions, of which 884 was preleased for deliveries dependent on power availability over the next few years. Phoenix was next with 748MW of new capacity signed.

Led by the Northwest, secondary markets added 554MW for the year, JLL added.

AI and Large Language Models such as ChatGPT require tremendous amounts of power, and its popularity is soaring, JLL said. ChatGPT had just over 100 million monthly users in January 2023, according to JLL and that by November, it had over 100 million active users weekly.

ChatGPT uses ‘roughly as much power as 33,000 households’

Training of ChatGPT-3 consumed over 1,287 MWh of power. JLL said that with hundreds of millions of daily queries, ChatGPT uses roughly as much power as 33,000 households.

“More and more companies and governments are exploring AI to do everything from customer service chatbots to advanced data analytics to operations management in order to achieve corporate objectives,” Matt Landek, managing director, data center & telecom, work dynamics at JLL, said in a statement. “All of this not only requires a tremendous amount of power but the need for additional infrastructure to handle the capacity.”

Seeking power, land, and innovation

With cloud and hyperscale users dominant in the larger markets, smaller enterprise users are pressed to find colocation space and power to meet their needs. JLL said that some enterprise users are evaluating the shift from enterprise to cloud due to rising costs, latency, and information security concerns and are moving toward a distributed cloud” environment or outsourcing enterprise data center operations.

JLL said that nearly all markets are seeing an uptick in construction in response to accelerating demand.

“Data center developments will expand to wherever there is enough power and available land,” said Kari Beets, senior manager, data center and industries research, JLL. “As capacity becomes limited in major markets, developers will seek stranded power, especially for AI uses for which latency is less of a concern. New tertiary markets and outposts will open, focused on reusing power capacity developed for other uses.”

Owners are expanding existing data centers both horizontally and vertically, JLL said.

Upgrades in existing power infrastructure or onsite power generation can also add capacity – making data centers denser in megawatts per square foot.

According to JLL, developers and enterprises realize their existing design does not support AI’s power-hungry demands, and traditional air-cooling technologies are no longer effective. That is ushering in an alternative method such as liquid cooling and greater change to design and operations.

“While data center campuses have been around for decades, we’ve really seen innovation in design over the past five years due to increased investor interest, land constraints, occupiers prioritizing sustainability measures and new technology like AI that require increased capacity,” Priya Velamakanni, national data centers lead, project & development service, JLL, said in a statement. “This lack of available land has led to the development of multi-story data centers, and technological advancements have given way to announcements for new developments now commonly exceeding 100MW.”

To see JLL’s full H2 2023 North American Data Center Report report, go here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.