![]() E-commerce. Mobile technology. Big data.

E-commerce. Mobile technology. Big data.

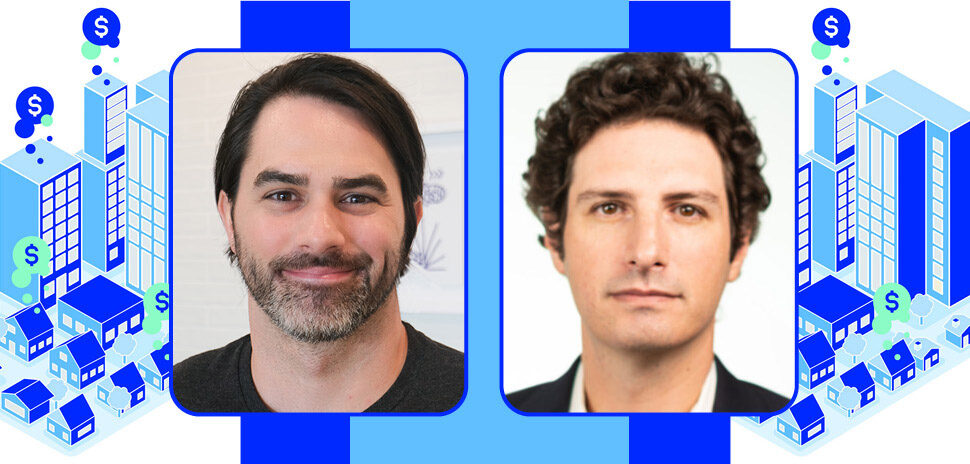

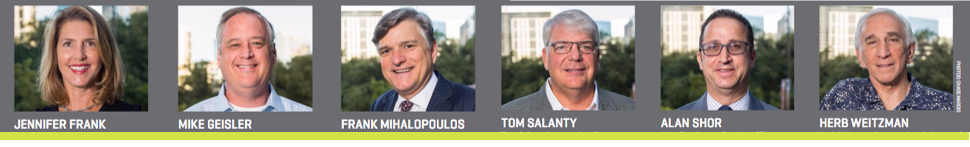

Retail real estate experts shared their perspectives on how technology continues to change the way consumers shop — and its impact on retail space. Tom Salanty, Jennifer Frank, Alan Shor, Frank Mihalopolous, Herb Weitzman, and Mike Geisler talk about Dallas-Fort Worth retail real estate in a roundtable discussion at the Amenity Lounge conference room at St. Paul Place in Dallas.

P A R T T W O This is part two in a series of extended content from the roundtable, “Talking Shop,” that originally appeared in the Summer 2017 edition of the Dallas-Fort Worth Real Estate Review. The discussion was edited for length and clarity.

The Panel

Jennifer Frank, Principal, Segovia Retail Group

Mike Geisler, Founding Principal, Managing Partner, Venture Commercial Real Estate

Frank Mihalopoulos, Owner, Corinth Properties

Tom Salanty, Managing Director, JLL Dallas

Alan Shor, Co-Founder, President, Co-Chairman, Retail Connection LP

Herb Weitzman, Founder, Executive Chairman, Weitzman Group

Moderator

Lance Murray , Managing Editor, Dallas-Fort Worth Real Estate Review and Dallas Innovates

TECHNOLOGY AND THE RETAIL EVOLUTION

How is technology changing brick-and-mortar retailing?

FRANK MIHALOPOULOS: We’re getting followed by everything we do. Data is the technology all the companies and consultants are trying to figure out. They know our patterns — how we’re going to shop, where we’re doing it, what our impulses are — they know more about our brain than we do sometimes.

JENNIFER FRANK: It’s data mining. Ulta is a great example of it. They have 15 million beauty club members. And they know specifically what each of their patterns are. They know how to direct market to their e-mails, and they’re great at it. Even when you’re on your own computer and you’re researching something, all of a sudden, you’re looking for a trip to Saint Kitts, different places in Saint Kitts show up, [thanks to retargeting].

MIKE GEISLER: [And with] geo-fencing, the retailer knows you’re in the area of a shopping center or certain store, and they can push something out to you to entice you to come in — [like] a discount. There’s a lot going on with that. Technology is affecting the bricks-and-mortar more so with efficiency — maybe more so with power needs — but that’s about it. I don’t see it much more dramatic than that.

TOM SALANTY: So every device, your phone, your computer all has its own IP address, then you join the loyalty club that you mentioned. And if they have your phone number, then your IP address then becomes known. You can walk into the store and they can shoot you a coupon. Boom. Just like that.

FRANK: It’s great for marketing.

MIHALOPOULOS: Yes. The consumer side of technology is changing how we shop. On the retailer side, they’re trying to figure it out —what they can do for inventory control. Some of the department stores are going to say, “OK, I will sell it on the internet, but you come to the store to get it.” They’re having inventory issues. Because if Tom comes in and gets that last size 44 sport coat, and the guy on the internet just ordered it, and they want it there. They need to know, how do we supply it so that we’re not upsetting our customer, because the jacket wasn’t there.

Retailers want smaller stores, but they also want to have the ability to act like a small distribution center.

Alan Shor

SALANTY: Retail stores can do more showrooming. If you don’t have the size coat that you want, they can have it on your desk or your office or your home the next day. The store doesn’t necessarily need to have all of the inventory. You might miss your point-of-sale, but if you really need it, they can ship it to you.

MIHALOPOULOS: That’s the customer-service part. Those who do it will succeed. The other part, there is no more — most stores don’t even have storage rooms anymore. The back of the house, the back of the office, everything is on display. At Home does it that way. Bath, they don’t have it. It’s not going to sell if it’s in the back room. They just adjust it for the season.

SHOR: The other major shift with retailers is they want smaller stores, but they also want to have the ability to act like a small distribution center. In other words, the customer can buy online and they can return it to the store. The store has to have the capability to get it back into inventory. Or the customer can place an order online, and pick it up at the store. We’re seeing more and more retailers seeing that as a way to continue to give the customer the experience they’re wanting.

SALANTY: And, if you come into the store to do something like that, you might buy something else. Maybe there’s something at the kiosk that’s the impulse buy while you’re walking through. That’s a big profit center — that impulse-buy stuff.

SHOR: 90 cents of every dollar, roughly, still gets getting rung up in a store, because the customer still wants to have that experience — the interaction, the touch, the feel — to have that instant gratification.

If they close a bricks-and-mortar store, the retailer can lose 30 to 80 percent of their internet sales in those ZIP codes.

Mike Geisler

But 80 percent of those customers, before they go in the store, they [research online] to help them lead into which stores they’re going to go into. To me, that’s an amazing statistic — eight out of 10 people.

GEISLER: I was at a [retailer-run seminar at RECon (The Global Retail Real Estate Convention) in May] … [They said] that if they close a bricks-and-mortar store, the retailer can lose 30 to 80 percent of their internet sales in those ZIP codes.

SHOR: To a competitor.

GEISLER: They just don’t know. One of [the retailers] was Shoe Carnival or [another in that category]. He said that a women can come in their store and try on three pairs of shoes. She’ll [typically] buy one and go home. Then she’ll buy another pair — or even two — online. There’s a lot you lose, if you lose the brick-and-mortar store.

FRANK: The e-commerce and the point you bring up is really driving more industrial sector growth, too, because I know just even with my couple of examples of two of the tenants that I represent, Ulta opened an 800,000-square-foot fulfillment center in Dallas last year, I believe. And I think we will see a lot more of that, more regional distribution centers, fulfillment centers.

SALANTY: If we are 94 percent leased in retail, how leased are they in warehouse space? It’s got to be higher.

MIHALOPOULOS: The biggest industrial problem is retailers right now. Amazon is your large industrial tenant. They are going crazy. They can’t build enough Amazon distribution centers.

Don’t they have five?

MIHALOPOULOS: They might have more. They might be adding five as we’re speaking.

[I sat in on] an industrial meeting as a retail guy, and I heard everybody talking about how the retailers are taking their space. That’s their new customer.

Tom Salanty

SHOR: Hillwood has done 7.5 million square feet. I read DFW has the highest amount of warehouse construction growing on than anywhere in the country. It’s an amazing number. Tens of millions of square feet.

SALANTY: [I sat in on] an industrial meeting as a retail guy, and I heard everybody talking about how the retailers are taking their space. That’s their new customer. I said, that’s been your customer for your whole business cycle. It’s just a different kind of guy. It used to be the manufacturer. The manufacturer rented the space, and then they send [the products] to the retailer. Now it’s going direct to the warehouse, direct to the customer, or direct to the retailer. So, 70 percent of the economy is retail. That’s not changing. [What’s changing] is how we are moving the widgets around.

LESSONS FROM ICSC

Let’s talk about International Council of Shopping Centers (ICSC). What were your major takeaways from Recon (The Global Retail Real Estate Convention) in May?

MIHALOPOULOS: It was very active — 37,000 people. I expected more of a negative, fewer retailers to be there, but that wasn’t the case. There was a lot going on — on a lot of different fronts. This ICSC was more about the changes that are happening in retail. For the first time at ICSC, in all the years I’ve been in business, I never thought a hedge fund would be part of our industry. But in three of the meetings I had, it all had to do with hedge funds, either shorting the retailer, shorting the REIT, or shorting the mall market. … We’re having a big short happening in our business because the retailers get on a call, or the REITs get on a call, and there’s a hedge fund guy there trying to knock it down.

In all the years I’ve been in business, I never thought a hedge fund would be part of our industry.

Frank Mihalopoulos

SHOR: Probably fewer deals got done, but we’re in this situation where retail is not in the cycle — retail is in sort of permanent change with what’s happening with e-commerce. [The] Amazon announcement that they’re buying Whole Foods for $13.7 billion … That’s also very telling for what’s happening in the state of retail.

MIHALOPOULOS: And what it did to their stock.

SHOR: When you look at the number of retail bankruptcies that have been announced — the number of store closures that have been announced in the last ten months — it already exceeds the number of store closings during the recession. It’s the highest 12-month period in the last 35 years, and that’s in a pretty healthy economy. That’s with a stock market that’s booming, low unemployment, and an economy that’s pretty good — not great. That tells you this is a permanent change. And so, the discussions we have with retailers, almost every time e-commerce was a topic of discussion at ICSC, is how do they react?

The retailer that’s going to survive is going to have to do both really well. There’s a reason why e-commerce retailers are opening up brick and mortar stores, because they’ve got to have both. You have to do both really well to survive. That’s the change that we’re in.

FRANK: I’ve done a lot of work with Ulta Beauty over the last 12 years. They’ve experienced 13 consecutive quarters of double-digit comps and 50 percent year over year on their e-commerce. They know how to do that well. They’ve been looking at opening a hundred new stores every year, and they’re going to continue to open a hundred new stores every year. It’s about market share — really penetrating the market — especially with the “Amazon effect.”

The takeaway from ICSC that I gained this year was creating a “mousetrap” in development, where you’re bringing in the entertainment and the right components — the right restaurants, the right mix of local chef-driven food concepts.

Jennifer Frank

The takeaway from ICSC that I gained this year was creating a “mousetrap” in development, where you’re bringing in the entertainment and the right components — the right restaurants, the right mix of local chef-driven food concepts. … it’s [about] bringing experience to the retail segment so the consumer will want to go to this destination to do their shopping, versus across town where there aren’t all the experiential-type components to it.

SHOR: They’re the new anchors.

FRANK: They are definitely the new anchors. Grandscape is a good example in The Colony of bringing [Nebraska Furniture] in … Who would have thought of a furniture store that size?

GEISLER: Legacy West is all about experience.

FRANK: Right. So they’ve created that effective mousetrap.

GEISLER: I think the summit at ICSC was very positive, more than I expected. I think that everybody was there to do business. But there was less business being done. It’s a healthy industry, but it’s an industry that’s adapting and reacting to tremendous change, more change than it’s ever experienced in my lifetime.

HERB WEITZMAN: The interesting thing is, the non-mall business is probably 96 percent of all the centers in the country. Most of the business is still done in non-mall projects. And there’s a whole group of tenants that thrive with visibility and easy in, easy access that serve the neighborhoods. Those are the community centers which are really the backbone of retailing in this country.

MIHALOPOULOS: The other part I sensed was capital — the banks being very cautious, traditional banks on construction loans — it’s very hard to get loans right now unless you put enough equity in. But the equity players that were there — the capital structure — it feels like there were more people bringing capital to the markets because they think there’s an opportunity. Because of the change in what’s going on, there’s also a change in how the structure looks at it. Half our meetings were with capital people.

What Amazon is building is what [Sears] already had. All they had to learn was … get on the internet. [Sears] had the infrastructure, and they would’ve been a package.

Frank Maholopoulos

I saw an interesting presentation by Marcus & Millichap. They showed us Sears versus Amazon: Where Sears was, what Sears had, and what Amazon is trying to build. Sears — the stores, catalog, distribution centers, and warehouses — the whole network was there. It was the number-one company at one time in America. And then Amazon started with an idea of selling books online. What they built was exactly what Sears had — a distribution facility, the catalog store. Now, [Amazon] is starting to get into brick and mortar to some extent. It was because Sears didn’t understand — they didn’t get the play of the internet and what was changing in the world — that they became a real estate play that was bought. They merged with Kmart. They’re falling apart on this side, and Amazon is building up … What Amazon is building is what [Sears] already had. All they had to learn was … get on the internet. [Sears] had the infrastructure, and they would’ve been a package.

Evolution happens to these retailers. How many of us did Blockbuster deals? It was a leading tenant in the ’80s and ’90s, and then something called Netflix showed up and changed the whole world. It’s part of what we see — there’s change every day here. One thing is, the majority of all sales — still 85, 90 percent — are still done brick and mortar, not on the internet. If you ask somebody in this room the total of internet sales in trillions of dollars of sales, [they would say] it’s 13 percent. Some call it 15 percent.

There’s education that needs to go on in the stores. There are a lot of products out there, and people don’t know what’s right for them.

Tom Salanty

SALANTY: The last set of numbers that were published by ICSC was 10 percent, and it was based on 2015 numbers. It’s certainly getting bigger. We don’t know where the number is today. It’s interesting to note that mail order — the pure-play online retailers — was 3.7 percent of the 10 percent at that time. Mail order catalog [is] still 3.1 percent. That business has been around for a long time. Omni-channel retailers are 2 percent. There’s another percent, the non-merchandise stuff, which is shipping. That’s what makes up the 10 percent. And all that is growing a little bit. We’re watching this change, but the brick and mortar is the last mile. There’s also education that needs to go on in the stores. There are a lot of products out there, and people don’t know what’s right for them, so they go into IKEA and pick something. They go into Best Buy and pick something.

The top five internet retailers are Amazon, Apple, Dell, Walmart, and Staples. How many of those have stores, of those five? A majority.

MIHALOPOULOS: But Amazon is over 50 percent of the internet sales.

SALANTY: Getting bigger — and getting brick-and-mortar stores.

SHOR: You look at what Wal-Mart is doing in the dot com. Wal-Mart made the decision, “we can’t do it organically like Amazon — we’re going to do it by acquisitions.” They buy jet.com for a billion dollars, which gives them the infrastructure. They buy Bonobos, Mod Market, and one or two other specialty retailers and e-commerce retailers. They’re going to do it by acquisition. I think they’re going to be a very formidable competitor to Amazon. And Walmart.com is going be a very strong player.

SALANTY: They’re not going to give up, I will tell you that.

Read next in the “Talking Shop” series

Part One: Halls and Malls

Part Two: Technology and Retail

Part Three: Want to Test a Concept? Come to Dallas-Fort Worth

About the panel

Jennifer Franks is principal at Segovia Retail Group, and has more than 20 years of experience in commercial real estate leasing and development. Her specialty is tenant representation throughout Texas, Arkansas, Louisiana, and Oklahoma. Her clients include IKEA, Ulta Cosmetics, Bath and Body Works, and rue21.

Mike Geisler is founding principal and managing partner at Venture Commercial Real Estate, which he co-founded in 2000 with longtime business colleague and friend, Kenneth Reimer. Geisler has spent more than 30 years as a real estate broker and 20 years leasing specialty and lifestyle centers.

Frank Mihalopoulos is the owner of Corinth Properties and has more than 37 years of experience in real estate investments and development of commercial retail and office properties. He has developments throughout the country, and is a graduate of Southern Methodist University.

Tom Salanty is managing director at JLL in Dallas, having joined the firm in 2016. He has more than three decades of experience in the commercial real estate sector, particularly in the sales of shopping centers.

Alan Shor is a co-founder of The Retail Connection LP, and serves as its president and co-chairman of the board. He is involved in TRC’s strategic direction, and he oversees the day-to-day operations of the company. Shor leads TRC’s investment and merchant banking business.

Herb Weitzman is executive chairman of the Weitzman Group, which he founded in 1990. It is a full-service real estate brokerage firm with the largest retail real estate brokerage force in Texas and one of the largest regional commercial estate firms in the nation. It ranks among the top 50 shopping center management firms in the country.

Talking Shop’ was published in the Fall 2017 edition of the Dallas-Fort Worth Real Estate Review. The retail roundtable discussion was transcribed and has been edited for length and clarity. The online version includes extended content.

READ NEXT

Getting in the Game: Arlington Repurposing Convention Center into Esports Stadium

The Esports Arlington Stadium is set to become the largest esports arena in the country.

Could Arlington’s Smart District Water Meters Save Money, Avert Disaster?

Redevelopment Breathes New Life Into Real Estate That’s Run its Course

Repurposing retail real estate in Arlington

“Talking Shop” Roundtable

“Talking Shop” Roundtable

Retail Real Estate in Dallas-Fort Worth

How we eat out — and how we shop — is changing. In a recent roundtable discussion, six Dallas-area retail real estate experts examine the nationwide food hall movement, the future of malls, and how North Texas is a center of activity.

Part One: Halls and Malls

As the retail world reinvents itself, real estate industry experts evaluate the present and look ahead to the future.

Part Two: Technology and Retail

Perspectives on how technology, big data, and the internet continues to change the way we shop.

Part Three: Want to Test a Concept? Come to Dallas-Fort Worth

The retail landscape is changing as service providers, grocers, health care delivery systems, and experiential concepts take on traditional retail space.

![]()

Get on the list.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

One quick signup, and you’re done.

View previous emails.

Read ‘Talking Shop’ in the Real Estate Review digital edition on Issuu.

Sign up for the digital alert here.