Four years after its launch, Dallas-based ROBO Global Robotics & Automation Index ETF (ROBO) has topped $1 billion in assets under management.

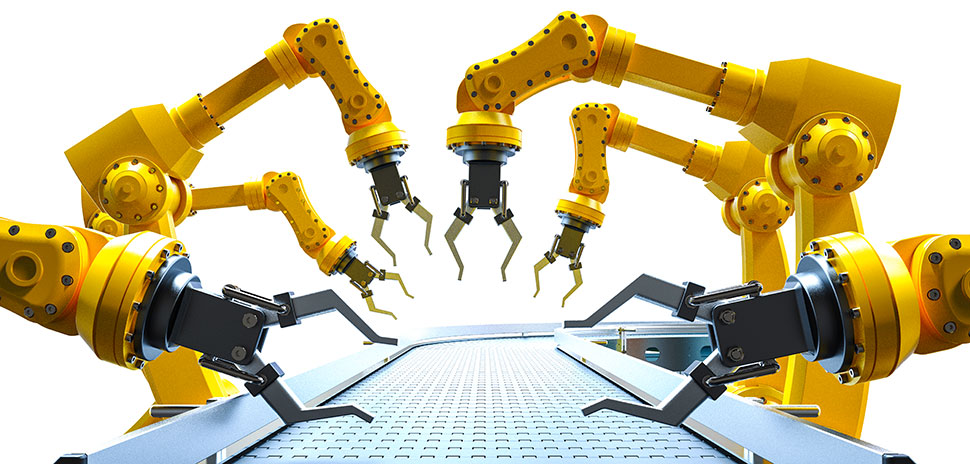

The ROBO Global Robotics & Automation Index, the original exchange traded fund dedicated to robotics investing, is composed of 83 companies from 14 countries in North America, Europe, Asia, and the Middle East.

“Our Index was carefully constructed to give our investors diversified access to the large, mid, and small-cap companies that are at the forefront of the robotics revolution that is changing the way we consume goods and how companies conduct business,” Travis Briggs, CEO of ROBO Global US, said in a release.

An exchange-traded fund, or ETF, is a marketable security that tracks an index, bonds, a commodity, or a collection of assets such as an index fund. Unlike mutual funds, ETFs trade similarly to a common stock on a stock exchange.

The ETF tracks the ROBO index, which offers investors access to the whole “value chain” of robotics, automation, and artificial intelligence, according to the release.

The $1 billion threshold was crossed on Aug. 8, the release said. The ETF holds 92 stocks, according to ETFtrends.com.

Total assets under management is well over $1.6 billion, when you combine the increasing number of funds in Europe and Asia also tracking the ROBO Global Index.

Dallas Innovates, every day

One quick signup, and you’ll be on the list.

View previous emails.

![Pudu offers many commercial service robots. Free 1-week trials of the PuduBot food delivery robot (far right above) are being offered to Dallas restaurants for a limited time. [Image: Pudu Robotics]](https://s24806.pcdn.co/wp-content/uploads/2021/11/Pudu-Robotics-970x464.jpg)