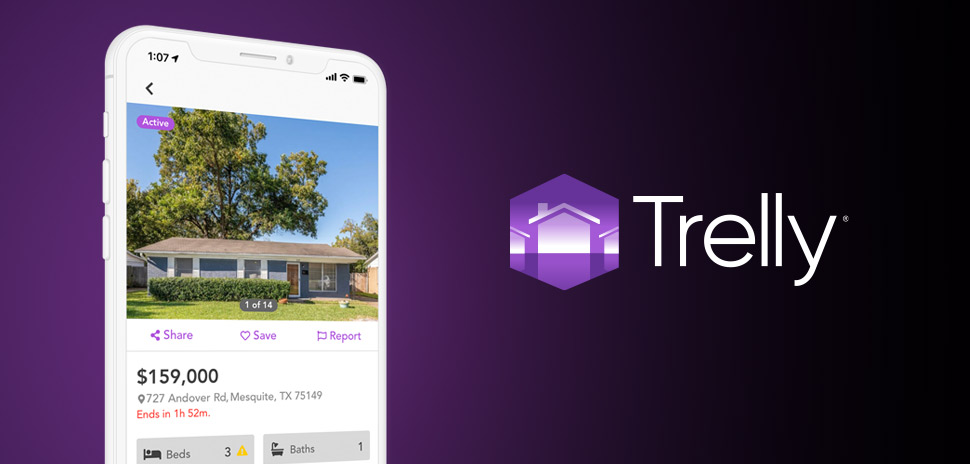

About two years ago, residential real estate entrepreneur Josh DeShong and his team set out to build the first marketplace for wholesalers and investors to safely and easily conduct trade deals. Today, he’s ready to unveil that project to the public: Trelly, a tech-enabled real estate investing platform that allows users to buy and sell off-market residential investment properties.

DeShong, an investor and 30-year industry veteran in real estate, says Trelly was built for investors, by investors. The Trelly marketplace is where single-family real estate investors can buy and sell distressed, investable real estate, the founder said.

A “B2B version of the MLS”

Trelly wants to offer investors a way to scale their businesses fast and effectively via investment properties. The platform, which can be used directly via phone, tablet, or computer, acts as an online marketplace for sellers to list off-market properties for investors to buy.

The team compares it to a “B2B version of the MLS,” a private database where participating real estate brokers can provide data about their properties for sale.

The properties on Trelly, according to the company, are exclusive. They can’t be discovered on the MLS or any other site.

What fits your “buy box”?

Users can find their next investment property by entering buying criteria, and Trelly will send a notification when something that fits their “buy box” becomes is listed. The tech will then automatically find data from official property records.

To DeShong, this is a less costly process for both acquisition and disposition. The platform’s base is exclusively active investors interested in buying and selling; that means no realtors are involved in a deal.

For investors, by investors

Josh DeShong, Trelly

DeShong, who is also Trelly’s CEO, sees growth in investor activity increasing the value of real estate.

“Investments flow to the greatest growth opportunities,” he said in a statement. “And because of both volatility in the financial markets and climbing inflation, real estate has become a much more attractive investment than ever.”

“Investments flow to the greatest growth opportunities.”

Josh DeShong

That growth also increases competition, he says.

Previously, for his own property investments, DeShong was finding and conducting hundreds of transactions through traditional channels like direct mail, cold calling, Facebook groups, local meetups, and yard signs.

He noticed a flaw in the system.

“It’s not that these channels were bad or didn’t work. It was just that they weren’t scalable without pouring in tons of manpower and capital,” he said in the statement. “That’s fine if you only want to do a few deals here and there, but if you want to scale your business, you have to operate more efficiently and profitably.”

Creating advantage

DeShong said it’s becoming more difficult for institutional investors and multinational giants to acquire the properties needed to scale their business. He sees Trelly as the solution to remaining profitable.

“It’s critical to run your investing like a business, using every advantage you can find,” DeShong said. “And I believe Trelly provides a significant advantage over other acquisition and disposition channels.”

DeShong’s expertise stems from his years as a real estate investor.

Throughout his career, the founder has closed around $2 billion in real estate transactions, earning his title as one of the top 50 real estate agents in the country. He has received more than 100 production and volume awards, according to a news release.

Test markets

By Deshong’s side is Stephen Chiang, a former project manager at Microsoft and software engineer at Google who is also an active real estate investor. As the chief technology officer of Trelly, Chiang assisted in developing the platform into a customer-focused ecosystem.

Trelly currently has a number of features dedicated to streamlining the path of real estate opportunity. The team launched a beta version of the platform in three test markets—Dallas Houston, and Tampa—conducting more than 680 transactions with real estate investors since going live.

That amounts to a total gross merchandise volume of more than $170 million, which the team says proves a “considerable demand for the service.” The number of users and listings is growing, DeShong told us.

Ripple effect

DeShong sees the impact Trelly will have for real estate investors who want to scale their businesses. But, he says, “I’m even more excited about the ripple effect that Trelly will create in the economy as a whole for so many other people,” DeShong said.

That’s a positive impact that’s “incalculable,” he said.

Trelly is available now online and through an app on the iOS and Google Play stores.

Quincy Preston contributed to this report.

The story was updated with additional information about Trelly’s test markets and focus on November 2, 2021 at 12:02 p.m.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.