Funding rounds brought millions in capital from investors for North Texas startups.

Lantern Pharma

The cancer-fighting Dallas pharma raised $3.7 million in May from its Series A equity financing to continue its search for and testing of abandoned cancer drug.

Lantern Pharma’s drug development efforts are led by biotechnology scientist and entrepreneur Dr. Arun Asaithambi.

Interactive Sports Group

In its first round of financing, the Frisco startup raised $95,000 from investors in December. Its electric version of flag football aims to reduce the risk of physical injury.

CerSci Therapeutics CEO Lucas Rodriguez and Chief Scientific Officer Scott Dax.

CerSci Therapeutics

The company founded by current and former University of Texas at Dallas professors received a $4 million boost in its work to develop non-opioid alternatives to treat pain in July. A group of North Texas investors made up a major portion of the Series A round.

Cosmic JS

Dallas startup Cosmic JS has racked up 60 customers in just 18 months, including Big Fish and Brand New Congress. The startup completed a $250,000 Angel Investment Round in November and planned a seed round in early 2018. Co-founders Tony Spiro and Carson Gibbons created a content management system that’s programming-language agnostic and compatible with all platforms.

Illustration by Scanrail via iStock

Fixd

A Dallas startup aimed at disrupting the home repair and warranty business raised $2 million in seed money so it can expand to Austin, San Antonio, and Houston this month. The app gives homeowners a way to find qualified professionals for repairs and installations just by swiping on the screen, reported Nicholas Sakelaris in December.

Image: DI/iStockphoto

ResMan

Plano-based property management software firm ResMan secured a $36 million investment from Mainsail Partners in October and planned to use the funding to grow the company. ResMan said it would use the injection of cash to accelerate development of its products, invest in its customer service organization, and drive further growth through expansion of its sales and marketing teams, MultifamilyBiz.com reported in October.

ValueInsured

Dallas-based home down payment protection insurance provider ValueInsured received a $6.5 million injection of capital from longtime partners Everest Re Group Ltd. and Houston International Insurance Group in October. The capital gave ValueInsured — the only provider of homebuyer down payment protection — the resources to “continue its aggressive distribution partnership strategy, expanding channel presence, and enhancing the features” of its proprietary +Plus product, the company said in an October release.

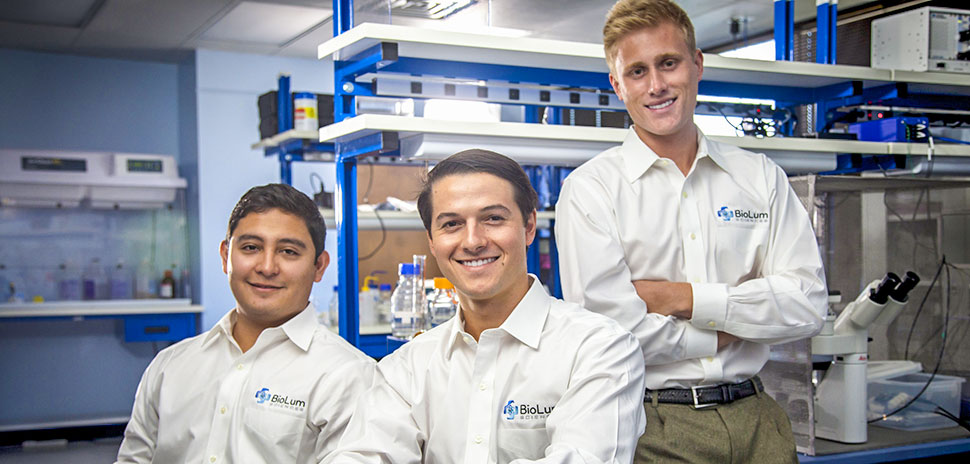

BioLum Sciences

Dallas-based BioLum Sciences received another round of funding from Intelis Capital, which invests in early stage ventures, wrote D’Anzia Robertson in September. The startup co-founded by Southern Methodist University graduates is working on a non-invasive device for asthma management. The device measures airway inflammation though a breath scan and will correspond with an app so patients and doctors can keep track of an individual’s health, according to the BioLum website.

Dallas-based BioLum Sciences was founded by three former Southern Methodist University students, Miguel Quimbar, Edward Allegra, and Jack Reynolds. [Photo courtesy of TriTex]

Fastlane

In early December, Dallas-based Fastlane, an online car-buying platform that allows car buyers to purchase a vehicle directly from the car dealer’s website and in-store sales while creating a convenient Amazon-like checkout experience, announced it completed a $1.5 million in a story on chicagotribune.com.

Selery Fulfillment

In November, JF2 Capital Partners, a new Dallas-based family office venture capital firm, announced that it had made its first deal, placing a substantial investment in Farmers Branch-based startup Selery Fulfillment. The JF2 investment came on the heels of Selery receiving $1 million in capital earlier in 2017 from Deep Space Ventures’ Stephen Hays, Mark Cuban, and angel investors.

CyberMiles

Dallas-based CyberMiles, a startup developing a blockchain-based platform for decentralized, online marketplaces, said in November it had raised close to $30 million in its “initial coin offering.” At the time, CyberMiles said it sold 420 million “CyberMiles Tokens” in its ICO.

Image: CyberMiles

Linux Academy, Cloud Assessments

Dallas-based online and cloud training platform and community Linux Academy and Cloud Assessments secured $6.8 million in Series A funding from Arthur Investments in October. The funds were to be used to continue expansion of Linux Academy’s content catalog, and grow its Cloud Assessments’ platform with new training and hiring tools, reported Lance Murray.

[Image: Jokerpro/istockphoto]

Syntilla Medical

Syntilla Medical raised $1.5 million in a round of debt financing, according to its SEC filing posted last fall. The company has not publicly disclosed its developments, but filed for a number of patents related to implantable neurostimulation systems to treat head pain, reported Fink Densford at massdevice.com.

Kubos Corp.

Denton-based Kubos Corp. announced in April 2017 that it closed $1.65 million in new funding to help it hire more employees and expand its platform. The round brought Kubos’ total funding to more than $2.4 million.

The Kubos Team. [Photo Courtesy Kubos]

Modern Message

The apartment rewards startup announced it had garnered $2 million in its Series A funding in June. The round was led by San Francisco’s AXA Strategic Ventures and included Dallas-area investors. Through its Community Rewards app, Modern Message gamifys apartment living giving residents reward points.

[Image via Modern Message]

FOLLOW THE MONEY:

For more funding successes go to Dallas Innovates’ Guide.

A version of this story first appeared in Dallas Innovates 2018, an annual magazine that showcases Dallas-Fort Worth as a hub of innovation. Read more about the region’s game changers, disruptors, creatives, and our new frontiers in the digital edition.

DALLAS INNOVATES 2018: READ THE DIGITAL EDITION

![]()

Get on the list.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.