What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

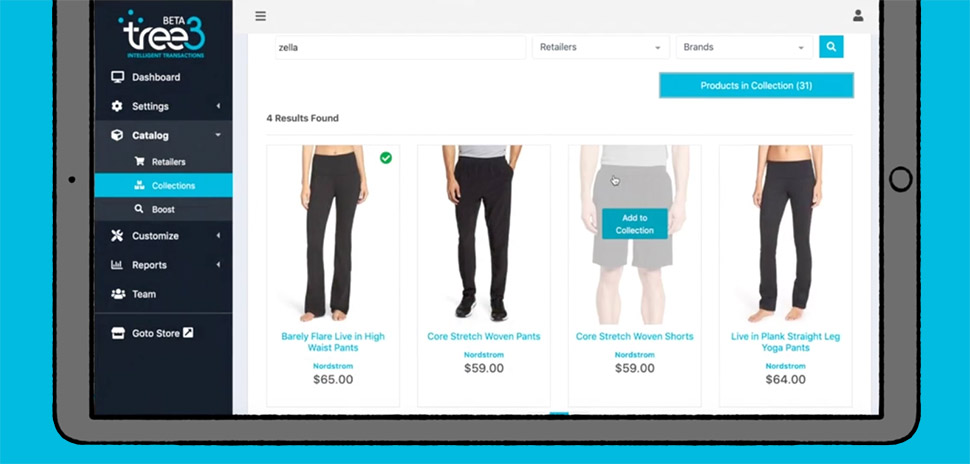

E-Commerce startup tree3 looks to raise $2M

⟫ Dallas’ tree3—an e-commerce platform that allows users to create customized online stores featuring their favorite brands and retailers, then make a commission from sales of those products—reported raising nearly $419,000 in equity from four investors out of a $2 million offering.

The company was founded in 2017, according to Crunchbase. Based on other SEC filings, the company has raised around $820,000 in that time. Per tree3’s most recent filing, the startup has previously gone by the names Shop Simply and RSI 64K.

PLUS

Universal EV Chargers lands $10M in grants for B2B charging services

⟫ Plano-based Universal EV Chargers has secured $10 million in government green energy grants, which it says will help the hospitality industry and other businesses offer EV charging services “by defraying upfront installation costs.”

Hemal Doshi, CEO of Universal EV Chargers and Universal Green Group [Photo: LinkedIn]

The company says it has already secured “approved vendor status” for hotel brands including IHG, Wyndham, Marriott, and Hilton.

“We won these green energy grants in competition with some of the largest EV charging providers in the U.S. because of our approach to solving common problems faced by EV owners,” Hemal Doshi, Universal EV’s CEO, said in a statement. “Thanks to the grants and our wide range of financial options, including a no-cost choice for qualified partners, hotels and other businesses will be able to install and operate EV charging stations quickly and economically.”

—

Traveller Capital Advisors raises $28.5M for fourth fund

Drew Crichton, founder and managing member of Traveller Capital Advisors, LLC

⟫ Traveller Capital Advisors amended an SEC filing from earlier this year to reflect raising an additional $10.9 million in equity from 24 investors for its fourth flagship fund. That brings the Dallas-based firm’s total to nearly $28.5 million for its private equity fund titled Traveller Capital Partners IV, LP.

Formed in 2013 by Managing Member Drew Crichton, Traveller focuses on the acquisition of interests in private equity funds on the secondary market. The firm says it considers opportunities across strategy types that include leveraged buyouts, venture capital, and credit funds.

Based on SEC filings, Traveller raised more than $15.3 million for its previous fund.

—

Brad Heppner, founder and CEO of The Beneficient Company Group. [Video still: Beneficient]

SPAC deal to take Dallas’ The Beneficient Company Group public, valued at $3.5B

⟫ Via a merger with San Francisco blank-check company Avalon Acquisition Inc., financial services platform The Beneficient Company Group could trade on the Nasdaq in a deal that values it at $3.5 billion.

Beneficient’s end-to-end platform provides liquidity, data custody, and trust services for alternative asset holders. The company says that since 2017 it has delivered liquidity on around $1.1 billion in net asset value to high-net worth individuals and small- to mid-sized institutions across investment types ranging from private equity and venture capital to endowments and private real estate investment trusts. It added that nearly $400 million of that liquidity was delivered over the past year.

Beneficient said the deal with Avalon, which closed its $207 million initial public offering last October, will allow it to offer more liquidity options and better serve investors by accessing the capital markets.

Subject to stockholder approval and other closing conditions, the deal, which includes around $200 million in gross proceeds from Avalon’s cash in trust, is expected to close in the first half of next year. Following that, the combined company—named Beneficient—will trade on the Nasdaq with existing Beneficient shareholders expected to continue to own 88% of the combined company.

—

Dialexa co-founder and CEO Scott Harper [Photo: Dialexa]

IBM acquires Dallas digital product engineering services firm Dialexa

⟫ IBM announced that it’s acquiring Dialexa, the digital product engineering services firm based in downtown Dallas’ East Quarter. By bringing Dialexa into the fold at IBM Consulting, the global tech leader aims “to deepen its product engineering expertise and provide end-to-end digital transformation services for clients.” Terms of the deal weren’t disclosed.

IBM’s deal to scoop up Dialexa is its sixth acquisition this year, and the first by IBM Consulting in the digital product engineering services market—which is expected to reach $700 billion by 2026, according to an IDC forecast. Today’s news adds to prior IBM Consulting acquisitions, including Neudesic, Sentaca, Nordcloud and Taos.

Upon the deal’s close—expected in Q4 this year—Dialexa will join IBM Consulting, tasked with spearheading IBM’s digital product engineering services presence in the Americas.

—

Health care payments, pricing firm Zelis acquires Plano’s Payer Compass

⟫ After announcing plans at the beginning of August, New Jersey health care payments and pricing company Zelis has closed on its deal to acquire Plano-based Payer Compass, a provider of reimbursement and claims pricing, administration, and processing solutions. Terms of the deal were undisclosed.

Payer Compass says that over more than 20 years, it has provided data and insights to reprice more than $200 billion in claims and generate more than $1.5 billion in savings. Its acquisition will help Zelis “evolve and expand” its solutions for out-of-network health care clients.

—

[Photo: NTT DATA/Business Wire]

NTT DATA to acquire consulting services firm Apisero, adding around 2K to its workforce

⟫ Plano IT and digital business services provider NTT DATA announced plans to acquire Arizona’s Apisero, a MuleSoft and Salesforce consulting partner—a move that it says supports its strategy to become the go-to for clients seeking end-to-end cloud, data, and engineering capabilities.

Wayne Busch, group president of NTT DATA Services’ consulting and digital transformation services, said the move will add to the company’s digital transformation business, building on other recent investments that include Nexient, Vectorform, and Postlight. Apisero will add more than 1,500 MuleSoft consultants and 500 Salesforce consultants to NTT DATA’s ranks.

—

Local IT services firm Prototype:IT becomes Westwood Technology Group’s tenth company

⟫ Utah-based technology service business-focused operating group Westwood Technology Group has acquired Prototype:IT, a Lewisville-based managed IT services provider. Prototype:IT said the move will help it provide a broader range of IT, cyber, and cloud services to clients.

Prototype:IT will continue to operate under the leadership of CEO Doug Oppenheimer and President Richard Crooks as a standalone entity under Westwood. While Prototype:IT will become the tenth brand under Westwood, the move marks the operating group’s first acquisition.

—

Starfish Partners’ current roster of brands

Starfish Partners acquires Direct Recruiters in ‘one of the largest’ deals in its industry

⟫ Marking what it says is one of the largest all-stock transactions in the mid-to-upper-management recruiting space, Plano-based investment and ownership platform Starfish Partners has acquired Ohio’s Direct Recruiters.

Direct Recruiters will join other Starfish owned businesses, including Plano’s Kaye/Bassman International Corporation, Full Spectrum Search Group, Sandford Rose Associates International, and Next Level Exchange. As part of the move, which will help both companies “maximize full growth potential,” Starfish is forming a new board that will include leaders from its brands, including Dan Charney, Mike Silverstein, Jeff Kaye, Karen Schmidt, and Nick Turner.

“With this expansion, the combined operational, finance, technology, marketing communications, hiring, training, coaching, and consulting divisions now represent the largest and most tenured team serving the third-party recruiting industry,” Turner said in a statement.

David Seeley contributed to this report

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

Mark Cuban

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.