What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

Fort Worth Investor Leads $147M Series C for Insurance Startup Unicorn

Dallas- and Tampa, Florida-based private investment firm Weatherford Capital led a $147 million Series C funding round for Ohio insurance startup Branch, giving the company a $1.05 billion valuation. The funding will help Branch, which bundles home and auto insurance through its API, expand across the U.S.

The new funding comes after Branch raised a $50 million funding round last year and has since grown its headcount to around 400. The company expanded its annualized written premiums by 1,300% in the last 12 months.

PLUS

Calaxy founder Spencer Dinwiddie [Photo: Calaxy]

Web3 Startup Founded by Dallas Mavericks Player Raises $26M

⟫ A web3 company co-founded by Dallas Mavericks player Spencer Dinwiddie aims to help content creators with fresh new funding.

Calaxy, which monetizes content and interaction with influencers and their fans, landed a $26 million “strategic” funding round co-led by Animoca Brands and the HBAR Foundation, an independent organization funded and established by Richardson-based distributed ledger technology company Hedera Hashgraph aimed at helping entrepreneurs build on its platform.

Calaxy co-founder Solo Ceesay told TechCrunch that the new funding will be “stored for bearish days,” but eventually be used to expand its product. The publication says the company, founded in 2020, will allow creators to mint their own cryptocurrency token, which will be pegged to the U.S. dollar via its stablecoin USD Coin.

The new funding adds to a $7.5 million seed round Calaxy raised last year, which included Dallas Cowboys running back Ezekiel Elliott as a backer.

—

Mark Cuban [Background photo: PicturePartners/iStock]

Mark Cuban Invests in Sensor Startup

⟫ Dallas billionaire Mark Cuban joined an $8 million Series A funding round led by Millennium New Horizons for Seattle startup Strella Biotechnology, a sensor technology company focused on tackling food waste by detecting ripeness in produce. The company said it found initial traction in the apple industry and will be using the new funding to expand into grocery stores nationwide, in addition to investing in additional produce types.

—

Capital Factory Invests in Two Startups

Capital Factory Invests in Two Startups

⟫ Capital Factory, the Texas-based early-stage investor and accelerator that’s planning to open a Center for Health Innovation at Dallas’ Pegasus Park development, had a busy week.

The firm unveiled two new investments, joining a $3.5 million seed round for Austin-based “social sports talk app” Colorcast and a $2.8 million seed round for California-based medical device startup De Oro Devices.

Colorcast, which allows users to comment on sporting events while supplying them with stats and scores, plans to use its seed round to enter the sports betting space. De Oro Devices said it will use its new funding to commercialize its cane-like NexStride device, which provides audio and visual cues to help users with Parkinson’s disease move more easily.

—

Fort Worth Railroad Raises Nearly $1B

⟫ Fort Worth-based railway giant BNSF has raised nearly $1 billion to support expansion while reinforcing its existing infrastructure, the Dallas Business Journal reports. With bookrunners including BofA Securities, Citigroup Global Markets, and Goldman Sachs & Co., the funding was raised via debentures, a type a debt funding. The move comes as the Berkshire Hathaway-owned company announced plans to spend $3.5 billion on capital improvements earlier this year, the largest portion of which will go towards replacing and upgrading rails along 14,000 miles of track.

—

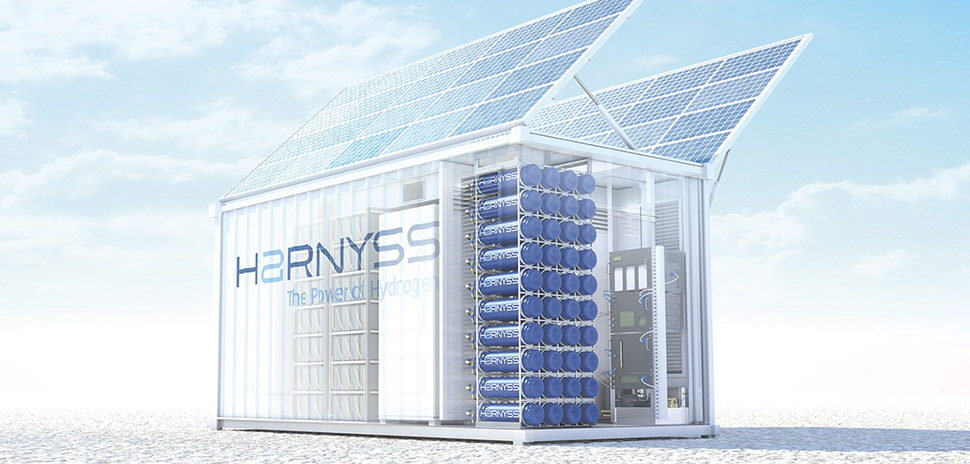

Image: Harnyss

Hydrogen Storage Solutions Firm Lands Equity Investment

⟫ Fort Worth’s Harnyss, a hydrogen storage solutions company, announced landing an equity investment from Houston firm Riverbend Energy Group’s Energy Transition fund. Terms of the deal were not disclosed. Harnyss CEO Kirby Smith said the move will help the company with its go-to-market and commercialization goals for its technology, which captures water from the atmosphere to produce hydrogen.

—

TPG to Buy Education Arm of Asia’s Largest Health Care Group

TPG to Buy Education Arm of Asia’s Largest Health Care Group

⟫ IHH Healthcare, Asia’s largest private health care group, has agreed to sell its medical education arm, International Medical University, to a consortium of investors led by Fort Worth- and San Francisco-based TPG’s The Rise Fund, the investing giants impact arm, for an enterprise value of $306 million. Other investors in the consortium includes the Hong Leong Group. TPG Senior Advisor Tunku Ali Redhauddin Tuanku Muhriz said the move is part of a “thematic focus” on providing professional medical education globally.

—

Accounting Firms Join Forces

⟫ Fort Worth accounting firm Whitley Penn is merging with South Carolina’s Elliott Davis to form Elliott Penn. When the deal closes on its expected date at the beginning of November, the combined firm will have about $400 million in revenue, along with 1,400 employees across 16 offices located in the South. The two firms’ CEOs—Larry Autrey of Whitley Penn and Rick Davis of Elliot Davis—will jointly serve as the top exec of the combined firm. Autrey said the move will create a “unique opportunity” to the firm’s customers and employees.

—

Cover art from StatLab’s product catalog

McKinney Medical Diagnostic Equipment Maker Acquires U.K. Company

⟫ McKinney’s StatLab Medical Products, a developer and manufacturer of medical diagnostic equipment and supplies, has acquired U.K.-based CellPath, a products maker and services company focused on the histology and cytology markets. StatLab, which is owned by Audax Private Equity and Linden Capital Partners, said the move will add injection molding manufacturing abilities to its lineup of offerings and expand its European reach—a market it entered last year with its acquisition of equipment manufacturer Pyramid Innovation. CellPath’s leadership will remain in place.

—

Market Researcher Makes New Acquisition

⟫ Looking to help brands better reach their customers, Plano-based market research firm Dynata has acquired fellow California-based market research company Branded Research for an undisclosed amount. Dynata said the move will help it deliver better data and insights to its clients.

—

Photo: rez-art/iStock

Standard Meat Co. Acquires Texas Sausage Maker

⟫ After partnering more than a decade ago, Dallas-based Standard Meat Company has acquired Ponder, Texas-based Syracuse Sausage. As part of the move, Syracuse, which supplies restaurants, grocery stores, and individuals via meal-kits, will become a new division of Standard Meat. Tapped to head up that new unit is Chris Horan, who runs a Fort Worth-based consulting business and has worked for a number of food giants, including HJ Heinz.

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

Image: InfStones.com

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.