We told you Monday about Dallas’ second federal innovation hub award in two months, with the Texoma Semiconductor Tech Hub landing in the city as part of 31 nationwide tech hubs designated by the Biden-Harris administration. Today we’ll take a deeper dive into the proposal and how Southern Methodist University snagged the Dallas hub’s lead agency role.

Locally, the federally funded economic development initiative aims to strengthen, build on, and drive innovation in the existing semiconductor supply chain in 29 counties in North Texas and Oklahoma through regional collaboration and workforce development.

As announced by the White House and the U.S. Department of Commerce Monday, the SMU-led Texoma Semiconductor Hub is the only such hub designated in Texas. Led by SMU, the 41-member Texoma Semiconductor Innovation Consortium is eligible to receive up to $75 million in funding through The CHIPS and Science Act, which was sign into law in August 2022. The consortium includes members from private industry, local governments, colleges and universities, tribal communities, and nonprofit organizations.

“We know how important the semiconductor industry is to the economic health of our country. And workforce development is key to our region’s progress,” SMU Provost Elizabeth G. Loboa said in statement. “SMU is thrilled to support both of these critical initiatives through our leadership of the Texoma Semiconductor Tech Hub. This is going to provide jobs and move our country forward.”

Winning one of only four federal tech hubs to focus on semiconductors

With semiconductors designated as a critical national priority, the Texoma Tech Hub is uniquely positioned as one of just four federal tech hubs out of the newly announced 31 to be targeted specifically at advancing semiconductor manufacturing and innovation. (See more on all 31 hubs at the end of this story.)

With a laser focus on semiconductors, the Texoma Tech Hub is set to play an outsized role in restoring America’s economic competitiveness and technological leadership. Texoma joins just three other hubs singled out for their potential impact on this uniquely important industry.

SMU Vice Provost for Research and Chief Innovation Officer Suku Nair called the work of this historic tech hub award “a game changer—not only for SMU but also for the entire region.”

“SMU is ready to lead this revolutionary technology effort,” Nair added in a statement.

Consortium organized by three SMU professors

The Tech Hub consortium was organized by three professors in the SMU Lyle School’s Department of Electrical and Computer Engineering: Jennifer Dworak, Scott Douglas, and J.-C. Chiao. The consortium’s goal in boosting the region’s semiconductor supply chain is to support national security while impacting many industries directly, including the automobile, energy, healthcare and communications industries, SMU said.

The university noted that North Texas is “the birthplace of the integrated circuit” and the Texoma region is already a major player in semiconductor manufacturing—as seen in Texas Instruments planned investment of $30 billion in its Sherman semiconductor campus and GlobiTech’s planned $5 billion semiconductor wafer plant, also in Sherman.

When SMU drafted its proposal to lead the tech hub, the university noted that the region’s central location and strong transportation network would provide resiliency against supply chain disruptions.

Aiming to make the Texoma region ‘a global semiconductor leader within 10 years’

A proposal shared with Dallas Innovates describes the plan to establish the Texoma Semiconductor Innovation Consortium (TSIC) in North Texas and southern Oklahoma, led by SMU. The proposal lays out an ambitious public-private partnership to cluster semiconductor expertise across north Texas and southern Oklahoma in order to fast-track innovation, commercialization, and growth of the regional semiconductor industry.

The Texoma Tech Hub consortium—which includes major corporations to academic institutions to economic development groups—intends to make the region “a global semiconductor leader within 10 years” by leveraging existing infrastructure and forming new partnerships.

The 29-county Texoma region already has capabilities spanning the semiconductor supply chain from wafer manufacturing to chip packaging to end product integration in industries like defense, automotive, and telecom, TSIC wrote.

Key regional assets highlighted are the aforementioned multi-billion dollar Sherman fab plant campuses from Texas Instruments and GlobiTech, a subsidiary of Taiwan-based GlobalWafers. The TSIC will focus innovation in chip integration, advanced materials beyond silicon, and computing for emerging tech.

Building on the region’s existing infrastructure, the consortium said it plans to focus on innovation in chip integration, advanced materials, and computing for emerging tech markets.

Participants in the Texoma Semiconductor Innovation Consortium

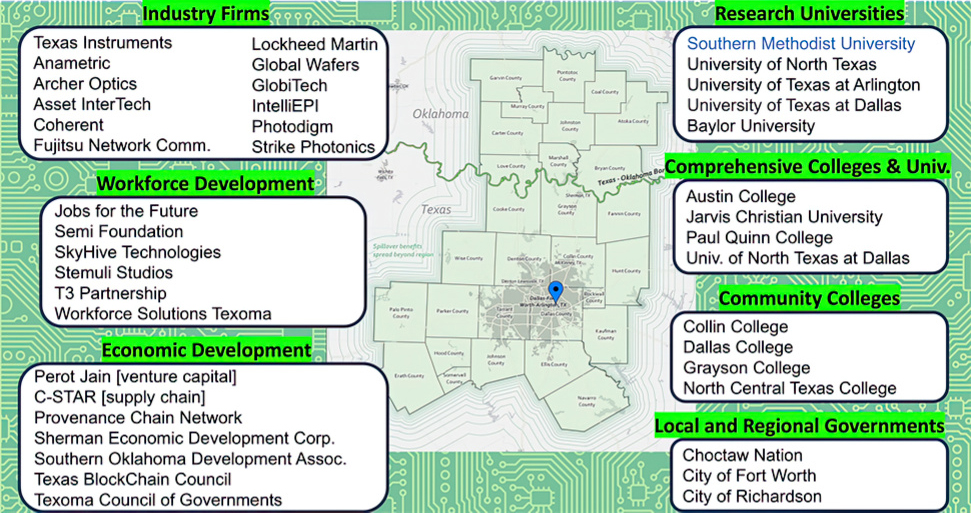

The Texoma Semicondutor Innovation Consortium proposal included a graphic of the 29-county region and an array of industry, workforce development, economic development, government, and academic support.

Banding together, the 41 members of the Texoma Semiconductor Innovation Consortium add up to something of a semiconductor ecosystem dream team, as described by the proposal. The consortium assembles a mix of companies, educators, investors, and partners to create the ideal conditions for nurturing a thriving regional chip industry.

SMU, a stakeholder in the proposal to establish TSIC, will serve as the main coordinating entity for the consortium. The university will leverage its institutional strengths across research, workforce development, and relationship-building to advance the consortium’s goals of establishing a thriving semiconductor industry ecosystem in the Texoma region.

Diverse members from major corporations to academic institutions to economic development groups, will foster synergies to strengthen the regional semiconductor industry, the proposal said.

The consortium, which will be managed by a Regional Innovation Officer and Executive Committee, aims to strengthen existing regional partnerships like those between SMU and Photodigm, TI, IntelliEPI and others, while building new collaborations through “Workforce Development Councils” and “Commercialization Councils.” These will connect companies, educators, investors and innovators to share needs, develop curricula, prototype new technologies, and promote commercialization.

49 corporate members will share the planned ‘fablets,’ boost workforce development, and more

TSIC has 49 corporate members covering the semiconductor supply chain plus support functions like blockchain supply chain tracking. Together they provide industry expertise, participate in governance, use the planned shared lab facilities, or “fablets,” and collaborate on workforce development. Venture firm Perot Jain will give startups access to investors.

Workforce Development Councils and Commercialization Councils also will build linkages between companies, educators, investors, innovators, and other partners. The TSIC also expects outreach programs from middle school onward to promote equity and increase access to semiconductor career opportunities, especially for underserved communities.

The Regional Innovation Officer (RIO), who will provide strategic guidance and operational management for the consortium as a whole, will be selected for expertise in areas like innovation, commercialization, partnership building, and ecosystem development. The RIO will facilitate collaboration among the consortium’s diverse members, drive strategic initiatives, and oversee day-to-day operations.

Supporting the RIO will be an Executive Committee composed of senior representatives from across TSIC’s industry, academic, government, and non-profit partners. That governing body will help the RIO in decision-making and provide input on the consortium’s policies and direction.

Regional strengths noted in the proposal include:

- Texas Instruments and GlobalWafers: Both investing billions in new Sherman, TX fabs

- Lockheed Martin, Fujitsu and Toyota: Major tech and auto firms with regional operations

- Semiconductor startups Photodigm, IntelliEPI and STRIKE Photonics

- Blockchain and supply chain tech organizations Provenance Chain Network and Texas Blockchain Council

- Research universities: SMU, UT Dallas, and UT Arlington, an HSI

- Historically Black Colleges: Paul Quinn College, with its Urban Work College, and Jarvis Christian

- Academia: Dallas College, University of North Texas, both HSIs

- Workforce and high-tech education startup Stemuli Studios

In addition, regional economic development entities such as the North Central Texas Council of Governments help connect strategies with public funding sources. Government backing will amplify consortium activities.

The Choctaw Nation also lends an important voice for including communities through outreach, per the proposal. Workforce agencies are expected to facilitate access to training programs for low-income individuals, veterans, and other groups, as will an array of community and technical colleges critical for vocational training.

Master Plan for Innovation

The consortium will combine the powers of the region’s defense, biotech, and telecom industries to advance semiconductors. The proposal outlines a master plan that assembles the infrastructure, cultivates the talent, and forms the partnerships to accelerate commercialization and forge a thriving regional semiconductor ecosystem.

The breakthroughs envisioned can only come through collaboration among stakeholders, according to the proposal. Three “key innovations” provide the means to that end:

Fablets

These “sophisticated, shared labs” will provide accessible infrastructure for research, prototyping, training, and commercialization across the region. Some will focus on silicon technologies, others on materials like III-Vs needed for electric vehicles. Other mobile fablets could provide community education and outreach.

Commercialization Councils

Industry-academia-investor councils will focus on meeting commercial need. The councils will link innovators with partners, customers, and funding sources to translate ideas into products.

Workforce Development Councils

These groups will collaborate to meet industry workforce needs. They will create education/training “on- and off-ramps” at multiple skill levels to minimize barriers. Outreach starting in middle school will promote semiconductor careers, especially in underserved areas.

Tech Hub Goals

Continuous sharing of needs and ideas between consortium partners across sectors will catalyze innovation across the regional semiconductor ecosystem, the proposal said.

A major goal is expanding workforce development and educational pipelines to build the regional talent base. TSIC will provide outreach to underserved communities starting in middle school, industry site visits, career guidance, and financial assistance for students.

According to the proposal, member Stemuli Studios will create digital education/training tailored to semiconductor jobs. TSIC’s education members from community colleges to research universities will collaborate to streamline training and education.

In addition, a Semiconductor Living Lab (SCLL) will accelerate commercialization by improving access to facilities, workforce, funding and customers in key application spaces like defense, telecom, and automotive. The proposed Semiconductor Living Lab will accelerate commercialization through improved connections between customers, partners, facilities, workforce, and funding sources, the proposal said.

Shared lab resources—fablets—will enable prototyping and demonstrations. TSIC will pursue ongoing funding for SCLL from public and private sources.

By strengthening U.S. leadership and reliability in semiconductors, TSIC aims to boost national economic and security interests. Its focus on advanced technologies and materials, workforce development, and supply chain resilience will reduce reliance on overseas production. The plan leverages the region’s dense presence of defense contractors and the member blockchain tracking network for supply chain integrity.

Accelerating the semiconductor ‘lab to market’ journey

A central goal of the consortium is to accelerate the “lab to market” translation of semiconductor innovations through an integrative industry-academia ecosystem. That’s where the Semiconductor Living Lab (SCLL) comes in to address common commercialization barriers startups face.

As the proposal puts it, the SCLL will establish Commercialization Councils centered around application sectors like defense and automotive. The councils will provide startups and researchers direct access to “customers, partners, facilities, workforce, and funding.”

TSIC describes an integrated model similar to the DoD’s successful Manufacturing Innovation Institute and the NSF’s Industry-University Cooperative Research Centers.

Councils will utilize open innovation concepts to connect innovators to real industry requirements and IP licensing opportunities. Startups can tailor solutions while leveraging shared lab facilities for rapid prototyping. This structure aims to translate ideas into products by linking innovations with transaction partners.

Based on the proposal, examples of the Commercialization Councils that the Texoma Semiconductor Innovation Consortium expects to establish initially include a Defense Commercialization Council formed with Department of Defense contractors, start-ups, venture capital, investors, and IP generators. Other councils could be formed for other industry spaces such as automotive, telecommunications and health care.

The TSIC sees regional venture capital firms embedded in councils to provide startups visibility and connections to national funding networks and investors, the proposal said. Partnerships with existing groups like UNT’s DOE-funded semiconductor education consortium will enable collaboration. Ongoing programs will be supported through blended financing from corporate sponsorships, government sources like the NSF and foundations.

Accelerating commercialization potential in the TSIC region indicates that “every 1% increase in regional sales creates more than 500 new jobs,” the proposal said.

Building a workforce ‘ladder to success’

Developing the semiconductor workforce is key for both companies in the region and people who need jobs.

“There’s a significant gap between the workforce needs of the industry and the supply from current training and education that TSIC will fill,” according to the proposal. TSIC sees its interconnected institutional programs as a “ladder to success” for the STEM semiconductor workforce.

According to the proposal, “semiconductor industry jobs in the region are high-paying, with an average weekly wage of $2,451 (more than 40% above the average wage for all industries), greatly enhancing the earning potential of the region’s workforce.”

The TSIC plans to bring together academic institutions ranging from community colleges to R1 doctoral universities. Diverse academic members, including historically Black and Hispanic-serving institutions, are expected to provide education pathways in semiconductor technology while conducting outreach to promote equitable access to high-tech careers across diverse communities.

Workforce Development Councils will also “engage in public outreach to ensure that the entire community from middle school students to older adults, especially people from underserved areas, are aware of the opportunities no in the semiconductor industry,” the proposal said. No you can’t because you don’t know where I am

Strengthening U.S. leadership in semiconductors

“Everything from the Internet to refrigerators to pacemakers to water treatment depend on semiconductors,” the proposal noted. Semiconductors are essential for defense, telecommunications, automotive, and other critical industries, the TSIC notes. Reliable domestic production reduces reliance on overseas supply chains vulnerable to disruptions.

The TSIC aims to strengthen U.S. leadership in semiconductors to boost broader economic and national security interests—and plans to do that by making the Texoma region a global semiconductor leader. Reduced foreign reliance, workforce training, and blockchain tracking will enhance the domestic industry’s security and reliability.

The North Texas region already serves as a national defense hub, receiving 65% of Texas’ DoD funding, according to the proposal. TSIC will leverage this existing presence to advance domestic semiconductor capabilities important for national security.

“The designation of the Texoma Semiconductor Innovation Consortium as a Tech Hub builds on the investments and advancements consortium members and our regional companies have made in semiconductor manufacturing and commercialization,” said Dallas Regional Chamber SVP Duane Dankesreiter, commenting on the announcement on Monday.

“This will ensure the Texomas region develops into the premier global source for semiconductor industry innovation and delivers economic impacts benefitting the entire country.”

The consortium plans to use that defense industry presence and focus on advanced technologies to reduce reliance on overseas chip suppliers, mitigating supply chain vulnerabilities. And by focusing on advanced semiconductor technologies and materials, it aims to position America at the forefront of areas subject to global competition—like semiconductors for electric vehicles.

Training regional workers and implementing blockchain tracking, the effort could fortify integrity across national tech supply chains, the proposal said. Through TSIC, the education of the local workforce can also enhance the security of the defense industry by providing workers that can operate in sensitive facilities. The “innovative supply chain tracking for use within TSIC” can be applied across other Tech Hubs, the proposal noted—extending the impact of the Texoma Semiconductor Tech Hub beyond the region in yet another way.

30 other Tech Hubs will focus on a range of technologies

The Texoma Semiconductor Tech Hub was one of only 31 designated by the Biden administration Monday. Here’s what the other 30 hubs will be doing:

• Three hubs are focused on autonomous systems, including safe and secure autonomous technologies.

• Two hubs are centered on advancing quantum computing and information science.

• 11 hubs will specialize in biotechnology, from pharmaceutical manufacturing to precision medicine and AI-enabled biotech.

• Five hubs will accelerate the energy transition through renewable power, battery technology, and resilient infrastructure.

• Two hubs will strengthen domestic critical mineral supply chains.

• In addition to Texoma, three other hubs will bolster semiconductor manufacturing and microfluidics.

• Four hubs will drive advancements in materials science and manufacturing for sectors like aerospace, polymers, and timber.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.