“The future of gig economy work is ever changing,” says Gig Wage founder and CEO Craig J. Lewis. “By building modern flexible financial technology, the infrastructure to manage that change will be readily available to the broader gig economy.”

Dallas-based Gig Wage aims to do just that with several new product updates on its platform.

The fintech—founded in 2014 to simplify payroll for the gig economy—has raised $16 million to shape the modern financial infrastructure for what it calls the “Future of Work.” Its platform was built to tackle complex challenges around contractor payroll, payments, and compliance.

The new product updates were developed after Gig Wage “thoroughly researched market offerings and talked to countless customers for real-time feedback,” Clarisa Lindenmeyer, the company’s chief of staff to the CEO and chief brand officer, told Dallas Innovates.”These updates address the most pressing issues for business owners—managing cash flow and payment speed.”

Aiming for 1 million gig workers on platform in 2023

Craig J. Lewis, founder and CEO of Gig Wage. [Photo: Jae Oates]

Founder and CEO Lewis told Dallas Innovates that he expects to have 200,000 gig workers on his platform by end of 2022, and he’s aiming for 1 million in 2023. Gig Wage now pays workers in all 50 states.

“Longer term, we look at the success and scale of companies like JPMorgan, Stripe, ADP, and Visa,” he told us. “That’s the type of impact we want to have, and the gig economy is large enough and underserved enough for it to be possible.”

Gig Wage itself currently has 20 employees. Lewis plans to keep his company “lean, operationally effective, and efficient,” adding, “I’ve always been curious if we could build a billion-dollar business with less than 100 team members.

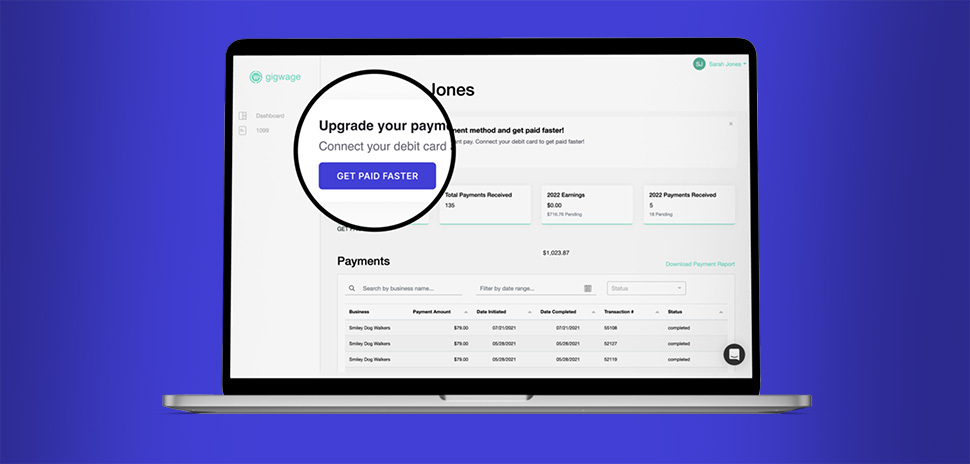

Faster pay for contractors

Image: Gig Wage

Gig workers—everyone from food delivery people to telehealth providers—often share one big complaint: having to wait to be paid.

Faster Pay, a new feature on Gig Wage’s platform, allows contract workers for participating companies to opt into getting their money sooner. For what Gig Wage calls “a small fee,” it will send money directly to workers’ debit cards, with no minimum amount.

Inflation is hitting workers on Gig Wage’s platform especially hard, says Rob Belsky, the company’s VP of finance, making faster payments important.

“Wage growth is stagnating round +4% while inflation hit +9.1% in June,” Belsky said. “The increase in the price of gas has hit some of our customer’s workers the hardest. But housing prices, rent, and food price increases have also increased substantially over the same time.’

‘We’re seeing an increased demand for quicker payments to meet household obligations and for credit,” he added, noting that many businesses have seen uncertain markets resulting in job cuts. “For Gig Wage, however, there’s been an increase in demand for our services, and we’re continuing to find ways to add value to our customers and their contractors,” Belsky said.

Helping to build a ‘social safety net’ for 1099 workers

Clarisa Lindenmeyer, chief of staff to the CEO and chief brand officer at Gig Wage. [Photo: Gig Wage]

Updates like Faster Pay are aiding Gig Wage in its mission to help build a “social safety net for 1099 workers.”

“We believe in modernizing payments and payroll and by doing so driving economic empowerment for all,” Lindenmeyer said. “There’s no better way than getting workers their money quickly, helping them stay compliant with the IRS, and in general serving as a financial resource.”

“Most importantly, we want to fill the gap of the predatory financial services that have existed for decades,” she added. “Products like our Faster Pay that allow workers to control their speed of pay by choosing a non-predatory service fee ensure that the control is in their hands—but not with such an enormous sacrifice.”

Cash Flow Advance through a factoring solution

Contractors aren’t the only ones who have to wait to be paid. Companies often watch mailboxes and inboxes anxiously, too.

“Many of our customers are paid in a very traditional way—net 30, 60, or even 90 days,” said Lindenmeyer. However, their workers expect to be paid quickly, if not instantly.

To give customers the funds to do that, Gig Wage is piloting a new factoring solution called Cash Flow Advance, which is currently in private beta. It aims to “seamlessly unlock cash flow for payroll and payments,” and is being piloted with a small number of companies.

Lindenmeyer says the solution has been “extremely successful” so far.

“We’re funding the pilot customers off of our own balance sheet, but have current financing relationships with Silicon Valley Bank, Green Dot, and more,” she said.

Through the solution, Gig Wage offers companies a complimentary cash flow audit and recommended improvements.

“We also offer an account receivables product that allows us to pull the receivables on behalf of our customers and directly pay their workers,” Lindenmeyer added. “We often find that the account receivable function in conjunction with our factoring services allows our customers to better manage their operations and at a lower overall cost.”

Subscription pricing and automated discounts

Previously, Gig Wage charged companies fees per transaction. But as of July 1, it transitioned them to monthly usage tiers, with subscription-based pricing that enables “more predictable monthly, bookkeeper-friendly accounting.” The subscription tiers allow customers to unlock automated discounts based on the percentage of payments sent to debit card contractors during a calendar month.

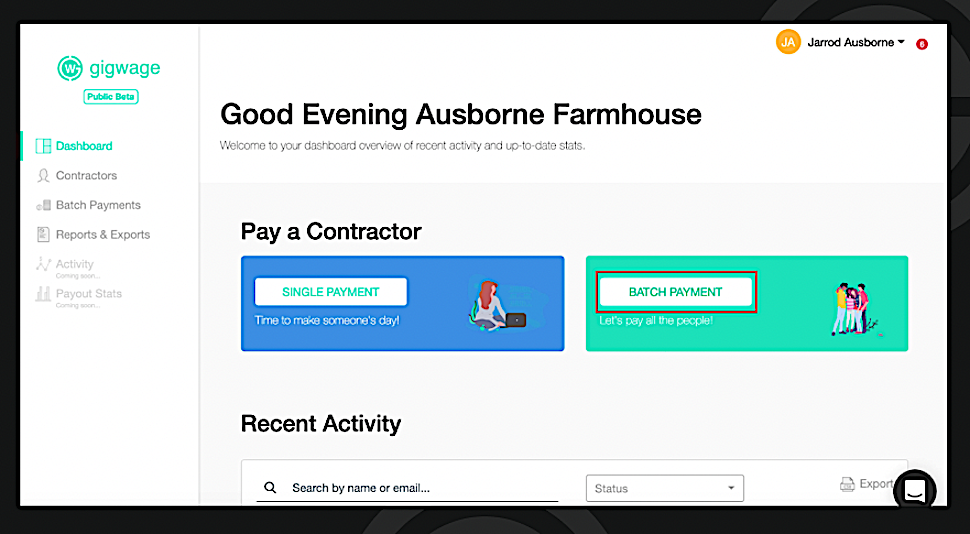

Batch payments

[Image: Gig Wage]

Anyone who’s run a company with lots of contractors knows how hard it can be to handle payments for many workers. “We get asked about batch payments all the time,” the company says on its blog post. Its platform offers a Batch Payment feature that makes the payment process more easier for its customers. Companies can upload their contractor list and send a long list of payments with a single tap.

Other recently launched features

Speaking of long lists, Gig Wage’s other recently launched new features include Automatic Balance Top-Off, ACH Return Automation, Automated TIN Check, TIN Check Dashboard, API Sandbox Access, TIN Check Webhook, and API Client Javascript Library. You can read about all of them here,

Coming up: debit card and mobile app

The company is currently working on the launch of a debit card and mobile app for freelancers and gig workers, Lindenmeyer says.

“We’ve decided to take our time and launch a product that gig workers not only need but will enjoy,” she said. “So many people take for granted that everyone is ‘banked.’ They are not. Many Americans are under- or non-banked. We aim to solve this with the right solution in the near future.”

Gig Wage’s investors

Gig Wage has raised $12.4 million in equity and $3.3 million in venture debt to fuel its growth, Lewis says. That includes a $7.5 million Series A round in 2020 led by Green Dot, a financial technology and bank holding company based in Pasadena, California; and a later $2.5 million investment by led by Jaclyn Hester, the first female partner of Foundry Group, a Colorado-based tech investor. (Foundry Group’s primary partner, Brad Feld, founded TechStars and was raised in Dallas.)

Green Dot wasn’t just an investor; it’s also served as an infrastructure bank partner for Gig Wage, allowing the startup to add Green Dot’s solutions to its instant payments platform for gig workers and the huge number of underbanked Americans.

But Lewis isn’t looking for more funding now.

“We have a strong balance sheet and don’t anticipate needing to do any equity financing this year,” the founder and CEO told us. “Especially given the market uncertainty and valuation corrections in venture. Happy, growing customers and lots of new customers are our favorite type of funding, so we’re leaning into that.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.