Dallas-based biotech CerSci Therapeutics has been acquired in a $52.5 million deal that could net nearly $900 million more for its shareholders with milestones and royalties.

The clinical-stage biotechnology startup was acquired by ACADIA Pharmaceuticals, along with the worldwide rights to its portfolio of novel compounds for neurological conditions, which includes the startup’s non-opioid therapies for acute and chronic pain, the California-based public company announced today.

In a transaction that closed on Wednesday, ACADIA acquired outstanding shares of CerSci for $52.5 million, mostly in ACADIA stock. But CerSci shareholders also could receive up to $887 million based on milestones for development, commercialization, and sales, as well as tiered royalties in the mid-single-digits based on annual sales, according to a news release.

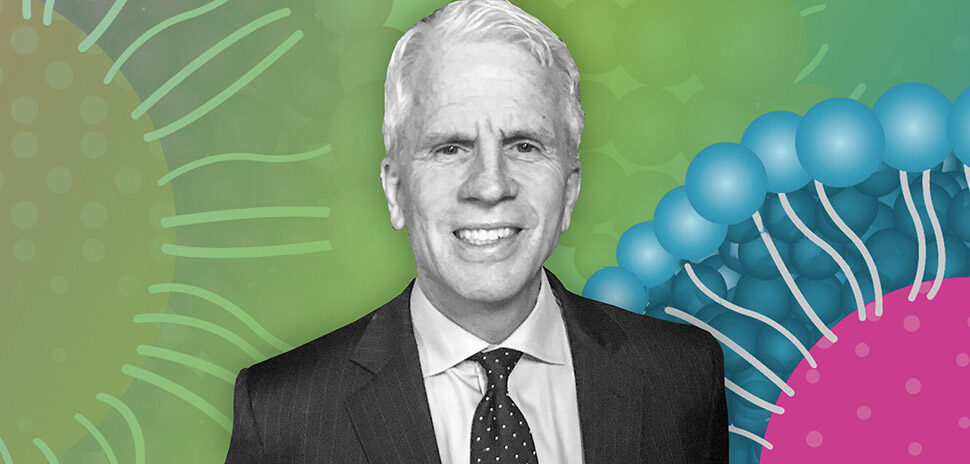

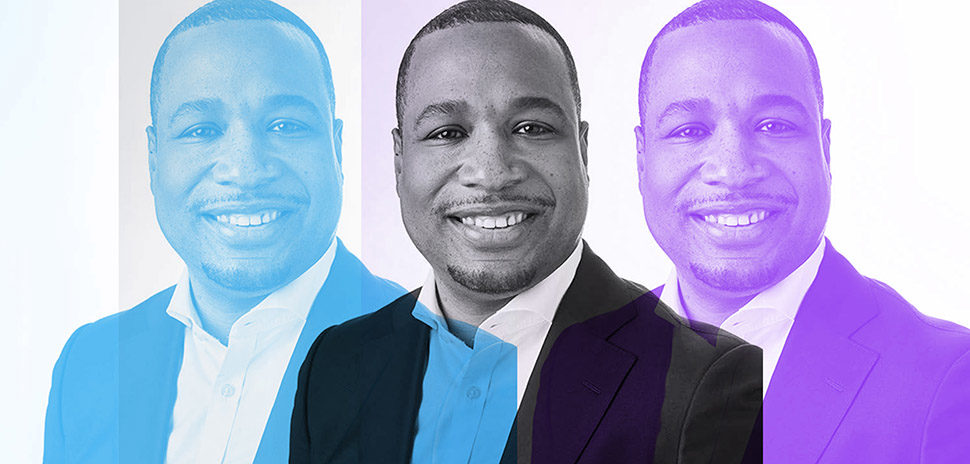

CerSci Therapeutics CEO Lucas Rodriguez and Chief Scientific Officer Scott Dax. [Photo: CerSci Therapeutics]

Lucas Rodriguez, CEO and co-founder of CerSci, launched the company in 2015 to develop the next wave of drugs for the treatment and prevention of acute and chronic pain, he previously told Dallas Innovates. CerSci used its early funding to acquire a molecular compound called CT-044, invented by Scott Dax, who is now CerSci’s chief scientific officer, in August 2016—just weeks before the U.S. surgeon general declared opioid abuse a public health crisis.

In practical terms that could mean CerSci’s pain drug doesn’t affect the central nervous system, so there’s no high and no addiction.

ACADIA to help CerSci deliver the next generation of medicines

The acquisition of CerSci ultimately can facilitate the delivery of a new generation of medicines that treats acute post-operative and chronic pain,” Rodriguez said in a statement, adding that he’s confident that ACADIA can advance the biotech’s program through its proven development and commercialization capabilities.

For ACADIA, the acquisition bolsters its clinical pipeline with the startup’s non-opioid pain therapies and their potential non-addictive properties, as well as reduced side effects typically seen with current opioid treatments, according to the news release.

“There’s an urgent need for new approaches to treat pain without causing addiction,” ACADIA CEO Steve Davis said in a statement.

The acquisition also strengthens the pharma’s development pipeline for long-term growth in central nervous system disorders, Davis said.

CerSci CEO Lucas Rodriguez was working on his Ph.D. in biomedical engineering and taking business classes at UT Dallas when he met a couple of faculty members who were researching non-opioid pain relief. Rodriguez says it took the men just three hours to decide to work together. [Photo: Skylar Fike]

Last March, CerSci’s Rodriguez announced a huge milestone: its Investigational New Drug (IND) application for CT-044 received notification from the United States Food and Drug Administration (FDA) indicating that its Phase I safety and tolerability clinical trial may proceed.

The company is enthused about the clinical utility of CerSci’s program that spans multiple pain modalities with its “novel non-opioid mechanism of action,” Davis said.

CerSci’s lead development program is a “unique Reactive Species Decomposition Accelerant (RSDAx), a “first-in-class” mechanism that’s focused on interrupting pathways that sensitize neurons to pain, according to ACADIA. The portfolio contains “additional preclinical stage molecules, including brain penetrant molecules, with potential for symptomatic and disease-modifying treatment utility in neurodegenerative diseases.”

The lead molecule, known as ACP-044, has shown promising efficacy and safety results in animal models evaluating incisional, inflammatory, and neuropathic pain, as well as favorable tolerability and pharmacokinetic properties in its Phase 1 trials.

The novel RSDAx has a mechanism of action that’s thought to interfere with multiple pain pathways by treating pain simultaneously. ACADIA said it’s planning for a Phase 2 clinical study by the end of Q2 in 2021.

Major investors in CerSci include JDH Investment Management, Hiawatha Education Foundation, Lennox Capital Partners and West Summit Investments.

ACADIA advisors are financial advisor BofA Securities and legal advisor Paul Hastings. CerSci advisors include financial advisor Evercore and legal advisor Skadden, Arps, Slate, Meagher & Flom.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.