It wasn’t long ago that we were asking ourselves: “Is coworking a fad?”

Guess what? It’s not a fad.

Over the last few years, coworking has grown up a lot. What was once a fringy experiment in utilizing vacant space has quickly become a mainstay of the office market.

According to research from Colliers International and Cushman & Wakefield, Dallas-Fort Worth currently has somewhere between 1 million square feet and 1.3 million square feet of coworking space in play.

At the national level, the sector has been growing at a rate of more than 5 million square feet per year for the last three years, and is expected to triple in size in the near future, making up as much as 5 or even 10 percent of the office space in many markets. As of August 2018, Cushman research indicates that coworking accounts for 1 percent of the national office space inventory.

With the sector’s performance over the last few years, and the numbers it’s projected to reach in the near future, it is becoming increasingly clear that what we have on our hands is not just a nice amenity, but the office space utilization tool of the future.

Trey Bowles, chairman of the board at the Dallas Entrepreneur Center, says the shared-space model might just be the new cubicle.

“How long was the cubicle model in? They didn’t do that back in the ‘80s. It really started in the end of the ‘80s and early ‘90s—and really started with the technology companies—but let’s call it 20, 25 years. There’s no reason coworking wouldn’t last that long,” Bowles says.

“Everybody thinks coworking is the future. And when I think coworking, I think shared space type models. I don’t think every company will be in a coworking space, but I think more and more companies think that’s the space solution of the future.”

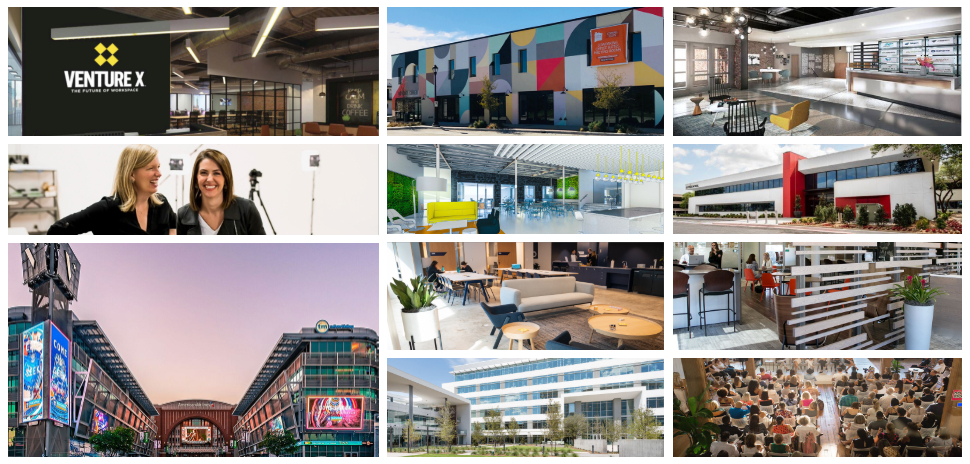

Naples, Florida-based Venture X set its sights on North Texas in early 2018 with an inaugural opening near the Galleria. [Photo: Courtesy VentureX]

In DFW, coworking is still very young. It’s only been around for about six years.

Nick Clark, founder and CEO of Common Desk, was one of the very first people to start a coworking operation in Dallas. He did so in 2012, just as the economy was starting to recover from the Great Recession.

Clark, who came from a commercial real estate background, says his friends thought he was off his rocker for betting on a 4,000-square-foot coworking space in Deep Ellum when there was finally real money to be made in traditional real estate for the first time since the market crashed.

“Four thousand square feet in 2012 seemed like a really big bet, and a lot of my broker buddies were looking at me like I’d lost my mind because that was kind of right when the market really turned around and everybody was finally making some money again in commercial real estate,” he says.

Fast forward to today, and Clark is now running one of the most successful coworking operations in North Texas. He can be credited with almost single-handedly kicking off the coworking revolution in Dallas-Fort Worth.

Over the last few years, Clark has seen his neck of the woods change and fill out with new operators and evolving customer profiles.

In the beginning, Clark says he remembers signing creatives up for desks one at a time, incubating the culture most people associate with coworking now.

But by 2014 and 2015, Clark’s spaces had become a popular option for small businesses, and the tenant mix began to skew away from strictly creative users.

Now, the story of coworking is one of rapidly accelerating market maturity as a growing number of large companies are snapping up big chunks of space in markets around the nation for a host of reasons, including the dire need for new talent pools, geographic proximity to projects, and the avoidance of costly long-term leases for departments that may be temporary.

“That’s what is fueling the incredible growth of coworking,” Clark says. “It’s really just becoming the new way people are wanting to office. The economics around that—of charging a corporation per head instead of per square foot—makes sense, and it’s easier to underwrite,” he says.

John Arenas, CEO and founder of Serendipity Labs, whose operation is targeted at this cohort of enterprise clients, points out that in addition to the ease of underwriting, there is a significant accounting benefit for publicly traded companies that is making coworking an ever more popular option for them.

In a partnership with Dallas-based HALL Group, Serendipity Labs launched a coworking space in September 2018. [Photo: Courtesy Serendipity Labs]

Thanks to new regulations from the Financial Accounting Standards Board, as of Jan. 1, 2019 companies will have to disclose their outstanding leases as liabilities on their balance sheets. For large companies entangled in a host of long leases, that can mean reporting a large, ugly number that could hurt stock values.

Utilizing coworking (or taking shorter, more flexible leases) goes a long way toward mitigating that risk, and Arenas says that is very attractive to companies.

In the last couple of years, forward-thinking developers have realized this changing tide in the office market and have begun to bake coworking space directly into their developments from the get-go.

Cawley Partners CEO Bill Cawley is one such developer and a big believer in the power of coworking, saying it boosts the value of office buildings by imbuing them with the secret sauce of placemaking.

“Coworking creates a better sense of place, and it creates a stickiness for your existing tenants that are going to make the investment more attractive to investors,” he says. “It’s matured to where it’s a value-add for any quality office building. The amenities they provide, etc., have gotten to a level where I think it just makes sense.”

Common Desk’s seventh North Texas office space will be located in Addison’s FOURTEEN5. The coworking space is the brand’s first location with landlord Cawley Partners. [Photo: Matt Shelley]

Putting his square footage where his mouth is, Cawley is making coworking a big part of his new Tollway development, Fourteen555, and will have Common Desk managing a roughly 28,000-square-foot chunk of the first floor in the project’s Phase 1 office building beginning in April 2019. Coupled with the existing Ascension restaurant in the project’s amenity building, Cawley hopes to activate Fourteen555’s amenities and create the kind of environment tenants are looking for.

Cawley says his decision was largely inspired by the successful combination of coworking and coffee at the Centrum in Uptown. The Mudsmith coffee shop and coworking tenants in the building have had a quickening effect on the building, he says, filling the common areas with energy and making the building feel more alive.

Cawley is betting that a similar combination will be the recipe for success in activating Fourteen555.

“In two years, I’ll let you know if it works,” he says with a laugh.

More likely than not, it will.

Fort Worth-based Locavore is a twist on the traditional coworking model, as it allows individuals or startups to rent space month-to-month, but with commercial-grade kitchen appliances. [Photo: Courtesy Locavore]

In the space of just a few years, coworking has become one of the hottest placemaking tools in the game, garnering major attention from investors, owners, and tenants alike.

“Coworking is no longer at an early adopter stage. We’re at sort of mass volume or mass market adoption. Everybody knows about it now,” Bowles says. “The first few years we were doing this, there was a lot of wondering: ‘What’s the future of space, what’s the future of office, what is coworking?’ And all the big real estate firms were asking this. We’re at a point now where they kind of know what they think it is.”

A new example of a coworking installation is Centrl Office, located in the St. Paul Place building in the Dallas Arts District. The space strives to create a common area where different companies can communicate and work together, says Matthew Fields, general manager. Based in Portland, Oregon, the coworking space has now expanded to six locations—the Dallas office marking the newest addition—though Fields says the company hopes to eventually expand across North Texas.

The space boasts 52-inch desks throughout private offices, with rentable offices ranging from two to 40 desks. The coworking area is currently offering new companies interested in the space a free month to help startups get off the ground as well as benefit the Centrl Office operational team.

Centrl Office is located in the St. Paul Place building in the Dallas Arts District. [Photo: Rebeca Posadas-Nava]

“We like to think of ourselves as a ’boutique-y,’ luxury coworking experience here,” Fields says. The space has full a concierge service, with complimentary kombucha and beer on tap. Centrl Office’s key demographic lends itself to the professional crowd, with a range of companies already renting their spaces: from startups, to tech companies, to accounting and investment firms.

For owners, the ability to incubate a potential tenant pipeline in-house, activate expensive amenities and common spaces, and garner higher rents per square foot, along with the hip, progressive image tenants and their talent crave, are all reasons coworking continues to gain momentum in the office market.

EXPLORE: Interactive map of coworking spaces in Dallas-Fort Worth

For many of the same reasons, investors have taken notice as the community has begun to get comfortable with underwriting office deals that involve coworking space.

Arenas says the fact that Morningstar has issued guidance on underwriting the deals is evidence that coworking is reaching market maturity. The investors have figured out how to deal with coworking, which means that office buildings with coworking space are about to get solidified as a kosher investment avenue.

As a result of this increase of comfort with coworking and a better understanding of its benefits and shortcomings, a growing number of developers are creating their own in-house coworking operations, cutting out the WeWorks, Common Desks, and NōDs of the world to tap straight into the demand vein.

“You can get a much higher rental rate from a one-, two-, three-man office than you can from a large, full-floor tenant,” Colliers Executive Vice President of Capital Markets Creighton Stark says.

But, he warns, it’s not a cut-and-dry cash cow. It’s important to have the right feel to operate a quality coworking space.

“If the ownership is just looking at it like a profit center, I think that the coworking environment will suffer, and I don’t think that it will provide the same atmosphere that maybe a small company would want to have,” Stark says. “If they’re a good manager of people, a good manager of tenants, then they’ll do well.”

Like everything else that is cool in the world, coworking works best in moderation.

A good rule of thumb is to have no more than 10 percent of a building dedicated to coworking. Stark says investors typically view coworking space as riskier than regular office space because of transient tenants and questions surrounding the credit of the young companies that typically populate coworking spaces, so keeping the percentage modest is best.

The exception is when a coworking space is in a place where everyone wants to be. Stark says a building in walkable, talent-rich Uptown could support coworking space that takes up as much as 40 percent of the building’s square footage.

WeWork is a national coworking giant that has multiple locations across the North Texas region, like the Uptown space shown above. [Photo: Courtesy WeWork]

And though it is true that the buzziest, most successful coworking spots tend to be in the urban areas of Dallas-Fort Worth, it’s becoming increasingly evident that desire for the product exists outside of the urban core. Demand is cropping up everywhere, and coworking’s cup runneth over in a market flush with demand.

In 2019 and 2020, Clark predicts that major coworking brands are going to triple down on their Dallas-Fort Worth presence.

“DFW is still, if you look at it compared to other major markets in the U.S., underserved when it comes to flexible office, which might sound crazy to some people, but we’re just now seeing coworking in DFW start to explode in the suburbs,” Clark says.

“I think you’re going to see 2019 prove to be the year that if you’re a Class A, nice building in Dallas and you have space available, you’re probably going to want to seek out coworking in your building, especially if you’re renovating your building and kind of right-sizing it for the future.”

Some questions that remain are how the market will deal with the end of the upcycle, market saturation, and blurring lines between developers and coworking operators as both look to cut a path into the other’s territory.

Some say the coworking market will take a major hit in the next downturn; others say it is well positioned to weather economic headwinds. As more developers jump into the coworking space and more coworking operators move into the real estate space, there will be a power struggle for tenants that leads to all kinds of creative one-upmanship—the likes of which we’ve already seen in the office market’s amenities arms race over the last few years. What the subsequent rise in rents does to demand for coworking space—which is already somewhat of an issue—remains to be seen.

But whatever happens, rain or shine, the coworking model’s success is real; it has changed the way we view our spaces, and it is here to stay.

Like Bowles says, coworking’s strength isn’t a function of its novelty; it is born of the evolution of how we look at office space.

A version of this article was first published in the Winter edition of the Dallas-Fort Worth Real Estate Review.

Read the digital edition of Dallas Innovates’ sister publication, the Real Estate Review, on Issuu.

The Dallas-Fort Worth Real Estate Review is published quarterly.

Sign up for the digital alert here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![Dallas-Fort Worth Coworking Map [Source Cushman & Wakefield, Dec. 2018]](https://s24806.pcdn.co/wp-content/uploads/2019/02/Dallas-Fort-Worth-Coworking-Map.png)