North Texas is booming—but even for investors with deep pockets, getting into the region’s most promising deals isn’t easy.

Derek Wilson saw this firsthand from Old Parkland, the investor enclave known as Dallas’ unofficial ‘capital of capital.’ After co-founding an early data center company that weathered the dot-com crash and was later acquired, Wilson shifted his focus to private investing through his family office. From his vantage point, he repeatedly saw how fast local deals moved—prime opportunities often filled and closed before investors could even react.

“Dallas has been on fire,” Wilson says, citing a surge of investment and business growth in recent years. Investors outside the region clearly see the momentum, he adds, but breaking in remains a challenge.

“Everybody’s hearing about what’s happening here, but no one knows how to access the investments,” he says.

Wilson wasn’t alone in spotting the gap. Calvin Carter, who built Bottle Rocket into a mobile-app powerhouse later acquired by WPP, and Bob Bennett, a private-equity veteran with multiple successful exits across manufacturing and media, saw it too.

All three had known each other since the late 1990s, part of a tight-knit circle of Dallas entrepreneurs who came of age as the internet was taking off. All three had successfully launched and sold companies, led multimillion-dollar deals, and built extensive local networks. And, as it turned out, all three saw the same problems—the best investment opportunities in Dallas were hard to access, and traditional fund structures limited flexibility and investor control.

So they did what entrepreneurs do—they built a solution.

Building the solution they wanted

Launched quietly in 2024, Dallas Opportunity Partners, or DOP for short, gives family offices and high-net-worth individuals a way to invest in businesses shaping North Texas’ future—offering access to what founders Wilson, Carter, and Bennett describe as the ecosystem’s “outsized advantage.”

Since making its first deal last summer, DOP has closed five investments, with a sixth in progress. Anchored by capital from the founders’ own family offices, the platform has secured roughly $40 million in commitments, with a target of $100 million—though Wilson notes there’s no upper limit.

But unlike a traditional “raise-first, deploy-later” model, DOP is raising and investing at the same time—and already returning capital to investors. “We’re doing both at the same time, which is really unusual,” Wilson says. “We wanted to put our money to work.”

For Wilson, liquidity is a core issue—and a personal one. “I’ve been in a seed fund out of San Francisco for about 14 years now,” he explains. “It was a great return, but there’s still about 10 companies in it.”

Dallas Opportunity Partners, left to right: Calvin Carter, Derek Wilson, and Bob Bennett [Photo: Michael Samples]

That kind of long lock-up didn’t fit the model Wilson, Carter, and Bennett had in mind. Instead, they set out to build a hybrid investment platform—one designed for more investor control and, crucially, quicker liquidity.

“We’re really focused on distributing capital,” Wilson says. Part direct investment, part private equity, DOP lets investors commit broadly to the fund or choose deals individually.

“We built something that we wanted ourselves,” Carter says, “and it turns out that other people wanted it too.”

Building on Y’all Street

The launch of Dallas Opportunity Partners aligns with the region’s rise as a national financial center—a shift that’s earned it a new nickname in headlines: Y’all Street.

As Wall Street mainstays like the New York Stock Exchange and Nasdaq expand their presence in Texas, Dallas has emerged as a serious challenger to traditional financial hubs, attracting firms once concentrated in New York and Chicago.

Wilson, Carter, and Bennett aren’t just watching this evolution unfold—they’re betting on it. DOP secured an early stake in the Texas Stock Exchange (TXSE), a Dallas-based exchange set to launch in 2026 with backing from major players, including BlackRock, Citadel, and Schwab.

“The Texas Stock Exchange has a lot of tailwind behind it,” Wilson says.

That momentum is also shaping DOP’s growing portfolio. According to its website, the group has backed Cross Development, T Bar M Racquet Club, and Method Bank—investments that reflect Dallas’ increasingly diversified and fast-moving capital ecosystem.

Wilson has seen Dallas’ transformation firsthand since moving to the city in 1994. Over the years, he’s watched capital concentration deepen and new industries take root.

Now, “the density around what’s happening—the way people are coalescing—it’s just different,” Wilson says.

That observation sparked Wilson’s “aha moment” two years ago. “The breadth of groups coming through—the different types of industries, different scales—companies, politicians, everyone,” he recalls.

For the founders, DOP is as much about where they invest as how. Their model is rooted in North Texas’ economic momentum—and in a structure built for flexibility, transparency, and investor control.

Wilson is unequivocal: If you’re investing in the U.S., Texas offers the best opportunities and business climate. And if you’re investing in Texas, “you’re going to focus in on Dallas,” he says.

DOP’s recent alliance with the Texas Economic Development Corporation further positions it not just as an investor but as a catalyst for regional growth. The firm is leveraging Texas’ pro-business policies, talent migration, and cost advantages to expand its deal pipeline.

“We think that Texas, and Dallas specifically, has an outsized advantage,” Carter says. “Let’s keep adding to that advantage.”

“We bring them back to Dallas”

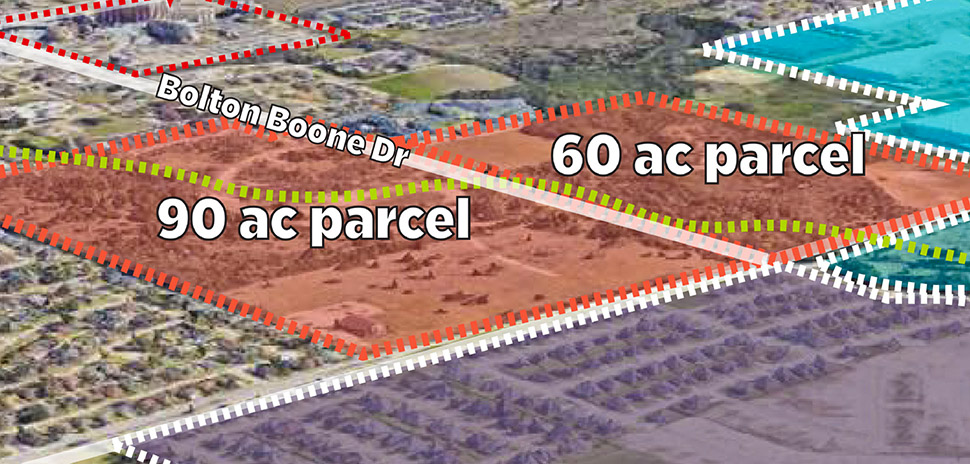

For Dallas Opportunity Partners, investing locally means more than funding businesses already in North Texas. They’re going out, acquiring companies, and bringing them home.

“If you really can’t find investments, then you’re not working hard enough,” Carter says. “We go out and find them. And if they’re not here, we bring them back to Dallas.”

That means scouting promising companies across the country, structuring smart acquisitions, and relocating them to North Texas to reach their full potential.

“We’ll turn it into a Dallas company,” Wilson says. “Bob [Bennett] has experience in these kinds of businesses. We’re buying it, and moving it.”

Bob Bennett [Photo: Michael Samples]

Bennett, he says, is the architect behind DOP’s investment strategy—bringing deep expertise in financial structuring and capital allocation.

“He’s really good at deal structure—understanding the capital stack, the appropriate amount of leverage to use,” Carter says. He notes that Bennett also works in sectors beyond tech: distribution, manufacturing, infrastructure, and consumer services.

“I’m obviously very tech-focused,” Carter adds, “but Bob brings expertise in swinging hammers, moving trucks, and building real-world businesses. He understands how to remove obstacles for founders and help them scale.”

Scaling, not just buying, companies

“We’re entrepreneurs speaking to other entrepreneurs,” Carter says. “Once they get here, we help them build—just like we built Bottle Rocket.”

While details of pending acquisitions remain under wraps, Wilson says DOP is targeting sectors with strong macroeconomic tailwinds—areas poised for long-term growth across Texas and the broader region.

“We’re leaning into the onshoring of aerospace, defense, and supply chains,” he says. “But we’re not limited to those sectors.”

The partners describe their approach as opportunistic, carefully vetting opportunities in infrastructure, manufacturing, distribution, healthcare, artificial intelligence, and more.

“The pipeline is robust,” Wilson adds.

Access is everything—and geography matters

But whether investing in established local businesses or relocating promising ones, North Texas itself remains the common denominator for DOP.

“I can invest in opportunities here directly, and other people can too,” Wilson says. “I don’t have to fly, I don’t have to go to New York or LA.”

But that proximity is about more than logistics. It’s about access to the people actually driving value.

“Having created value directly for my shareholders,” Wilson says, he wants to know the management team, see operations firsthand, and stay engaged. “We need to be able to drive to the CEO or whoever’s running the value creation.”

Carter frames it as a fundamental truth of investing: “Anything you do, the further away you get from the center, your risk increases exponentially.”

The partners’ philosophy around geographic focus and hands-on involvement has guided DOP from day one. But it’s their decades-deep networks across North Texas, built over the years as entrepreneurs, investors, and dealmakers, that set their strategy apart.

“Three-plus decades of getting to know people—and getting to know the people who know people—is what makes the difference,” Carter says. “In Dallas, we’re one degree of separation from the right decision-makers.”

Calvin Carter [Photo: Michael Samples]

Doing business the Dallas way

At its core, Dallas Opportunity Partners is built on relationships and trust—a distinctly Dallas approach to investing, Wilson says.

He describes it as a karma economy: “I help you out, you help me out,” he says. “We like each other, we trust each other, and opportunities naturally come from that. In other places, everyone tries to put a fee on helping you out.”

That trust-first culture shapes every part of how DOP operates—from evaluating deals to partnering closely with founders and leadership teams. It’s rooted in the founders’ decades-deep connections and a shared investment philosophy shaped by experience.

“We can quickly qualify someone’s integrity, their long-term thinking, and whether they approach business as win-win or winner-takes-all,” Carter says.

That insider advantage, he adds, is what makes DOP especially valuable for investors outside North Texas—those without boots on the ground or long-standing relationships in the region. For them, DOP offers something few firms can: authentic insider access delivered by operators who’ve actually built, scaled, and sold companies themselves.

Even the firm’s branding nods to its Dallas roots. Its logo is a knowing wink to the iconic ’70s TV series Dallas—which became shorthand around the world in the ’80s for ambition, wealth, and Texas grit. But unlike the oil-soaked drama of the show, DOP is focused on building, not backstabbing—committed to long-term value and investing in the place that helped shape the founders’ success.

“I don’t think I would have produced what I produced anywhere else,” Carter said. “Everyone talks about this place being special, but I’ve lived it. I have tangible proof that North Texas isn’t just a little bit special—it’s very special.”

Dallas Opportunity Partners, left to right: Bob Bennett, Derek Wilson, and Calvin Carter [Photo: Michael Samples]

From founders to funders

“Dallas isn’t a black box or an enigma wrapped in a riddle,” said Carter, who moved to Dallas about 35 years ago to attend SMU and never left. “But if you haven’t lived here for years, built companies here, or been part of the professional organizations, you’re not going to know what the good and bad deals are.”

After years of investing individually through their own family offices, the partners realized they could pool their hard-won local knowledge—and help others invest more successfully.

“We realized we could help people invest here more wisely, with better results and less risk,” Carter explains. As Wilson puts it: “Everyone should be investing something in their own backyard.”

Together, the three founders of Dallas Opportunity Partners bring nearly a century of combined operational and investing experience—and a shared track record of spotting opportunities ahead of the curve.

Derek Wilson

Wilson didn’t plan to be a tech entrepreneur. He started his career in finance, moving to Dallas from Washington, D.C., and working in the field at Crescent before shifting into private equity and strategic planning for The Walt Disney Company. He would later become a founding investor in Optic Gaming, long before esports made headlines.

But the late ’90s pulled him toward the future. In 1998, Wilson co-founded a data center company—1-800-Hosting—with a classmate from Duke’s Fuqua School of Business. “It was a great cash-flow business,” Wilson says. The company rebranded as NeoSpire and pivoted to managed services, running for nearly 15 years before its exit in 2012.

After NeoSpire, Wilson focused full-time on direct investing—backing ventures in technology, real estate, and finance. His evolution from entrepreneur to investor ultimately led to the creation of Dallas Opportunity Partners, where he saw a chance to take more control of his returns and help others do the same.

“I wanted to participate at a different, higher level,” he says. “It feels really, really good.”

Calvin Carter

Carter’s career has been built on instinct—seeing what’s next, then moving fast.

Long before Bottle Rocket, he was deep in the dot-com boom. In the late ’90s, he co-founded Luminant Worldwide, an early internet consultancy that went public in 1999. “Back then, we had what I call ‘poof IPOs’—before SPACs, companies would be cobbled together and taken public at hyperspeed,” Wilson adds, recalling the era.

That early ride taught Carter how to navigate rapid growth, shifting markets, and big exits. So when Steve Jobs opened the iPhone to third-party developers in 2008, Carter didn’t hesitate. He launched Bottle Rocket the very next day.

The mobile app studio went on to develop more than 500 digital products for major brands like Disney, American Express, and Coca-Cola. Under Carter’s leadership, Bottle Rocket became the most awarded iOS developer in the world—earning four Apple App Store Hall of Fame awards (no other company has won more than one). The company grew 94% annually before being acquired by WPP, where Carter continued to scale it another 300% before stepping down in 2022.

Since then, he’s pursued a blend of business and curiosity—dabbling in algorithmic trading, astrophotography, and scientific research in West Texas.

“I like to tinker,” he says. “If something interests me, I dive deep.”

Bob Bennett

Bennett hasn’t worked for anyone else since business school—and never needed to.

Since earning his MBA from USC, he’s spent his entire career building, buying, scaling, and selling small and mid-market companies. “He’s always done his own private equity deals,” Wilson says.

A buyout specialist with an entrepreneurial streak, Bennett has focused on industries often overlooked by tech-driven investors: manufacturing, infrastructure, distribution, and services that keep the physical world moving.

As founder and CEO of First Lexington, LLC—a private equity sponsor firm based in Dallas—he’s spent 25 years building platform companies through a mix of organic growth and bolt-on acquisitions. Beyond private equity, he’s also a founder: Bennett co-launched CultureMap, a digital lifestyle media company that expanded into multiple markets before being acquired in 2015.

His edge is precision. He knows how to structure a deal, manage capital, and scale operations without unnecessary overhead.

“When you’re dealing with other people’s money, you’ve got to be detailed,” Carter says. “Bob is excellent at that—he understands structure, governance, and how to set businesses up for long-term success.”

The operators’ edge

The partners’ deep Dallas networks—cemented through groups like Young Presidents’ Organization (YPO) and decades of building businesses in the region—give Dallas Opportunity Partners a competitive edge.

“We have all these people creating value here, right now,” Wilson says. “We’ve all grown up together, and we all know each other.”

Those relationships are hard to replicate without decades spent operating in North Texas.

Dallas Opportunity Partners, left to right: Bob Bennett, Derek Wilson, and Calvin Carter [Photo: Michael Samples]

“It’s unusual to have three operators as partners,” Carter says. “Most investment firms are run by finance professionals—maybe one entrepreneur. We’re hearing investors say, ‘We’ve never seen a group like this—operators who’ve actually started, scaled, and sold successful companies.’”

That shapes how they invest. “Very few investors have actually built companies in a growth fashion versus just maintaining them,” he adds.

At DOP, the partners say that combination—direct investment experience, strategic deal structuring, and hands-on operator know-how—sets them apart.

“It’s a different model,” Wilson says. “And we’re just getting started.”

“We’ve seen what it takes”

“We started businesses literally out of our living rooms with two pennies to rub together,” Carter says. “We’ve seen what it takes to scale something real—to add value not just to customers but to employees and the community.”

That hands-on experience shapes how the partners evaluate opportunities and support the companies they invest in. Looking through an operator’s lens, Carter recalls a recent meeting with a founder where the conversation quickly moved beyond numbers.

“Instead of just talking about the deal and money, we said, ‘You’re operating a wonderful business here. Operator to operator—what’s working? What’s not? What obstacles have you been unable to remove?’” Carter says.

That approach gets beyond the usual investor-founder dynamic. “We come away looking at each other as real partners in growing the business. It’s operator and operator—we just happen to be the ones providing the funding,” he says.

DOP’s role isn’t to run the companies it invests in—it’s to help them grow.

“We have intense respect for the leadership teams,” Carter says. “We offer support, remove roadblocks, open doors—providing all the things you want from a partner, without the things you don’t.”

The building blocks of a novel investment framework

“I don’t know of anyone else doing exactly what we’re doing—especially focused on the opportunities we’re targeting in North Texas,” Carter says. “Maybe they’re out there, but we haven’t found them yet.”

When the founders first began structuring Dallas Opportunity Partners, they assumed they’d find plenty of firms blending elements of the endowment model, private equity, and direct investing.

“I was certain we’d find at least 20 firms doing this,” Carter says. “But we didn’t.”

Their model emerged from a set of frustrations they’d each experienced as investors. To understand what needed fixing, Wilson spent more than a year canvassing family offices at Old Parkland—digging into the pain points, limitations, and structural hang-ups that kept capital from flowing the way it should.

A fresh approach

“It’s amazing how little freedom we have in traditional investing,” Carter says, “and how powerful it is when you get that freedom back.”

At the core of DOP’s model is what they call the Quadrant framework—a methodology Wilson developed and refined over time. Rather than classifying investments by asset class alone, DOP evaluates opportunities through four lenses, something Wilson calls the partners’ “secret sauce.”

“Instead of focusing on asset classes, we analyze opportunities based on Quadrants—how we access them, who’s behind them, and where we can add value,” he says.

Derek Wilson [Photo: Michael Samples]

How unique is the model?

DOP doesn’t claim to have reinvented investing. Wilson and Carter are clear on that. But they also haven’t found another firm structuring things quite like this.

“Nothing is brand new,” Wilson says. “But these are all things family office investors find very attractive—and no one’s really put it together like this.”

Carter assumed they’d find plenty of firms doing something similar. But after real research, they didn’t. “I’m sure someone out there is doing any one or two components,” he says. “But I haven’t found anyone doing all of them.”

It’s not just the structure that sets DOP apart—it’s the combination: endowment-style diversification, direct investing, and exclusive access to Dallas deals.

“We built this as something we wanted for ourselves,” Wilson says. “It gives investors control. They can be all-in on the fund or pick individual deals that make sense for them.”

The system allows DOP to keep an open mandate while still applying rigorous standards. “We’re agnostic about asset class,” Wilson explains, “but extremely selective about the people behind each opportunity.”

People before projects

Beyond fund structure, DOP flips the traditional investment model on its head. Instead of starting with returns and risk metrics, the partners begin with people.

“Most investors underwrite the returns, then the risk, then the people,” Carter says. “We do the opposite. We start with the person. I’d rather be in a bad deal with a good person than a good deal with a bad person.”

“We either know the person, or we know the person who knows the person,” Wilson adds. “And if we can’t get that level of familiarity, we don’t touch it.”

That local connectivity allows DOP to move fast—and build with confidence. Over decades of running successful businesses, the partners say they have cultivated a deep bench of talent.

“The three of us have worked with a lot of great people who actually want to work with us again,” Carter says. “We supported them—and in many cases, they did the best work of their lives with us. When they see another opportunity to do that, they’re interested.”

That trust pays off in execution. DOP doesn’t have to scramble to fill leadership gaps post-deal.

“We can stand up dream teams faster than if you were starting from scratch,” Carter says. “In one deal we’re closing, I think we may have already identified our CRO, our CMO, and our CFO—before the deal even finalizes.”

What’s ahead

Wilson sees Dallas Opportunity Partners growing to several hundred million in committed capital—a natural progression in a region built for high-growth investing. And he believes Dallas can support the scale.

One promising path forward? Serving Registered Investment Advisors (RIAs)—independent financial advisors who manage capital for high-net-worth clients.

“RIAs are leaving UBS or Morgan Stanley and setting up their own offices,” Wilson explains. For these RIAs—and their clients interested in the Dallas market—DOP could provide essential boots-on-the-ground access, bridging the gap between distant capital and local opportunities.

Looking further ahead, Wilson envisions broadening DOP’s reach over the next five to seven years.

“I would love to see Dallas Opportunity Partners grow into Texas Opportunity Partners,” Wilson says. “And eventually, I’d like to create ways for retail investors to participate in deals.”

Fueling the fire

Is the region ready for a platform built around North Texas? “Dallas is telling us it’s ready by presenting the opportunity,” Carter says.

It’s a place that rewards speed, conviction, and people who know how to build.

“The pro-business environment, the ‘let’s go’ attitude, the entrepreneurial spirit,” he says. “Dallas is all that—plus a million things we’ll never be able to fully articulate.”

For the founders of Dallas Opportunity Partners, the platform isn’t just an investment fund. It’s a catalyst—one designed to accelerate what already makes North Texas special.

“If what we’re doing attracts investors from outside the Metroplex, that adds capital here,” Wilson says.

Or, as he puts it: “It’s my way of fueling the fire.”

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.

![From left: Calvin Carter, Derek Wilson, and Bob Bennett, the founders of Dallas Opportunity Partners, a new Dallas-based investment platform. [Photo: Michael Samples]](https://s24806.pcdn.co/wp-content/uploads/2025/03/DallasOpportunityPartners-970_MNS5714-fullsize.jpg)