Looking to cut its greenhouse gas emissions, American Airlines is investing in new fuel distribution technology.

The Fort Worth-based carrier announced making a “strategic equity investment” in Los Angeles’ Universal Hydrogen Co., a startup developing a hydrogen fuel distribution and logistics network for the aviation industry in the U.S. and Europe.

American says the investment makes American the first U.S. airline “to make two direct investments focused on the development of both hydrogen-electric propulsion technology and the future of hydrogen distribution logistics.” (In August, American invested at least $5 million in California-based hydrogen-electric engine developer ZeroAvia.)

While terms of the deal were not disclosed, American said the investment supports its goal of meeting the Paris Agreement targets by 2035 and ultimately hitting net zero greenhouse gas emissions by 2050. The airline joined Airbus Ventures, GE Aviation, Toyota Ventures, and other “major hydrogen producers and aircraft lessors” in the funding for Universal Hydrogen.

“This technology has the potential to be a game-changer on the industry’s path to zero-emission flight,” Derek Kerr, American’s CFO, said in a statement. “Our investment in Universal Hydrogen represents a vote of confidence for green hydrogen as a key element of a sustainable future for our industry.”

Universal Hydrogen expects deliveries for regional aircraft to begin in 2025

Universal Hydrogen has previously raised at least $85 million in funding, with other backers like Mitsubishi HC Capital, JetBlue Technology Ventures, and TIME Ventures—the firm formed by Salesforce leader Marc Benioff.

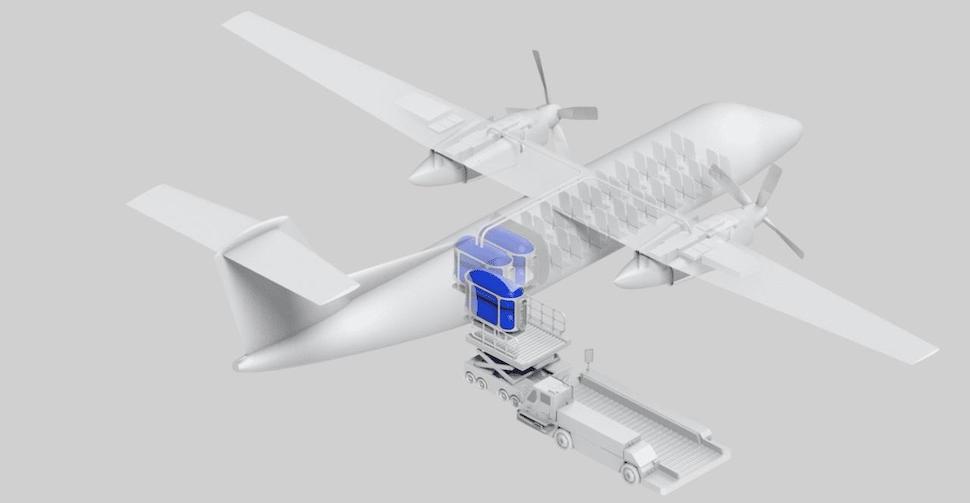

The company says it’s looking to speed up re-fueling operations while avoiding the need for new fueling infrastructure, by using modular capsules to store the hydrogen fuel that can be handled like cargo. Universal Hydrogen is also developing a powertrain conversion kit in order to retrofit existing aircraft to use the fuel. The company expects to begin hydrogen fuel deliveries targeting regional aircraft in 2025, expanding that to single-aisle aircraft to be used as a primary fuel by the mid-2030s.

American’s investment builds on Universal Hydrogen’s recent growth. Since raising a $62 million funding round last October, the company announced plans in March to invest more than $254 million and hire 500 employees over the next seven years for an anticipated manufacturing and distribution center at the Albuquerque International Sunport. If followed that up in July with the opening of an engineering design center and European headquarters in Toulouse, France.

“Together with our investors, we’re putting together the end-to-end value chain to make hydrogen aviation a near-term commercial reality,” Paul Eremenko, co-founder and CEO of Universal Hydrogen, said in a statement. “This move by American is a strong signal that customers want a true zero-emissions solution for passenger aviation and are willing to back tangible, pragmatic steps to get there quickly.”

American sees increasing revenue as it invests in sustainability

The investment in Universal Hydrogen is American’s second investment in hydrogen fuel technology since August, when the carrier invested at least $5 million in California-based hydrogen-electric engine developer ZeroAvia’s Series B funding round. That deal also saw American ink a memorandum of understanding to order up to 100 engines from the company for its regional aircraft.

American is also looking at other alternative fuel technologies. In July, the company finalized an agreement with Colorado biofuel company Gevo, Inc. to purchase 500 million gallons of sustainable aviation fuel made from refined corn—a $2.75 billion deal, the Denver Business Journal reports.

Earlier today, American announced that its Q3 sales were likely higher than previously forecasted. Expecting an increase of 10% to 12%, the company said its revenue for the three months that ended in September will be up by 13% from the $11.9 billion 2019 pre-pandemic numbers it saw same time period, according to CNBC.