Dallas-Fort Worth has assumed a position near the top of data center industry nationally, and a recent CBRE study indicates that will continue into the future.

The wholesale colocation market in Dallas-Fort Worth is as competitive as its ever been, says CBRE, which noted 17 facilities in DFW having at least 1 MW of available vacant capacity.

Dallas is one of the nation’s top three data center markets. But, CBRE said the region hit a lull in the first half of 2019, with colocation supply at an all-time high and demand lagging development.

Two large colocation deals—Social Media & Technology—were the drivers during the first half of the year, with both being absorbed in the first quarter, CBRE says. A third large deal, Federal IT, was signed in the second quarter, but it won’t be absorbed until later this year.

READ NEXT TMGCore Unveils Transformative Data Center Platform About the Size of an SUV

Tenants will find the competitiveness of the DFW market as good news, whether it is an enterprise requirement looking for a state-of-the-art, hybrid environment or a hyperscale cloud provider seeking speed to market, CBRE says. Dallas-Fort Worth’s data center providers offer many options and users are leveraging competitive supply to achieve attractive pricing and deal terms.

User-owned data center construction is still driving separate supply in the market with a Fortune 500 bank delivering a new facility in north Fort Worth, and tech giant Google breaking ground on its $600 million data center in Midlothian.

While no new buildings were delivered in North Texas in the first half of the year, CBRE says that QTS, Stream, and Equinix are under construction with their own campus expansions. And, the long-term planned pipeline of data center construction exceeds 400 MW for DFW, not including those under construction.

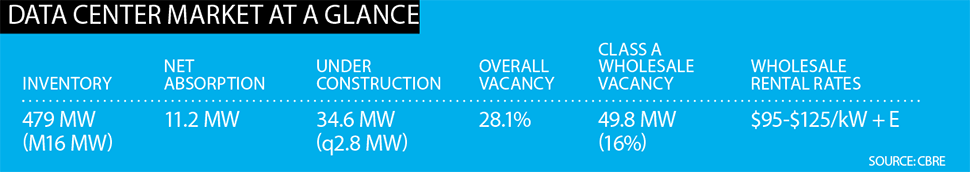

[Chart: CBRE]

CBRE reports that tenant activity picked up slightly near the end of the second quarter, but that the median deal size is well below 1 MW, and is driven mostly by local enterprise activity. Dallas continues to be a top tier market from a data center investment standpoint.

Dallas is a target market for acquisitions via sale leaseback, where users sell owned data centers, convert it into a lease structure and continue operating the center, CBRE says.

Some of the drivers for the Dallas-Fort Worth market are low power costs, abundant fiber connectivity, a low hazard-risk profile, and attractive tax incentives.

Read the digital edition of Dallas Innovates’ sister publication, the Real Estate Review, on Issuu. Sign up for the digital alert here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.