Your mistakes as a founder can lead to success, and learning from them can help you achieve success faster.

That was the central message from Joshua Boger, a keynote speaker at Pegasus Park’s July 11-13 MC | Innovate 2023 conference. As a founder of biotech giant Vertex Pharmaceuticals, Boger has lived through his share of startup challenges and triumphs.

Launched in 1989 to “transform the way serious diseases are treated,” Vertex went public just three years into its startup journey—a journey so remarkable it was documented in a 1994 book, “The Billion-Dollar Molecule.”

Boger served as CEO for over two decades, steering the once fledgling biotech company into pioneering milestones in the industry. Vertex, now a Fortune 500 company widely recognized for its work in treating cystic fibrosis, boasts a market cap of around $91 billion.

READ NEXT: Global Startup Accelerator Tapped Dallas for Its First-Ever MC|Innovate Conference

The biotech continues to push the boundaries of medical innovation. Its latest endeavor, exa-cel, is a pioneering gene-editing treatment for blood disorders, developed in collaboration with CRISPR Therapeutics.”

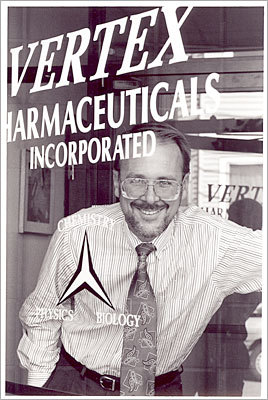

Joshua Boger

Boger, an organic chemist who studied philosophy, retired from his position as CEO in 2009 and stepped away from the Vertex board in 2017.

The founder “unretired” last month, “lured” back into biotech by Alkeus Pharmaceuticals. Alkeus, which recently raised $150 million, is working on the development of a drug for Stargardt disease, a genetic eye condition that causes blindness.

“If I don’t do this, I’m wasting the knowledge that I gained in the past,” Boger told BioPharmaDive after joining Alkeus as executive chairman.

He also has advice for founders. Just don’t expect sugar coating.

“Mistakes that led to success”

His story, he says, might be be akin to that of “every lottery winner who claims to be a math genius.” Still, Boger hopes his account of the “mistakes that led to success” can help other entrepreneurs fast-track their own paths to success.

Proving what’s possible, Boger recalls his own humble start with Vertex. There was a time Vertex had only one employee. Just me—for four months,” he said. ” I didn’t feel it was ethical to hire a second employee until I had some money. So I raised the first money by myself, with no proprietary technology or licenses.”

Joshua Boger, who founded Vertex Pharmaceuticals, remembers a time “we were too poor to have a file cabinet, so we kept everything in boxes on the floor.” [Photo: Jackie Loubriel/MassChallenge]

Boger says that when you start a company, you have to learn many new skills and face unexpected challenges. Recalling the early days at Vertex, he said, “We moved into a laboratory that used to be a car parts garage, with just one sink. We wanted to build a laboratory while still occupying the space. That’s when I learned something about sinks—water runs downhill.”

He tells the story to make a point. “I should have asked the right questions from the start,” he said. “There were many such revelations as we built the company.”

Joshua Boger, with a background as a chemist at Merck, started his own company in 1989 to make drugs with a “reasoned and strategic” approach, rather than using the prevailing “combinational chemistry” at that time. [Josh Boger via MC|Innovate]

And about those sinks? Boger needed 15 of them, with each drain pipe lower than the other. He dug deep trenches through 18 inches of concrete to make them work. While working onsite.

Sometimes even the fundamentals aren’t what you think. “Always remember to find out which category your company is in,” the Vertex founder advised.

“I thought I was starting a pharmaceutical company,” he said. “We made small molecules, made pills.” But Boger discovered that Vertex was, in fact, a biotech company. “That’s what the investors told me. So I said, ‘Okay, I am a biotech company.'”

That identity as a biotech played a pivotal role in shaping the perception of the company. Embracing it, the startup forged ahead, making an offering in “what was the worst month that entire year and had a devilish time getting it done at the bottom end of the range.” But just four-and-a-half months later, Boger says, they made a second offering at “twice that price”—and “literally had not accomplished a single thing in between.”

Vertex engineered its initial public offering (IPO) of stock at $9 per share in 1991, under the VRTX ticker.

Going public, Boger says, “is not for the faint of heart. But you’ll have a whole other group of people with problems you can solve.”

At the MassChallenge conference, Boger said eight lessons he’s learned throughout his career. Each “rule” is drawn from “about 40 years of failure,” he said. Here are his unconventional insights for startup success:

- Mission and vision are more important than detailed plans.

“I’m here to tell you, you have it exactly backwards,” Boger said. “Mission beats strategy, strategy, beats tactics, and plans are not very useful. The details of your business plan are probably the least important part of your business.” Many entrepreneurs spend too much of their time on detailed business plans, rather than focusing on their vision and mission.Drawing from his experience at Merck, Boger elaborated on the potency of a mission-driven business model. “We tried never to forget that medicine is for the people. It’s not for the profits,” he reminisced about the company’s former CEO, George W. Merck’s credo, adding, “The profits will follow, and if we remembered that, they never failed to appear.” This mission-centric approach was central to Merck’s success.

Former president and Army general Dwight Eisenhower had a similar perspective, which also valued the planning process over detailed plans. While detailed plans are useless—they inevitably change or are abandoned, because no plan survives contact with the enemy—the process of planning itself is indispensable. That’s because it forces you to engage your vision and mission.

- Be humble about your talents, but be ambitious about your aspirations.

While many entrepreneurs might be prone to boasting about being the best, the fastest, or having the most advanced technology, Boger offers a different perspective. “It’s more important to brag about what you’re going to do with your talent and assets,” he says. Small visions only elicit small support.“Do not restrain your aspirations,” Boger advised. He encourages entrepreneurs to aim for something big, something distinct from what everyone else is doing. As he put it: “I don’t want to beat all those other fish. I want to be in a different bowl, I want to have a different goal.”

Boger learned this at Vertex, whose vision was audacious: “We’re going to build a new rational approach to drug design.” That’s the reason the business plan was funded, he said.

- Don’t brag about the technology; tout the value of what you’re doing with it.

Boger warns about the trap of overestimating the immediate impact of new technologies. He points out that new technology is almost always developed “before its time.” He cites the fax machine as an example of this phenomenon, revealing that it was actually invented in the 19th century, but didn’t gain traction for business use until a century later.He highlights the importance of practical experience and patience when dealing with groundbreaking innovations. Success in the tech sphere, Boger suggests, hinges not only on the novelty of the technology but also on strategic execution. It’s about demonstrating tangible value to customers and investors, and often, a fair bit of luck.

So, Boger’s advice to entrepreneurs? Focus less on boasting about the technology itself and more on articulating the value it brings.

- Every successful innovation is partly a result of luck—and you’re going to need it.

Successful innovators actively seek luck rather than passively expecting it, Boger said, citing the role luck played in his own success at Vertex. These successful innovators remain alert to unexpected positive opportunities aligning with their mission and, as a result, often experience even more instances of luck.It’s actually a case of cause and effect, Boger said. “Following your business plan as if it was a map— you stop looking for luck. You stop looking for things that would that are unexpectedly positive opportunities that you may not have anticipated.” Don’t let it pass you by. “You’re going to need luck,” he said.

- Every business is ultimately a people business, and success or failure often comes down to the people you hire.

Rather than focusing on positions, functions, and resumes, Boger advised stressing a role’s minimum qualifications and hiring people who align with your mission and values and are interested in solving your problems. Then, it’s important to encourage interdependence and collaboration among the members of your team.Boger learned this lesson the hard way at Vertex, where he fired his first three chief medical officers because he’d hired them based on impressive resumes. “Total disaster,” he said.

For every business, the difference between success and failure has very little to do with your business plan and your technology, he says. It has everything to do with the people.

“I hear entrepreneurs say, ‘I’m out looking for a fill-in-the-blank.’ You’re doomed already,” Boger said. “You’re looking for a function.” And to put things in perspective, he added, “ChatGPT can probably perform that function.” His advice? Don’t hire for positions, hire people—people who are interested in your problem.

Boger also said that people do not come in functional units of 1.0, “especially when you’re building a business.” The focus should be on the “mission and values and adherence to values in the team and signing on to the mission that you have for the company.” Boger believes you’ll build a better team this way, and consequently, “you won’t fire as many people.” He ended on a note of caution, “Some people just working for the money is not a good thing.”

-

Sell the FOMO, not the data.

Boger offers a unique perspective to startup entrepreneurs who are in the process of raising funds. He counsels them not to sell potential investors on data alone. His reasoning? It simply won’t be convincing enough. Instead, he suggests focusing on stoking FOMO, the fear of missing out. According to Boger, selling isn’t about convincing someone to buy what you have, but about understanding and solving a problem that the “buyer” had before you entered the picture.“Do not sell data, sell fear of missing out. Data always sells at a discount,” Boger said emphatically. He added, “Almost all of the funders, especially startup funders, will do diligence until you die. They always want to see another bit of data.”

His advice? Engage with them only up to a point. “Then tell them you’ll come back when your valuation is 10 times higher, and you’ll be happy for them to invest in the next round,” he suggests. His advice is to move on and talk to somebody else.

He was clear on his stance, saying, “Don’t try to prove that you have the value you’re asking for. You’ll never do it.” Instead, he advises, prove that the value you’re asking for is a bargain compared to what you will be in the future.

- Understand the buyer’s problem and solve it.

Echoing the previous lesson, Boger said, “I’ve sold about $4.5 billion in biotech deals, but I’ve never sold a biotech deal to anybody—I just thought I did. I’ve signed some enormous deals that I thought, ‘Boy, I did a great job convincing them that we were the best partner, blah, blah.’ Then I found out that a month before, they’d had a big meeting and decided to partner with someone who would walk in their door. I just happened to walk in their door.”

“Selling is about solving a problem that someone had before you walked in,” he said. “When you’re talking with angels or venture capitalists, think: ‘What is their problem? Are they scared of losing money?’ No, actually, they’re not scared of losing money. Their business model assumes that some of their investments are zero, which is, by the way, why you’d never want to sell data because that’s very uninteresting to them. Fear of Missing Out, that’s what their problem is.”

Addressing larger venture funds, he pointed out, “you’ve got to assume that they’re scared of missing out.” Boger noted his interactions with entrepreneurs who said, “‘I talked to XYZ venture fund, and they weren’t interested.’ To them I ask, ‘Do you know what year their fund is in?’ And they say, ‘What do you mean—the year the fund is set?’ Well, you’re talking to people in a room who have concentrated funds, but they’re probably thinking about investing in fund six. Figure out how your mission and your values present a solution to their problem. That’s what sales is all about.”

- You will always need to be raising money.

That’s because you can never have enough money, Boger said. He often encounters entrepreneurs who say they’re tired of fundraising, believing they have enough to reach their next milestone. They’re wrong: “You do not have enough money to get to your next milestone. Your plan says you have enough money to get to your next milestone. I guarantee you don’t have enough money to get to your next milestone.”Never stop fundraising until you’re comfortably and reliably cash-flow-positive, he says.”Vertex raised $250 million dollars the evening that Lehman Brothers collapsed,” Boger recalled. “We raised it in two hours between 6 p.m. and 8 p.m. when the world was coming to an end. We raised it because someone would give it to us,” which, he said, is the only thing you should concern yourself with.

And what about dilution? Boger stresses that it’s not a cause for concern. “Nobody ever died of dilution,” he said. “I hear people saying, ‘I can’t take money because it’ll dilute my existing shareholders.’ I don’t care. That is not death. Nobody ever died of dilution. So just never say that. It does not matter what the dilution is, it’s nothing. You should never care a minute about dilution.”

Hearing “no” is another common founder grievance: “We went to seven venture capitalists, and they all turned us down,” he often hears. “Seven? Are you kidding me? I went to 107. I went to 40 venture capitalists in San Francisco, and not a single one invested. So then I went to another city.”

“Raising money is the easiest part of what you’re doing,” Boger said in closing, acknowledging the statement might strike a nerve with many startup founders. “So if you’re tired of the difficulty of raising money, you don’t have the guts to do the rest. You just need to get the right attitude.

“It’s hard, but if you follow my rules, it becomes a lot easier,” he said.

Feature image: Triangle_c/istockphoto]

Dallas Innovates is a media sponsor of MassChallenge MC | Innovate. This story is independently written by the author for Dallas Innovates.

The story was updated on July 26, 2023, at 11:15 p.m. with additional comments.![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.