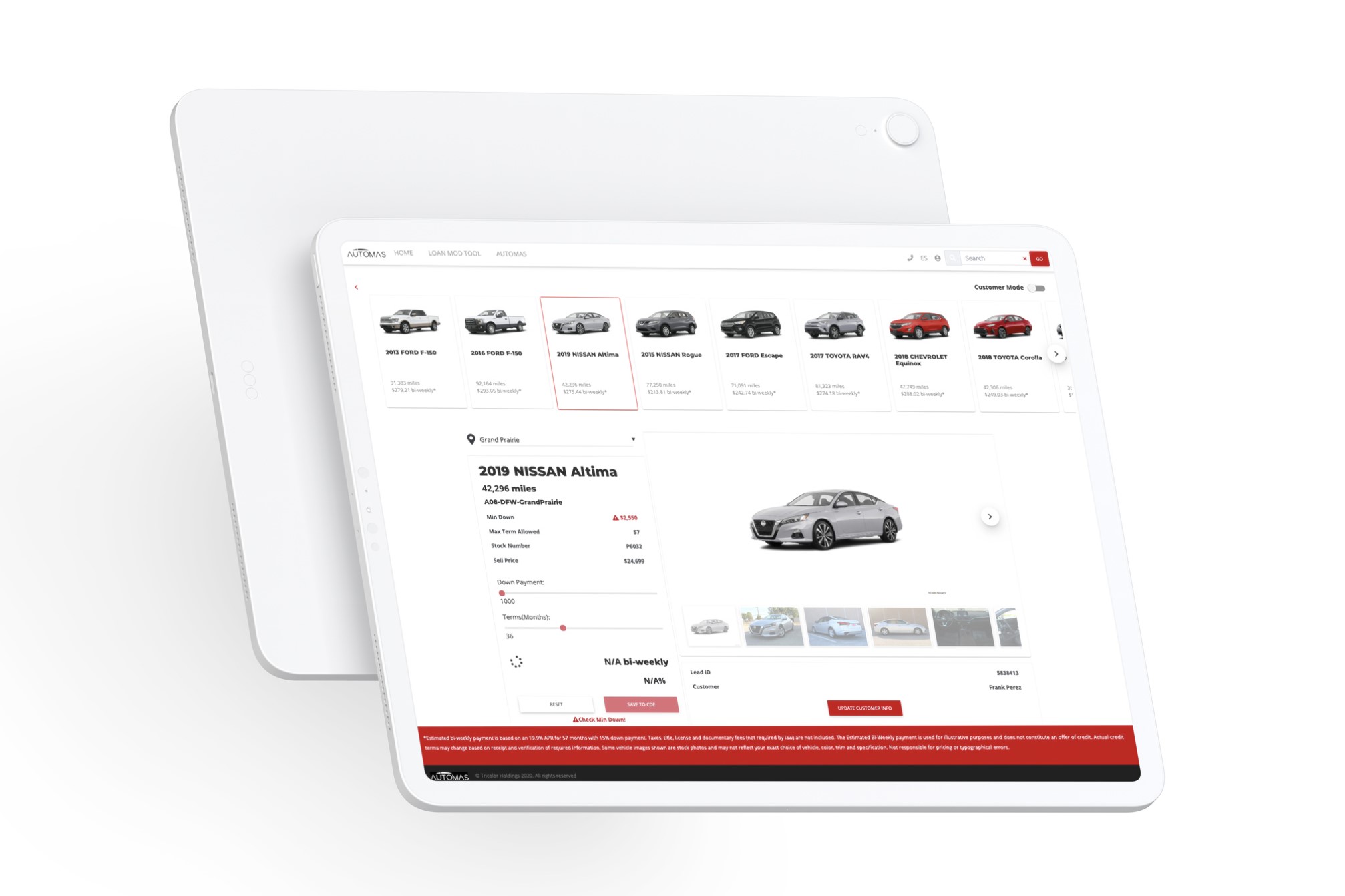

Dallas-based Tricolor, the nation’s largest used vehicle retailer to the Hispanic market, has increased its ability to help underserved consumers buy a used vehicle after securing a patent for its artificial intelligence (AI) interactive tool called Automás.

Tricolor said the new tool, U.S. Patent No. 11,574,362, leverages data across the company’s integrated platform to give historically marginalized consumers the power of self-selection when choosing and financing a vehicle from Tricolor.

“From the beginning, we’ve resolved to provide financially underserved customers, a population often subject to extremely limited options and predatory pricing, with an unprecedented premium brand experience that results in both physical and financial mobility,” Tricolor CEO Daniel Chu said in a statement. “Developed using 16 years of impactful results and more than 25 million non-traditional customer attributes, this breakthrough AI innovation powers an interactive tool that maximizes customer success, expands financial inclusion and sets customers on a path to a better future.”

While some global technology leaders and others have voiced concerns about the emergence of recent AI-driven technologies such as chatbots, Tricolor said its Automás reinforces the power of AI for positive impact.

Automás website

Escaping predatory loans

The company said that historically, financially underserved Hispanic customers have very limited options when buying a vehicle. With little or no credit history, financing for any major purchase also generally is restricted to predatory terms, Tricolor said.

For the first time, Tricolor said the Automás application gives this group of consumers the power of self-selection, utilizing machine learning to generate specific offers on both the vehicle model and the financing terms.

Consumers can customize their own financing terms — such as down payment and payment amount — by leveraging information gained in the application process and connecting precise profiles to historical loan performance and proprietary data points.

For example, Tricolor said that if a customer uses Automás to incrementally lower the interest rate by increasing the down payment, the interactive tool helps them understand the impact of increasing the down payment above the minimum amount in order to achieve overall savings.

‘The upside of fintech’

Other conventional purchase methods require separate transactions with a vehicle dealer and a lender, but Tricolor’s integrated model has a unique advantage of “end-to-end” visibility across the entire transaction because it both sells and finances the motor vehicle, the company said. That allows Tricolor to acquire proprietary data insights across the entire customer experience and illuminates behavioral insights, such as which consumer attributes closely correlate to loan performance.

Tricolor said it uses AI to understand the nuances of each applicant and optimize the terms of the transaction to achieve positive loan performance. The company said that aligns the customer’s goals with its business objectives.

“We have conviction that the upside of fintech lies in its potential to improve lives,” Chu said. “At a time of growing concern about the impact of inflation on consumers’ budgets and rising subprime delinquencies, this is a compelling use of AI for a positive outcome, empowering consumers on a path to more affordable, mainstream credit and a better future.”

Combining physical mobility and financial mobility

Tricolor’s use of technology to make high-quality, reliable used vehicles affordable to the Hispanic community has helped it achieve prominence within the fintech industry.

Tricolor, a U.S. Department of the Treasury certified Community Development Financial Institution, said that to date it has disbursed over $2 billion in affordable auto loans as part of its mission to empower underserved Hispanics and help them achieve a better future via physical mobility and upward financial mobility.

Tricolor’s recognition includes being named one of Inc. Magazine’s Best in Business for 2022 and the winner of the Excellence in Financial Inclusion Award at the 2022 LendIt Fintech Industry Awards. It also issued the first rated social bond in all of consumer ABS last year.

Tricolor and its affiliate Ganas Auto Group operate more than 50 retail hubs across 20 markets in Texas, California, Nevada, Arizona, and New Mexico with a shared services center in Guadalajara, Mexico.

The company said that on a combined basis, Tricolor and Ganas have served more than 100,000 customers and disbursed over $2 billion in affordable auto loans using their proprietary model.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![[Image: Ryzhi/istockphoto]](https://s24806.pcdn.co/wp-content/uploads/2019/02/Ryzhi_big-data-and-artificial-intelligence-domination-concept-vector-id1060622908-970x464.jpg)