The Bureau of Labor Statistics recently reported that the U.S. added 245,000 jobs in November for an unemployment rate of 6.7 percent. That comes at a time when COVID-19 cases are continuing to rise. But, according to Dallas-based ThinkWhy, despite the slow pace of economic recovery expected in early 2021, “there’s hope ahead.”

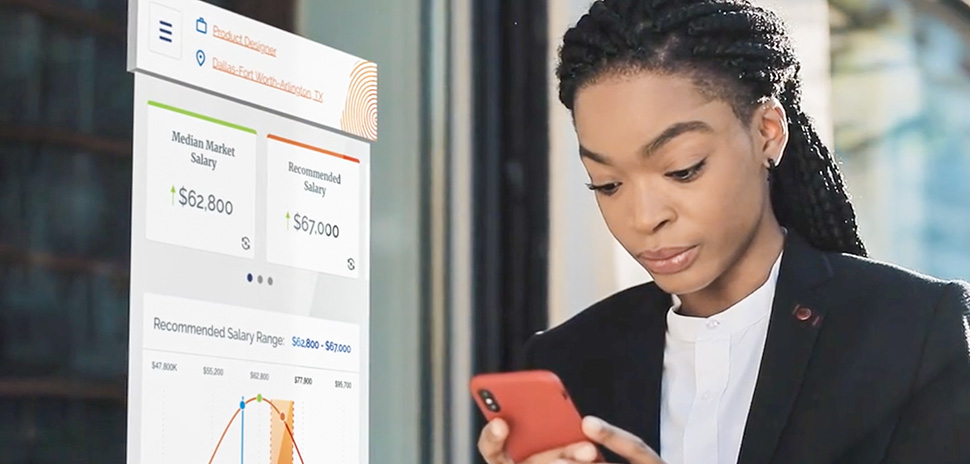

ThinkWhy’s LaborIQ, a platform that provides talent acquisition professionals with labor supply and demand to stay competitive and plan for employment costs, forecasts economic acceleration in the back half of next year. Jobs however will not be fully recouped until early 2023, LaborIQ predicts.

The newly released national jobs report from ThinkWhy is meant to show the biggest storylines to watch through early 2021 as economic recovery continues. The SaaS company, which aims to help businesses navigate the labor market, sees the rise in virus counts and colder weather as an indication that there will be a continually slow pace of recovery through early next year.

Many industries have seen flattening job growth as travel and dining remains sidelined. ThinkWhy points out that the cold weather restricts consumer behavior and certain types of employment, such as those related to outdoor activities. Winter will be a struggle for the travel and restaurant industries, for instance, since COVID-19 cases lead to restrictions.

Jay Denton, ThinkWhy’s chief innovation officer and SVP of Business Intelligence, calls the imminent vaccine availability a “ray of hope” for a major economic rebound in 2021. But, he says, businesses that rely on social contact could go months before seeing any lift in employment.

The recovery speed will remain “slow and uneven” until a vaccine is widely available.

“There is reason for optimism as we near the end of 2020,” the company wrote in a blog post. “The news has shifted from the possibility of a vaccine to conversations around logistics and prioritization of who will receive it first. While there are still plenty of unknowns surrounding the multiple vaccines being prepared, reports of wide availability in the U.S. by summer 2021 line up well with the LaborIQ by ThinkWhy forecast of an economic acceleration in the back half of next year.”

LaborIQ, which launched in February, is ThinkWhy’s first product.

Claudine Zachara, ThinkWhy’s co-founder, president, and chief operating officer, says it was built to make labor market data—previously only decipherable by economists—more accessible and affordable for all businesses.

The SaaS platform uses U.S. labor market data to give employers insights into talent supply and demand, salaries by occupation, and benchmarks for individuals and teams. It also lets employers search job roles by metro area.

READ NEXT ThinkWhy Launches its Flagship Labor Market Data Platform

“[We] saw an opportunity to build a product that connected economic and compensation planning through one intuitive platform that addresses modern roles, skillsets, and compensation models created by the evolution of technology and the way we work,” Zachara says. “That product is LaborIQ.”

LaborIQ sees the labor market back to pre-pandemic level by 2023

The 2023 prediction of jobs being fully recouped is based on the statistic that the U.S. still has 9.8 million jobs to recover from before the pandemic. Some industries will recover faster than others, and some will lag behind the 2023 timeframe, ThinkWhy says.

Its projection is based on “moderate job growth during this year’s fall and winter seasons, followed by stronger, more sustainable job growth beginning in mid-2021.”

Companies that provide professional and business services in major U.S. cities should prepare for robust hiring next year, according to ThinkWhy. The company’s economists see this industry as primed for acceleration, especially with a vaccine on the horizon.

ThinkWhy also outlined a rough timeline for other industries that could return to pre-pandemic employment levels:

• 2022: construction, financial activities, healthcare

• 2023: manufacturing and trade, transportation, and utilities

• 2024: government and mining and logging

• 2025: leisure and hospitality

ThinkWhy also sees recruitment for some businesses being more robust for others next year. The company noted that with our country’s administration changing, there could be an addition of fiscal stimulus, which might drive consumer spending.

ThinkWhy says these are the types of businesses to watch in terms of 2021 hiring:

• Finance and insurance

• Home delivery services

• Grocery stores

• Computer equipment

• Utilities

• Housing construction

• Scientific research and development

And, those jobs being filled are expected to be in a few key areas. LaborIQ reported a list of upcoming “hot hiring markets,” and Dallas-Fort Worth made the list. Others included:

• Virginia Beach, VA

• Raleigh, NC

• Los Angeles, CA

• Memphis, TN

• San Jose, CA

• Indianapolis, IN

• Birmingham, AL

• Austin, TX

• Charlotte, NC

The bottom line though is that without a vaccine, there will be some bumpy months ahead. ThinkWhy and its LaborIQ platform do indicate some economic activity toward recovery, but “the expectation of a strong rebound on the other side of COVID-19 is the baseline.”

Next year, ThinkWhy recommends paying close attention to the following:

• Timing, efficacy, and number of people who will get a vaccine,

• Impacts to industries and locations based on tightening social restrictions to contain the virus, and

• Stimulus to keep businesses and consumers afloat.

“The first vaccine recipients—frontline medical workers and nursing home residents—are unlikely to change their behavior all that much as a result of being vaccinated,” Marianne Wanamaker, a labor economist and ThinkWhy executive advisory board member, said in a release. “But the second tranche of vaccinations, older Americans and those with pre-existing conditions, are high-propensity spenders. These are the people who have largely stayed at home since March. Freeing up this group to spend and be active in the economy again will likely be a huge boom to consumer spending and business activity.

“That vaccine-induced spending should have positive job implications, hopefully by Q2 2021.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.