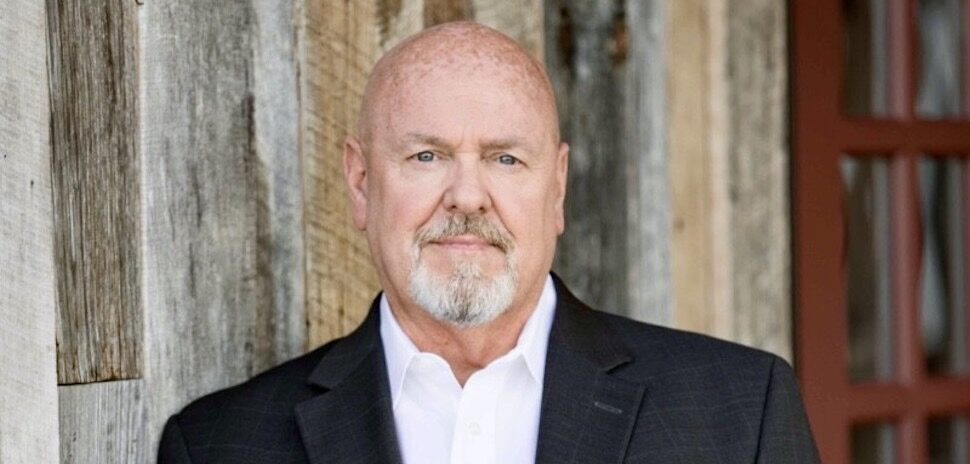

The Shadow CEO is an ongoing series with tips for entrepreneurs from serial founder and high-tech industry veteran Dennis Cagan, who has served on sixty-seven for-profit corporate boards, including ten publicly traded companies.

Many first, second, and even third-time founders get themselves into bad situations that could be avoided if they knew more about how corporate governance and equity distribution worked in early-stage companies.

![]() Whether you hope to eventually sell your start-up to a larger firm or navigate through an IPO, if you plan on taking in investors—friends and family, angels, venture capital, or strategic corporate investors—you need to understand how to protect yourself and your management team.

Whether you hope to eventually sell your start-up to a larger firm or navigate through an IPO, if you plan on taking in investors—friends and family, angels, venture capital, or strategic corporate investors—you need to understand how to protect yourself and your management team.

The segments in this ongoing series can not only save you time and energy, but they could result in making—or saving—you millions of dollars.

Equity for entrepreneurs

Before the “tech bubble,” there was a Silicon Valley joke: A sign on the counter of a local deli read, “Sorry, We Do Not Accept Cash or Credit Cards—Only Stock Options.”

Those days are far behind us, but now more than ever, stock options and other equity incentive instruments have become a common and vital element of compensation in a majority of the early-stage companies that have the objective of a liquidity event (selling the company) in their future plans. However, few compensation alternatives in today’s workplace are less understood, particularly for employees that have never experienced them, and entrepreneurs who have never provided them.

This series will discuss everything equity, from raising capital to stock options: How do you get equity in the first place? How to distribute it? How to retain it, and how to maintain long-term control of the early-stage enterprise you’re starting?

The Shadow CEO has answers for entrepreneurs.

Getting the right advice

Getting advice is always a valuable attribute for entrepreneurs, but even more important are two additional considerations: who do you get advice from and determining if you want to actually take the advice.

It may seem obvious, but all advice is not equal.

Many well-intentioned founders idealize a culture of transparency, which is admirable, especially when contrasted with a dictatorial one.

As an organization grows, however, it becomes cumbersome—even problematic—to try to extend that policy as a whole into an expanding company. Leading a company is a delicate and challenging job. Someone must make the final call.

As a CEO faced with a decision on which tech base to build your application on, would you weight the opinion of your marketing executive the same as your CTO? No. Similarly, would you weight the opinion of your CTO the same as your marketing person on a decision for the design of your company logo? No.

A marketing expert is not likely to be as qualified to advise in technology subjects as a CTO, and vice versa.

The best advisors

What do the best advisors look like? You’re looking for professionals with expert knowledge and experience in the subject that they are advising on. Would you ask your attorney for medical advice or your doctor for legal advice?

One frequent misalignment of advisors involves lawyers and accountants. Each is licensed to give advice in very specific areas—the law and financial accounting. While there are certainly lawyers and CPAs who have deep business experience, particularly if they have been practicing for a long time, however that may not be their area of primary knowledge.

Consider: Have they started for-profit companies that developed an e-commerce platform, or software, or manufactured a product, or any B2C or B2B business?

Have they built a team, struggled to make payroll, developed a product, marketed and built a base of customers and revenue—beyond their particular professional services practice?

Some of the best advice you will ever receive is to seek out counsel in the form of a board of directors, or advisory board, or simply ad hoc consultation, in the areas of business that are critical to the task of building your enterprise.

The critical core

Some examples of critical areas of advice include (alphabetically): capital acquisition, corporate governance, customer support, engineering, facilities, finance, financial projections, geographical, hiring/firing, human resources, industry expertise (specific), investor relations, leadership, legal, M&A, manufacturing, marketing, negotiations, operations, out-sourcing, regulatory compliance, risk, sales, strategy, technology, and more.

It is up to you as the entrepreneur to make sure that an advisor is truly qualified to opine on a particular subject. This is something where actual experience can out-weigh degrees like MBAs or PhDs or licenses such as legal, CPA, or MD.

Great advice is out there—often available free for the asking. In the field of entrepreneurship and building start-ups or commercial enterprises, the best knowledge comes from experience, and unfortunately, from making mistakes and learning from them. When building a company everyone makes mistakes. Why not minimize yours by learning from others?

Know what you’re missing

In 2006, I was asked to step in as the interim CEO of an insolvent but operating company. The firm was still publicly traded and Sarbanes Oxley compliant, however, the once-thriving company had suffered under the management of a major private equity-backed roll up.

On my first day, I called for an all-hands meeting in the atrium of the 250,000-square-foot headquarters building. I told the employees who I was and how I would work to get things back on track, retaining as many jobs as I could and recruiting a long-term CEO. A young man in the back of the crowd called out a question: “Sir, what qualifications will you be looking for in that long-term CEO?”

I responded: “The right person will have led a public company, a tech company, have good people skills, and be decisive.” He then asked, “Sir, wouldn’t you be looking for someone with experience in the workplace training business?”

“No, why would I do that?” I replied. Because, he quickly said, “that’s the business we’re in.”

My answer? “I’m looking at 225 people who know that business, but that does not seem to be what you’ve been missing,” I said.

The point? A business leader needs to assemble a team that covers all the key skills and experience that contribute to success. More, a leader must access and arbitrate the input from the whole team to arrive at key decisions.

Whatever the skills and experience that your team has, if you can access even more skilled and experienced counsel in the form of advisors you should always do so.

Note: The information provided in this article does not, and is not intended to, constitute legal or tax advice; instead, all information, content, and materials available below are for general informational purposes only. Information in this article may not constitute the most up-to-date legal, tax, or other information. Readers should contact their attorney or CPA to obtain advice with respect to any particular matter. The views expressed here are those of the author writing in his individual capacity only.

MORE SHADOW CEO

PART 1: Early-Stage Insights for Entrepreneurs

PART 2: Deciding to Distribute Startup Equity? Here’s a Founder’s Guide

PART 3: Using Equity as an Incentive and the Role of the Board

PART 4: What Entrepreneurs Need to Know About the Foundational Documents of a Corporation

PART 5: Equity Distribution Techniques

PART 6: Equity Beyond Stock Options

PART 7: Stock Classes and Raising Capital

PART 8: Determining Startup Value

PART 9: Explaining Common Metrics

PART 10: Calculating Share Price

PART 11: Protecting Founders and Special Voting Preferences

PART 12: Additional Equity Grants

About the author:

Dennis Cagan, a noted high-tech entrepreneur, executive, and board director, has founded or co-founded more than a dozen companies and served as CEO of both public and private companies. The venture capitalist, private investor, author, and consultant, is a long-time board member of some 67 corporate fiduciary boards. In his Shadow CEO® role, he steps in side-by-side with a CEO to help them navigate circumstances and situations on a day-to-day basis.

A version of this column was previously published in Cagan’s “A Primer on Early-Stage Company Equity.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.