Chris Rawley, founder and CEO of Harvest Returns [File photo]

“With the banking crisis and farm lending contracting, agribusinesses need flexible, creative financing, now more than ever.”

Chris Rawley

Founder and CEO

Harvest Returns

.…on his company reaching a $30 million milestone in agriculture investments.

Fort Worth-based Harvest Returns has found good soil to plant the seeds of investment success since its 2016 founding by Rawley and COO Austin Maness. The two military veterans created an online crowdfunding marketplace that brings agricultural producers together with investors, and today they announced that they’ve reaped a milestone: The company’s platform has reached the $30 million mark in funding more than 50 farms, ranches, and other agribusinesses.

In just one example from January, Harvest Returns helped Idaho’s American Beef Ranch complete a $470,000 raise for its grass-fed, grass-finished beef and lamb operation.

Harvest Returns says it has distributed over $7.1 million in returns to platform investors in its debt and equity offerings through its reported community of over 13,000 investors and more than 1,500 farms and agribusinesses.

As to Rawley’s Last Word above about the banking crisis and farm lending contracting: “Our private credit deals solve that problem for farmers and ranchers,” he said in a statement, “while at the same time providing high yield, secured income for our investors.”

The company says its investment portfolio includes “indoor controlled environment farms, early-stage agriculture technology companies, regenerative livestock operations, and other niche agribusinesses.” And it says the demand for its “curated, risk-adjusted opportunities in a compelling asset class previously inaccessible to individual investors” continues to rise.

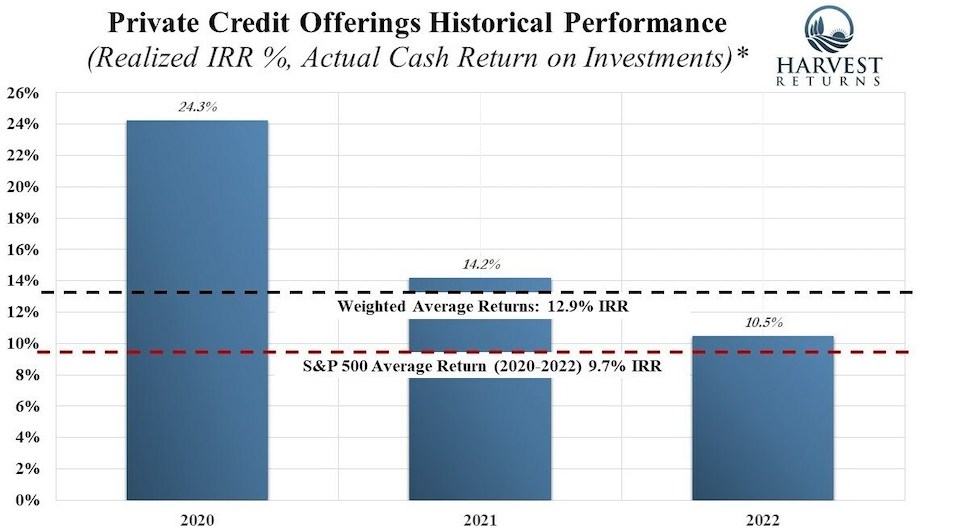

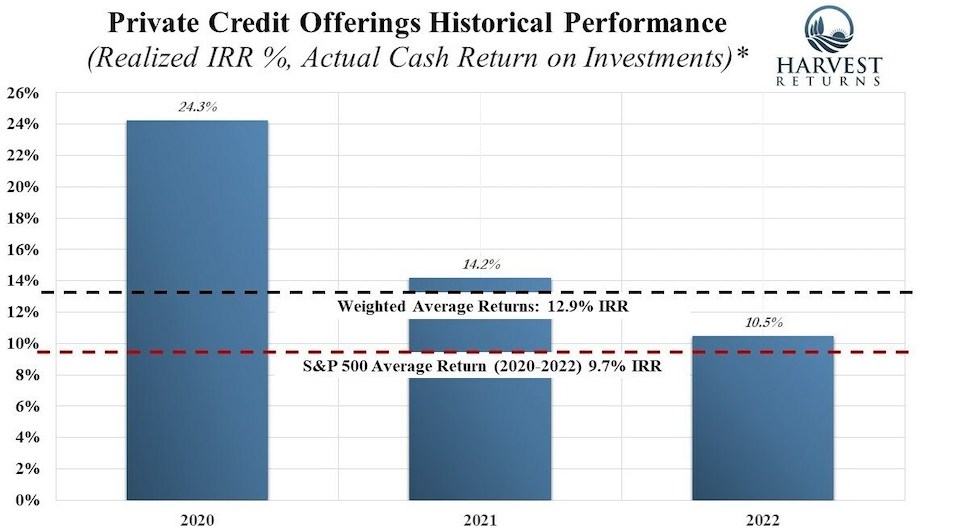

From 2020 through 2022, the weighted average returns of Harvest Returns’ private credit livestock offerings was 12.9%, the company says, bettering the average return of the S&P 500 Stock Index during the same period. [Graphic: Harvest Returns]

Harvest Returns has offered private credit investments in sustainable livestock production on its platform since 2017, and says “they remain some of the company’s most popular and successful vehicles.” The investments are collateralized with real assets, including land, farm equipment, and livestock inventories. As shown in the graphic above, from 2020 through 2022, the weighted average returns of Harvest Returns’ private credit livestock offerings was 12.9%*, bettering the average return of the S&P 500 Stock Index.

You can learn more about Harvest Returns’ beginnings by reading our 2018 profile.

For more of who said what about all things North Texas, check out Every Last Word.

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Barnstorm Agtech, a Canadian startup developing driverless robotic tractors known as 'Barnstormers,' has closed on a $217,500 equity capital raise through Fort Worth-based Harvest Returns' investment platform. The company, co-founded by a fourth-generation farmer and a robotics expert, plans to deploy 'swarms' of the tractors as a service to farmers in the U.S. Midwest and Canadian Prairies to address chronic labor scarcity and other "pain points" of traditional tractor systems.

-

After a pandemic hiatus, 1 Million Cups Dallas is back for connection, conversation, and coffee. A “grand relaunch event” for the gathering of entrepreneurially-minded people will be held both in-person and virtually on Wednesday, June 22. The weekly meetup—which has been a staple in the local startup ecosystem—consists of entrepreneurial presentations, Q&As, networking, and (of course) free coffee. The Kauffman Foundation launched 1 Million Cups in 2012, and it has since spread to more than 160 cities around the country. The name comes from the idea that entrepreneurs can meet and exchange ideas over a million cups of coffee. Connected Coworking, located at…

-

Harvest Returns, a Fort Worth-based crowdfunding platform, recently helped American Beef Ranch complete a $470,000 raise. According to Harvest Returns, the Idaho-based ranch aims to raise high-quality grass-fed, grass-finished beef and lamb. A fifth-generation rancher, owner, and operator, Jesse Nelson has worked the ranch for over 10 years giving him an advantage in understanding how and where certain improvements are to be implemented, Harvest Returns said. “There is a need to offer premium organic produce, meat, products, and forage in today's market,” Nelson expressed. “Due to certain market criteria, we would need a partner with a unique financing platform to…

-

Jerry World is still a marvel to millions, but it's not quite as cutting-edge as when it first opened in 2009. Now the Dallas Cowboys are about to do something about it, with $295 million in upgrades planned for AT&T Stadium. That's according to a report by Sports Business Journal, which says the refresh won't "radically alter" the look and feel of the 100,000-seat stadium. Instead, most of those millions will go toward refreshing premium spaces that are set for lease renewals, as well as upgrading back-end systems and technology in the run-up to the 2026 World Cup.

-

Alternative investments and capital markets specialist Marc Rucinski has joined Civitas Capital Group as head of capital markets. Civitas Capital is a Dallas-based alternative investment manager offering niche opportunities in U.S. real estate. "Marc's hiring is the latest example of Civitas' commitment to institutional-quality investment management," Heather Jones, chief operating officer for Civitas, said in a statement. "Marc brings deep experience in private equity and real estate capital markets with leading global financial institutions, which marries perfectly with our firm's growth strategy." Rucinski will focus on expanding Civitas Capital's equity and debt investor base across its target asset classes including…

![]()

![]()

![Barnston Agtech showed off its swarm farming robotic driverless tractors at the Barnstorm R&D Center in a recent YouTube video. [Video screenshot]](https://s24806.pcdn.co/wp-content/uploads/2022/12/Barnstorm-AgTech-Swarming-Robot-Tractors-970x464.jpg)