When evaluating job growth in Dallas-Fort Worth, JLL Research Manager Walter Bialas doesn’t want the impact of small- and medium-sized businesses to be forgotten.

In a recent “Snapshot,” Bialas looked at the growth of smaller Dallas-Fort Worth companies as a way to evaluate the decline in startups in recent years.

The idea that the creation of startups has significantly gone down comes from Dallas entrepreneur, developer, and author Craig Hall in his new book, “Boom, Bridging the Opportunity Gap to Reignite Startups.” Hall said the nationwide decline has been happening since the Great Recession, which is generally regarded as the period from December 2007 to June 2009. Hall asserts that the implications of this are great, because innovations from startups move and change the whole world.

READ NEXT Craig Hall on Democratizing Entrepreneurship, Being a Leader, and the American Dream

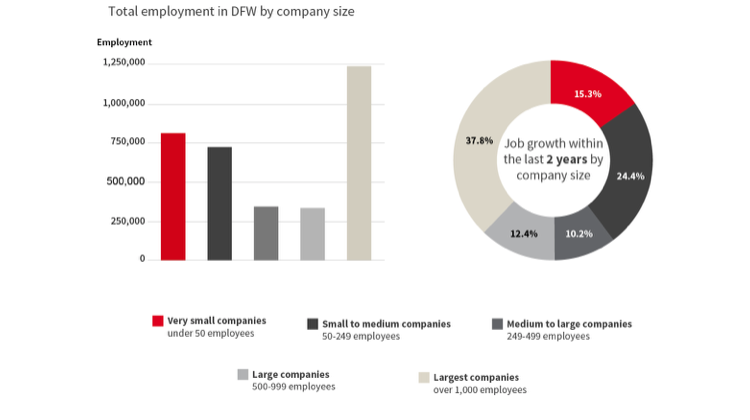

In his assessment, Bialas wrote that it’s interesting because small companies—those employing less than 250, even under 50—have seen strong growth in North Texas during the last few years, which has been a “major contributing factor to the kind of economic expansion we have been seeing.”

“While Texas’ economic growth is a contributing factor, I believe a major part also has to do with the longstanding entrepreneurial spirit that is a hallmark of North Texas,” he wrote.

Job growth is a sign of a thriving regional economy

According to Bialas, the region has been thriving, adding a significant number of new jobs every year. The highly visible large employers are obviously contributors, such as Toyota Motor North America, Liberty Mutual, and JPMorgan Chase.

But, the significance actually is with those companies that have 250 or fewer employees—which Bialas said is some 1.5 million or 42 percent of jobs in Dallas-Fort Worth’s employment base. In comparison, 46 percent of jobs in the U.S. are that size.

[Image: via JLL Snapshot]

Those companies have even surpassed their national counterparts.

Beyond that, those very small to medium-sized local companies account for around 40 percent of DFW’s job gains in the last two years, compared to 28.5 percent for the U.S. as a whole.

Bialas attributed key sectors like professional and business services, the construction trades, and hospitality and leisure as contributors to the rapid growth.

But, Bialas did note that as the number of startups decreases, it’s more important than ever to “continue to advance DFW’s longstanding spirit of entrepreneurship”—a key sentiment in Craig Hall’s book.

“I think the basis is here, we just got to keep nurturing it,” Hall said during a keynote speech in April. “First, we have to make sure that both the elected officials and the policies are apart of that. Clearly, Texas, is a can-do state,” he says. “And Dallas is a can-do city.”

In a follow-up, Bialas also referenced an essay by the Federal Reserve Bank of Dallas’ president, Robert Kaplan.

Kaplan warns that financial situations can change quickly, and he expects job growth in Texas and the nation to slow. Kaplan said that in a Dallas Fed survey, some 71 percent of companies said they are looking to hire, but 83 percent are having difficulty finding qualified candidates.

Bialas said that suggests that jobs gains will slow down.

Dallas-Fort Worth has shown that it could be more than up to the task. A recent study by the Computing Technology Industry Association, the CompTIA Tech Town Index 2018, noted that tech employment in the Dallas metro area added 9,324 jobs last year.

Dallas ranks No. 6 on the new index, breaching a Top 10 laden with big-name tech centers on the East and West Coasts, as well as fellow Texas contender, Austin. Illustrative of the region’s strength, Dallas ranked No. 3 for the number of IT job ads on the index.

Alex Edwards contributed to this report.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.