The Dallas-Fort Worth retail real estate market entered the pandemic with record occupancy numbers, and the hit from COVID-19 to date is less than the downturn during the Great Recession of 2008-09, according to a mid-year report from Weitzman, a company specializing in the Texas retail real estate market.

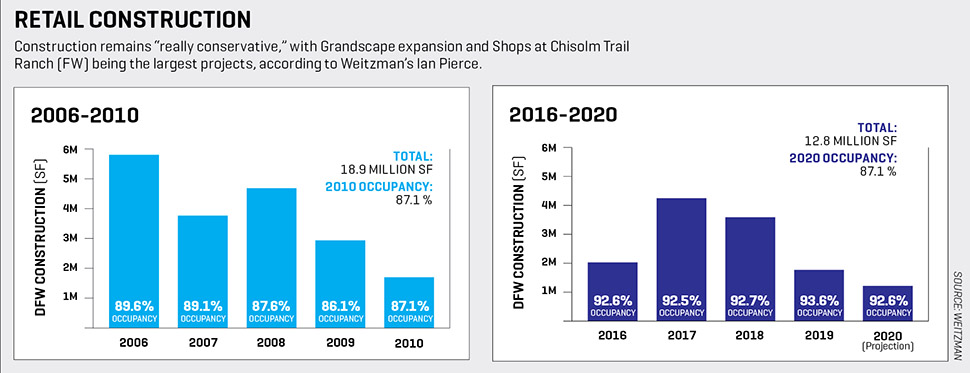

At the end of June, the overall market occupancy was 92.6 percent, down from 93.4 percent at the end of 2019. During the downturn of 2008-09, occupancy dropped to 86 percent. Since then, conservative retail construction has kept the market from oversupply. The occupancy rate is based on a DFW retail market inventory of 200.2 million square feet in shopping centers with 25,000 square feet or more.

How are retailers, restaurateurs, and retail landlords surviving the challenges of greatly reduced shopper traffic, forced closures, and reduced occupancy?

Some are taking advantage of the Paycheck Protection Program and others are working on rent deferrals and other accommodations while new retail construction has slowed but not stopped. So far in 2020, the market has taken a hit with retailers who were already struggling announcing closures.

JCPenney is closing its Music City Mall location in Lewisville, Belk closed its Dallas Galleria store in March, Nordstrom will close its Hurst location in 2021, Tuesday Morning announced six store closings, and Fort Worth-based Pier 1 Imports is going out of business, closing 14 area stores. Bed Bath & Beyond announced it is closing hundreds of stores but hasn’t yet identified local closures.

If the pandemic stretches into 2021, the region will see more closures and a further decline in occupancy, experts say. No one knows how long it will last, but the downturn could end with a vaccine or better treatment for COVID-19.

“Until that sense of safety is achieved, and consumer confidence increases, it’s up to the retail real estate industry and national, state, and local governments to help lessen the massive challenges faced by retailers and restaurants during the current pandemic,” said Herb Weitzman, executive chairman of Weitzman.

The good news for the DFW retail market is that the local population growth continues and “retail follows rooftops.” A March 2020 census report noted that the region gained more residents in the last decade than any other metro area in the country.

2020 Retail Roundup

Large regional projects opening or under construction at midyear include:

• The expansion of Grandscape in The Colony, anchored by the mammoth Nebraska Furniture Mart, featured the opening of sporting goods retailer Scheels in an impressive 331,000 square foot store. The center also added 110,000 square feet of family entertainment with Andretti Indoor Karting & Games. A 16-screen Galaxy Theatres is slated to open later this year.

• The AT&T Discovery District, a new retail component at the telecom’s headquarters in downtown Dallas, will include 65,000 square feet of retail space including restaurants and a fitness club. Originally set to open in May 2020, the project has been delayed by the pandemic.

• The Shops at Chisholm Trail Ranch in Fort Worth includes 225,000 square feet of retail space, with Ross, Old Navy, Marshalls, Ulta, and Petco recently opened.

• Gates of Prosper Phase 2 in booming Prosper will add 250,000 square feet of retail space to existing stores Walmart, Ross, Dick’s Sporting Goods, and DSW.

• Food-related retailers continue a strong showing. A Sprouts in Mesquite opened in March, a Tom Thumb is set to open later this year at Live Oak and Texas streets near downtown Dallas, and a Specs Wine Spirits & Finer Foods is leasing a 16,770 square-foot space in Cedar Hill.

• While 24 Hour Fitness and Gold’s Gym closed several locations, a number of other fitness-related businesses are opening. Fitness Connection opened a 55,600 square-foot space formerly occupied by DSW at Golden Triangle Mall in Denton. The company also leased a former Albertsons in Grand Prairie. Club4Fitness will open centers in Craig Crossing in McKinney, Valley Ranch Center in Coppell, Grand Prairie, and Murphy.

A version of this story first published in the Summer 2020 edition of the Dallas-Fort Worth Real Estate Review.

Read the digital edition of Dallas Innovates’ sister publication, the Real Estate Review, on Issuu.

Sign up for the digital alert here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.