Dallas-based Pearl Energy Investments has closed its third fund, Pearl Energy Investments III LP and affiliated funds, with total commitments of roughly $705 million.

That represents the largest investment vehicle in Pearl’s history.

“We’re thankful for the trust and support of our investors,” Pearl Managing Partner Billy Quinn said in a statement. “In what has been a challenging time for traditional energy, the Pearl team’s disciplined investment approach has allowed us to make significant distributions to our investors over the past several years. We are humbled that our diverse group of existing and new investors has entrusted us to steward their capital and will work diligently to continue to generate excellent risk-adjusted returns.”

Pearl was founded in 2015 and manages roughly $1.9 billion of cumulative capital commitments across a series of funds. It is a leading provider of equity capital and sponsorship to the North American energy industry.

Typically, Pearl said it targets equity investments of $25 million to $150 million and has led investments requiring more than $400 million.

“Our conviction in the attractiveness of the current investment environment is driven by persistent global demand, continued underinvestment in supply and limited access to capital for natural resources,” Pearl Partner Stewart Coleman said in a statement. “We have built an exceptional team at Pearl and remain focused on supporting entrepreneurs and being value-additive partners to our management teams.”

Pearl Energy Investments focuses on partnering with proven management teams to invest in the lower-to-middle market North American energy sector.

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Fort Worth-based Harvest Returns has found good soil to plant the seeds of investment success since its founding by Rawley and COO Austin Maness in 2016. The two military veterans created an online crowdfunding marketplace that brings agricultural producers together with investors, and today they announced that they've reaped a milestone: The company's platform has reached the $30 million mark in funding more than 50 farms, ranches, and other agribusinesses.

-

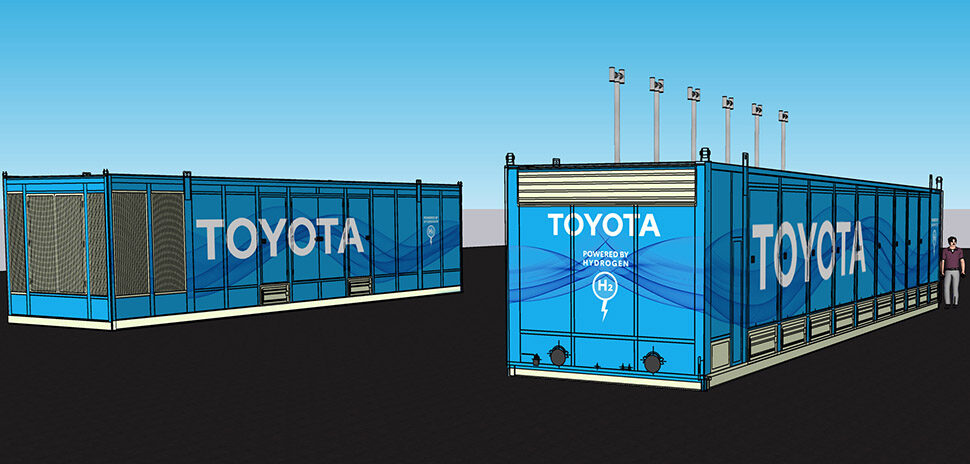

Fuel cells for cars? Think bigger—because Toyota sure is. After developing hydrogen fuel cell technology for over 25 years, mostly aimed at carbon-zero vehicles, the company is scaling up the tech for uses far beyond cars. Now it's working with the U.S. government to build a system that can add energy to the grid, power things like data centers, and more.

-

As part of a Department of Energy-backed effort, Dallas-based Southwest Airlines is investing in SAFFiRE Renewables, a new startup that aims to turn corn waste into sustainable aviation fuel. Once the product is fully tested, SAFFiRE says about 7.5 billion gallons of sustainable aviation fuel could be produced by 2040. Southwest CEO Bob Jordan calls the technology "game-changing."

-

SMU researchers aim to help address problems in the broad area of computational mathematics for sustainability—such as the management of the energy grid under intermittent renewable power. The research is aimed at developing new algorithms for materials design, bioengineering, and power grid applications. Researchers will use SMU's high-performance computing system—enhanced with an NVIDIA DGX SuperPODTM—as well as the supercomputing resources at Argonne National Laboratory.

-

Energy Transfer LP, a Dallas-based midstream energy company, will acquire Lotus Midstream Operations LLC, based in Sugar Land, for $1.45 billion in a deal that includes $900 million in cash and approximately 44.5 million newly issued Energy Transfer common units. The acquisition will add Centurion Pipeline Company LLC, an integrated, crude midstream platform in the Permian Basin, to Energy Transfer's portfolio.

![]()