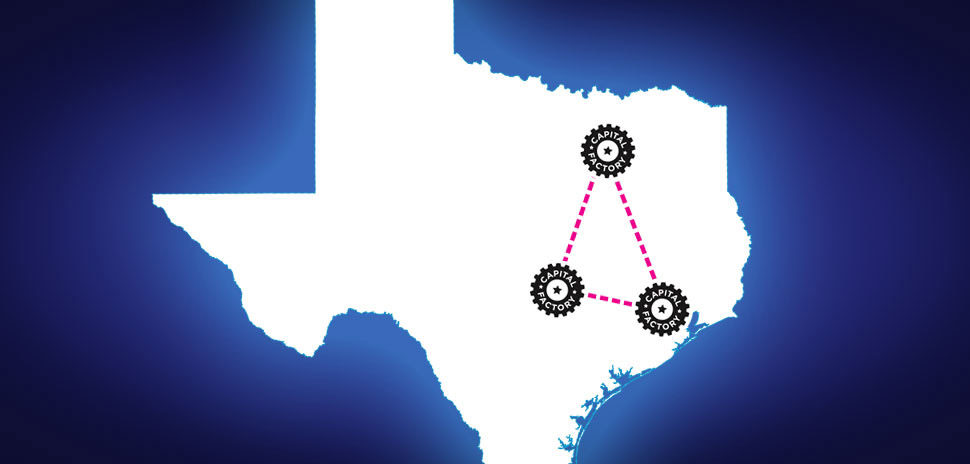

With over 3 million Texans out of work due to the COVID-19 crisis and 1.4 million Texas households under the federal poverty line, according to a statement, Rhode Island-based nonprofit Capital Good Fund is coming to the Lone Star State at a critical time.

Capital Good Fund works to help families build their credit and avoid high interest loans through equitable loans and financial coaching.

JPMorgan Chase helped bring the nonprofit to Texas through a $700,000 commitment and United Way of Metropolitan Dallas supported these efforts with a $50,000 grant.

“This partnership with Capital Good Fund will provide a boost to the financial wellbeing of hard-working people across our state,” Alice Rodriguez, Head of JPMorgan Chase’s Community Practices, Engagement, and Inclusion, said in a statement. “The support is part of JPMorgan Chase’s $125 million, five-year commitment to financial health.”

Capital Good Fund says its Texas expansion aligns with its mission to provide loans to the economically underserved nationwide. Thus far, the organization has provided over 5,800 loans totaling more than $11 million with 1,700 people having completed its Financial + Health Coaching programs, according to a statement.

A Capital Good Fund client. [Image: Courtesy Capital Good Fund]

“Our clients are people who can’t access mainstream loan products due to being low-income, having poor credit, not trusting the financial system, or other barriers,” Andy Posner, Capital Good Fund Founder and CEO, said in a statement.

Its loans can be used in a variety of cases including immigration expenses, vehicle purchases, security deposits, and emergencies. During the pandemic, Capital Good Fund has granted more than 775 COVID-19 Crisis Relief Loans.

“Our financial investment in Capital Good Fund will ensure loans are accessible to those who may not qualify for traditional bank loans and would have to resort to predatory payday and auto title loans,” Susan Hoff, Chief Strategy and Impact Officer at United Way of Metropolitan Dallas, said in a statement.

The nonprofit also aligns with one of United Way’s Aspire United 2030 community goals to make sure more North Texans are financially stable.

“In our first year in the state, we will give hundreds of low-income Texans a long-overdue alternative to the state’s payday loan industry, which charges an average APR of 661%, as well as other predatory actors—such as rent-to-own stores and auto-title and buy-here-pay-here auto lenders,” Posner said.

Capital Good Fund Founder and CEO Andy Posner [Image: Courtesy Capital Good Fund]

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.