Lantern Pharma CEO Panna Sharma has built quite the resume for himself. Sharma has played a role in four IPOs and been involved with five public companies: two as CEO, one as CSO, and two as a board member and advisor.

The latest? Sharma’s role as chief executive for Dallas’ Lantern Pharma.

The clinical stage biopharmaceutical firm, which finalized its IPO in the middle of COVID, innovates the development of precision therapeutics in oncology. At the close of last year, Sharma and his team reached a major milestone of surpassing one billion data points on their proprietary artificial intelligence platform. Lantern believes it is the most amassed by any company in the biotech sector.

Though he’s been making big moves as of late, Sharma says each of his experiences has been uniquely challenging.

He learned from the dot-com bubble. He learned how incredibly difficult it was for a small company to go public before the JOBS act passed. “I was lucky each time because it tapped into different parts of my own background,” Sharma said during a Dallas Startup Week event.

Initially, Sharma kickstarted his career in finance and consulting. He was able to see what it took to manage both private and public companies, and says he realized he had an innate passion for working collaboratively with teams. That positioned him uniquely for what he does today.

For many, a company’s transition from private to public is seen as the end goal. But in reality, Sharma says, it’s just the beginning.

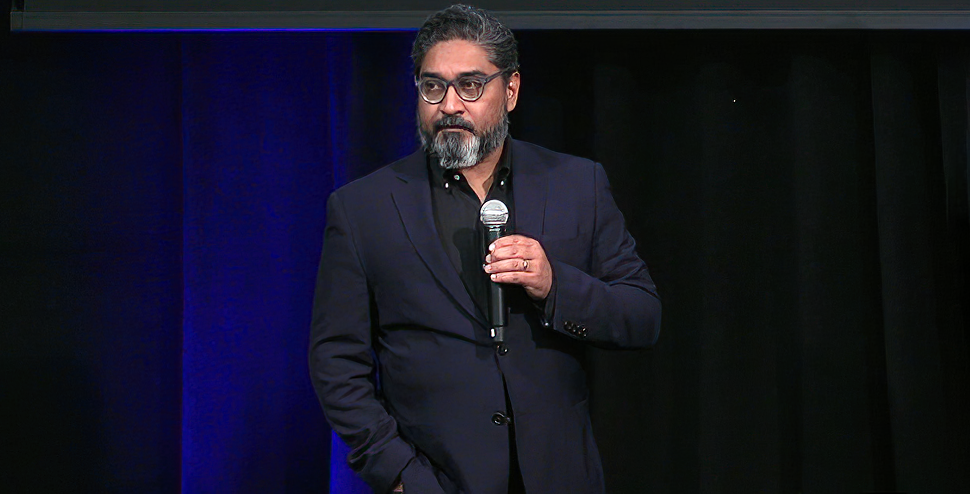

Panna Sharma — CEO, President and Director of Lantern Pharma [Photo: Lantern Pharma]

The IPO expert believes there are four phases to transforming your startup into the next public success story. Here’s what he had to say during Dallas Startup Week 2021.

1. The power of purpose

“One of the most important things when you decide to take a company public is not your VCs. It’s not your board. It’s not your desire to go public,” Sharma says. “It’s your purpose. Why are you taking the company public?”

Sharma believes it’s crucial that a company finds its ‘why’ prior to embarking on the IPO journey to avoid wasting time and money. Many boards will not initially agree on taking a company public, as it can be a challenge to secure value for investors.

Sharma asks for startups to consider the following: “Why is [going public] entering your mind? Is it that your cost of capital will be lower? Is it the timing of the market for your particular type of companies? Will you be able to attract people differently? Will you be able to advance your science faster? Will you get the attention of bigger companies to get acquired?”

Unless there’s answers to those questions, Sharma says it becomes an “aimless ambition.”

2. Building a support system

It takes a village of seasoned professionals to get the job done.

Solopreneurs trying to take a company public imposes a greater risk and liability, according to bankers, Sharma says. Companies must assess who around them are both on-board with the idea and willing to be part of the IPO team.

Sharma has found that when you go public, at least a third of your time can get consumed by the market-facing issues, taking a lot from core operations.

A great way to build the perfect team, Sharma says, is to analyze other successful companies in your sector. By finding those that are admirable, you will get a better idea of what kind of people and proxies you want on your journey.

“You have to really think about who’s supportive in this mission, because it can take a long time,” Sharma said. “There are some companies that try to take a bite at the apple two or three times before they go public. Understand who’s really supporting you and who will be able to spend time understanding and nurturing your vision as a public company.”

3. Prepare, prepare, prepare… And prepare some more.

Taking a company public may cost a lot, but it pays to be prepared.

“Every time you [IPO], it’s a little different. You have to be audited, you have to have impeccable data room, you have to have all your files in order, you have to have all your patents ready to be reviewed, you have to have all employee matters organized,” Sharma said. “Then you have to properly spend time and money with the right legal and banking team to prepare. And you have to do all this with as minimal cost as possible.”

Sharma says it can become nearly impossible to stay organized when you are also have to juggle running a company. As a CEO or founder, you have to be willing to take on two full-time jobs without missing a beat.

For instance, Sharma says if you have a meeting with your banker and they ask for patents, you should be able to forward these documents with just the push of a button.

Sharma emphasizes the importance of timeliness: “Any question that someone has, you should already have an answer.”

To him, that’s how you know someone is prepared to go public. It indicates that you’re serious; it shows your readiness.

4. Plan your milestones

Preparation also extends internally, Sharma says. This forces you to organize your business in a way that will yield milestones, because that’s what most investors care about.

Plans are nothing, planning is everything.

Interested parties will always want to know what’s next, Sharma says. Milestones look different for everyone. They can be about your portfolio, platform, investors, and many other things—they can even change. However, the key lies in communicating your expectations both externally and internally.

Externally, this allows for investors to be more confident in your company’s purpose. Proper planning should clearly highlight how and when the company plans to reach these milestones. Internally, planning a comprehensible roadmap both informs the team exactly what they need to do to work towards the company’s milestones and incentivizes them to be reached.

Failing to plan how, what, why, and when your company is reaching these major milestones is just planning for your IPO to fail, Sharma says.

Sharma suggests that companies take time intricately planning, and if at first your plan does not sound like it will work, change it—not your goal.

This article was updated on Friday, August 6 at 11 a.m.to included clarify and correct details regarding the Lantern IPO.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.