Domain at Midtown Park is a 395-unit class A multifamily community near Royal Lane and U.S. 75 in Dallas. Built in 2016 with a contemporary Spanish architectural design, it features a resort-style pool with lounge areas, a golf simulator, a co-working business lounge, a clubhouse with billiards, a spacious dog park, and more. Units from studios to three-bedrooms offer wood-plank flooring, “large soaking tubs,” stainless steel appliances, and open-concept floor plans.

So far, so nice, right? Now you can add another feature to the mix: Starting immediately, rent rates for new, qualified residents will be restricted “to create stable workforce housing,” as part of an agreement with the Dallas Housing Finance Corporation in exchange for 100% property tax abatement for 99 years.

Earlier this week, three companies based far from Dallas announced a joint venture to acquire the property, in their shared mission to increase the supply of affordable workhouse housing in the city and beyond. The companies—Newport Beach, California-based Waterford Property Company; Chicago-based Vistria Group; and Brooklyn, New York-based Northern Liberties—entered into a long-term ground lease with the DHFC for the property at 8169 Midtown Blvd.

Created by the city of Dallas in 1984, DHFC provides tax-exempt mortgage revenue bonds and other support for the acquisition, construction, or substantial rehabilitation of multifamily housing as part of Dallas’ department of housing and neighborhood revitalization.

Bringing a California workforce-focused housing approach to the heart of Texas

“Through this acquisition, Waterford is continuing its mission to pursue innovative essential housing solutions,” Waterford Co-Founder John Drachman said in a stsatement. “We’ve worked diligently over the last few years in California to build a portfolio of workforce-focused housing using a creative approach to lower costs for residents impacted by the high cost of living. Now we’re able to focus on a similar much-needed solution in Texas with our partners and the city of Dallas.”

Drachman’s co-founder, Sean Rawson, noted that rents across Dallas and the U.S. have become less and less affordable.

“As Dallas has experienced strong growth over the past 10 years, its rents have continued to climb, like many across the country, and the city is dealing with affordability issues,” Rawson said in a statement. “The cost of housing has gone up as much as anywhere in the United States and police, teachers, and other essential workers are the ones who are at risk.”

“This is just the beginning of our focus on Texas and the opportunity to be part of the solution to bring more affordability into the market,” he added.

A mission to help ‘people prosper’

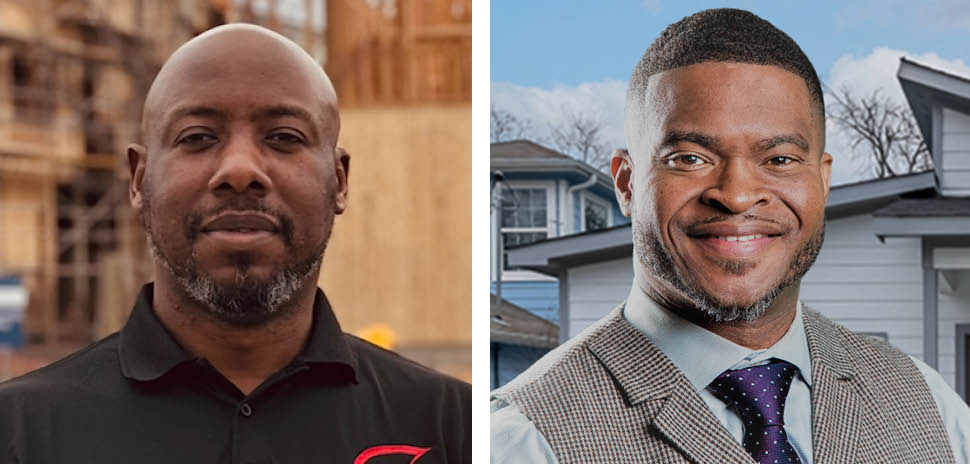

Northern Liberties Co-Founder and CEO Sharif Mitchell said his company’s entry into the Dallas market “highlights our investment thesis to acquire well-located assets in high-growth markets where we can create or preserve workforce and affordable housing. Our mission is to create housing stability while providing year-round services that empower our residents. By acquiring properties, investing in people, and creating community, people prosper.”

Margaret Anadu, senior partner and head of real estate at The Vistria Group, said that creating more affordable housing is “a crucial element in building more resilient households and vibrant communities,” and that helping to make it possible is “core to our investing and impact philosophy.”

“We’re thrilled to partner with Waterford Property Company and Northern Liberties to ensure housing is affordable at Domain for years to come and look forward to working alongside our community partners to deliver essential services to our residents,” Anadu added.

The companies said the community’s current tenant base is comprised primarily of moderate-income workforce employees and families. Moving forward, the joint venture will restrict rents at the property by setting aside 51% of the units for residents who make 80% average median income, 39% of the units for families who make 140% AMI, and just 10% of the units at market rate.

Freddie Mac provided debt for the transaction through Walker & Dunlop.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.