You’d think a pandemic would keep hospitals hopping. But fears of infection postponed both elective and routine procedures, keeping beds empty nationwide. PPE and safety procedures raised operating costs. Then the rent came due.

Despite all those challenges, Lance Hardenburg sees a cure at the end of the tunnel. As healthcare rebounds, his company’s medical office acquisition fund is poised to seize opportunities.

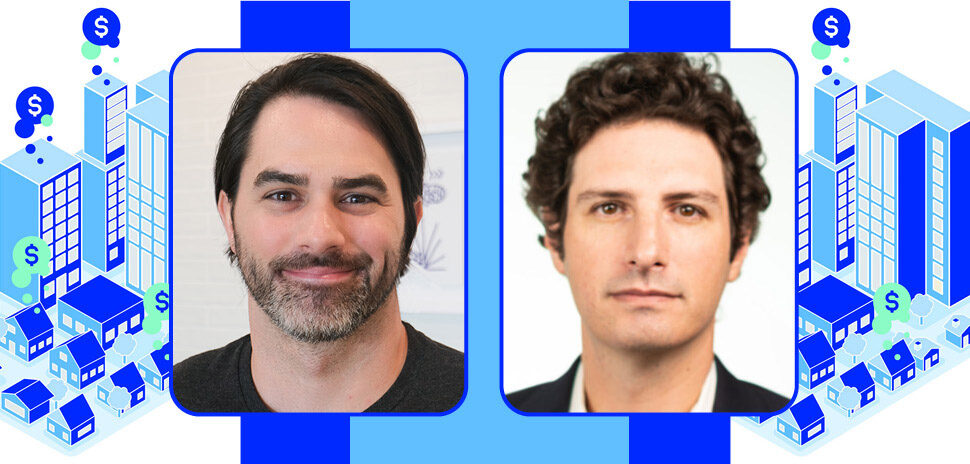

Hardenburg, the managing partner and CEO of Caddis Healthcare Real Estate, is among the experts in our commercial real estate feature, “21 On 2021.” He shares his outlook on what’s next in a Q&A.

What opportunities and challenges do you see in healthcare real estate?

What opportunities and challenges do you see in healthcare real estate?

Financial pressure is expected to continue through 2020 for physician groups, health systems, and other healthcare real estate tenants as a result of the COVID-19 pandemic. Patient numbers are down due to patients’ safety concerns and also the impact of government shutdowns at the local and state level. Government shutdowns impacted routine examinations and procedures, along with “elective” surgeries for any condition not deemed life threatening. In short, our healthcare tenants were dealt a significant blow to their normal revenue stream. In addition, healthcare tenants saw their operating costs increase, including costs from outsourcing care providers hired to address staffing shortages and higher patient care costs for PPE and other safety procedures implemented in response to the virus.

Given those headwinds affecting our tenants, owners of healthcare real estate received numerous requests for rent relief, especially in the early stages of the shutdown. As federal assistance began being distributed, the number of requests decreased, however, short-term cash flow has been impacted, as Caddis and many other owners agreed to defer rent to later this year or even the following year. The combination of government assistance and some level of landlord relief certainly helped healthcare tenants address short-term impacts on their business. The long-term outlook remains very positive, as healthcare was one of the industries showing the quickest and strongest recovery. Tenancy remained strong in our medical office portfolio, and we experienced positive absorption even during periods when many of our healthcare tenants were closed due to local or state shutdowns.

What changes in the healthcare industry brought on by the pandemic do you expect to last long term?

Many changes that started prior to this year have been accelerated by the impacts of the pandemic and are likely here to stay. Facility design changes will be seen in the forms of enhanced telemedicine technology and usage, improved air-quality advances, increasingly adaptable space design to handle critical patient overflow, and additional outpatient facilities to reduce hospital patient density. We predict that the healthcare employment sector will experience positive gains and also that new policy and delivery model changes will influence strategic and capital plans.

How are you handling those changes and uncertainty in your business?

Despite the multiple changes put into motion, healthcare continues to benefit from demographic-supported demand and the priority that the population places on receiving excellent healthcare. As a developer, acquirer, and operator of healthcare real estate, Caddis continues to seek opportunities to partner with physician groups and health systems, whether through acquiring existing medical office buildings or developing buildings in coordination with our physician and health system partners. We can offer liquidity to physician groups and health systems by way of sale-leasebacks and/or development capital and expertise for groups in need of new assets to broaden their footprint.

What current or upcoming projects are you excited about?

We launched our first medical office acquisition fund, Caddis Acquisition Fund I LP, in late 2017 as part of Caddis’ overall strategy of focusing on long-term ownership and capitalizing on the many opportunities available in a robust medical office market. We’ve been pleased to see that our medical office portfolio has been resilient in the face of pressures from the impact of the pandemic on our tenants and the severe impacts to the economy resulting from government shutdowns. This has confirmed Caddis’ expectations and prior experience as to the reliability of medical office investments, which continue to perform well in difficult economic times. We expect the fund to be fully deployed early in the fourth quarter of this year, having approximately 30 medical office assets. As we complete our first fund portfolio, we plan to move our focus to planning and fundraising efforts for our next medical office acquisition fund later this year.

The interview has been edited for brevity and clarity. A version of this story first published in the Fall 2020 edition of the Dallas-Fort Worth Real Estate Review.

Sandra Engelland contributed to this report.

Read the digital edition of Dallas Innovates’ sister publication, the Real Estate Review, on Issuu.

Sign up for the digital alert here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.