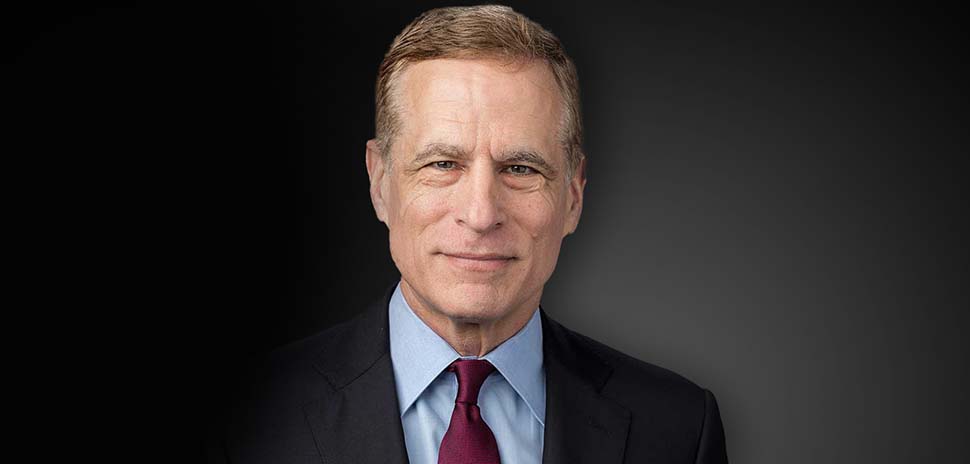

Former Federal Reserve Bank of Dallas President and CEO Robert Kaplan has joined New York City-based Star Mountain Capital LLC as senior advisor.

Kaplan is bringing his more than 40 years of investment management, business management, monetary policy, investment banking, and leadership experience to the specialized investment firm.

“We’re honored to have Rob join Star Mountain as an aligned senior adviser bringing extensive investment, strategic leadership, business management, and governance experience,” Star-Mountain Capital founder and CEO Brett Hickey said in a statement. “Having met Rob in 2009 as a student of his at Harvard Business School where I attended a CEO leadership program, it is a gratifying reflection, and we are excited for the future where Rob can also have an impact in building leadership best practices with our portfolio companies.”

The firm said it has one of the largest teams focused on investing in established, profitable, small, and medium-sized private U.S. businesses representing about 50% of U.S. GDP.

“There are many needs and opportunities to support established, growing private businesses, which is something I am excited to support,” Kaplan said. “It is a pleasure to join friends and former colleagues as part of Star Mountain’s team. The firm’s core values, including alignment with investors and with each other, was an important consideration for me.”

Beside Kaplan’s role at the Federal Reserve Bank of Dallas, Kaplan was vice chairman of Investment Banking and Investment Management Divisions of Goldman Sachs, and professor and senior associate dean of Harvard Business School. He also was interim CEO and board member of the Harvard Management Co., chair of the Investment Advisory Committee of Google, member of the Investment Committee and trustee of the Ford Foundation, and board member of State Street Corp.

Currently, Kaplan is co-chairman of the Draper Richards Kaplan Foundation, a global venture philanthropy firm that invests in developing nonprofit enterprises dedicated to addressing social issues. He is a member of the advisory council of the George W. Bush Institute, an advisory board member of the Baker Institute, a board member of Harvard Medical School, and serves as chairman of Project ALS.

He is the author of three books on leadership.

Star-Mountain targets systematic alpha and low market-correlated returns for its global institutional and high-net-worth investors. With roughly $4 billion in assets under management, Star Mountain takes a data-driven approach to investing in the North American lower middle market through two complementary investment strategies: direct debt and equity investing and in secondaries (acquiring LP interests and direct assets and making primary LP commitments).

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.