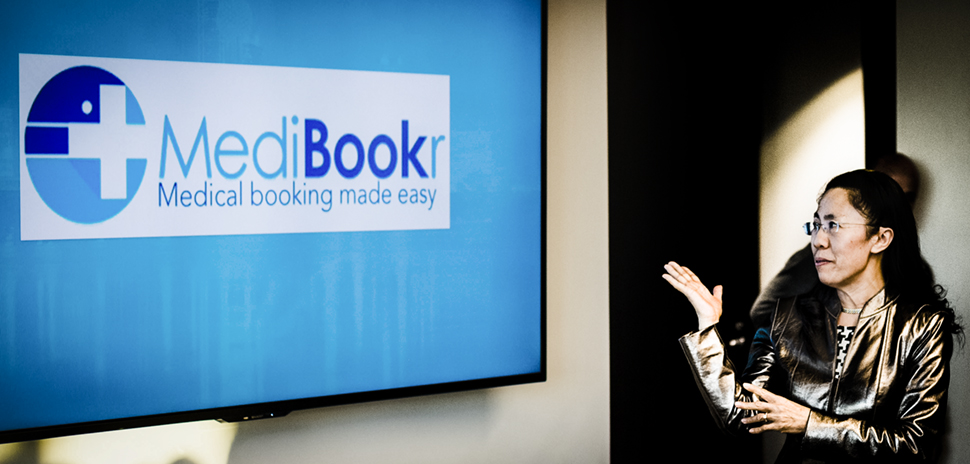

ANGELS INVEST $675,000 IN DALLAS-BASED MEDIBOOKR

MediBookr, the Dallas-based health-care shopping platform, raised $675,000 in seed funding that will go toward product enhancement and client support.

The MediBookr website and mobile app allows users to search for and find health-care providers’ profiles, including price and ratings, shorten the search result list through digital filters, compare them, and then book with the best providers.

Founder and CEO Sunny Nadolsky said the investment came from individual angel investors, who besides funding, also brought the company a “network of potential clients” through their connections.

“Now, we are on to the VC round,” Nadolsky told Dallas Innovates.

Last year, the Health Wildcatters graduate was recognized by Premier Inc. as one of the top “groundbreaking” health-care companies in the nation, and in 2016, it was the winner of Southwest Airlines’ Soar to Success Business Pitch Competition.

GRAPEVINE COMPANY GETS $55 MILLION IN SERIES C RAISE

defi Solutions, a Grapevine-based provider of lending industry software, raised $55 million in Series C funding, with an investment of primary and secondary capital from Bain Capital Ventures.

The company will use the primary capital to accelerate development of existing and emerging products, expand facilities and resources, and increase the number of employees by almost 50 percent in 2018. Employees will be added in the areas of technology services, client support, and sales and marketing.

defi Solutions offers its customer a configurable software-as-a-service (SaaS) loan origination system to manage their application lifecycle and receive analytics in one platform.

ENDOSTIM RAISES $12.1 MILLION FROM 20 INVESTORS

Netherlands and Dallas-based medical device developer Endostim raised more than $12.1 million in equity funding from 20 investors, according to a Form D filing. The company’s treatments include those for gastroesophageal reflux disease, which causes severe heartburn and acid reflux. Endostim is attempting to raise $25 million as part of the offering.

FILELY TO REBRAND WITH HELP OF $10,000 INVESTMENT

Dallas-based Filely received a $10,000 investment from Acupo Ventures that will be used for a major rebranding in the coming weeks.

Acupo Ventures is a pre-seed venture capital firm and said its investment is to help Filely through its rebranding period. Filely is a file sharing service similar to Dropbox or MediaFire, but provides customers with a way to create their own file-sharing ecosystems as well as features for developers.

Filely has raised $47 million in four funding rounds beginning in 2012.

FORT WORTH INVESTOR BACKS MOBILE ESPORTS PLATFORM

Skillz, a San Francisco-based mobile esports platform that connects the world’s 2.6 billion mobile gamers vis competition, received $25 million in Series C investments from five investors including Fort Worth-baed Wildcat Capital Management.

The esports provider for more than 3,000 game studios, Skillz accounted for over 30 percent of all esports prizes awarded in 2016 while broadcasting 40 million minutes of gameplay to spectators worldwide.

SQUARE BUYS ENTREES ON-TRAYS, EXPANDS DFW OFFERINGS

TechCrunch reported that Square has bought Entrees On-Trays, the 32-year-old restaurant delivery service, with plans to expand to expand Square’s on-demand food delivery service, Caviar, in Dallas-Fort Worth.

Caviar product lead Gokul Rajaram told TechCrunch that the acquisition will allow Caviar to take advantage of Entrees On-Trays’ existing relationships to accelerate Caviar’s growth in DFW.

Now, Caviar will be able to deliver such notable Fort Worth favorites as Hoffbrau Steak and Grill House and Riscky’s Bar-B-Q; Esperanza’s, a part of Joe T. Garcia’s family restaurants; and Terra Mediterranean.

No financial details of the deal were released.

READ MORE

Funding and Exit Successes

Who are those companies that are finding funding or having a big exit? We’re tracking what’s happening in North Texas in the Dallas-Fort Worth Innovation Guide.

Browse our funding and exit successes →

Raise a Round

Texas is home to every stage of capital that a growing company may need. Angel investors, family offices, venture capital, and private equity firms are looking to find — and invest in — great companies.

Explore funding opportunities →

Get on the list.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.