JUST is on a mission to rewrite the “story of opportunity” in Texas, one woman at a time.

The Austin-based nonprofit, which solely supports female entrepreneurs to create more resilient communities, has announced it’s headed north for the team’s first-ever expansion of operations.

“We have been, and continue to be, so inspired by the community here in Austin with the program that we’ve built and changes we’re seeing in our community of really deserving female entrepreneurs,” CEO Steve Wanta told Dallas Innovates. “We’ve always felt that if we figure out part of the solution, we have a responsibility to serve as many people as possible.”

Steve Wanta

Part of that, he says, eventually led to thinking about what the next Texas market would be.

“Hindsight 2020, had I known what I know today, Dallas would have been an easy decision,” he says, noting that the JUST team also explored San Antonio and Houston. “The community that has shown up to invite us into Dallas is nothing short of remarkable.”

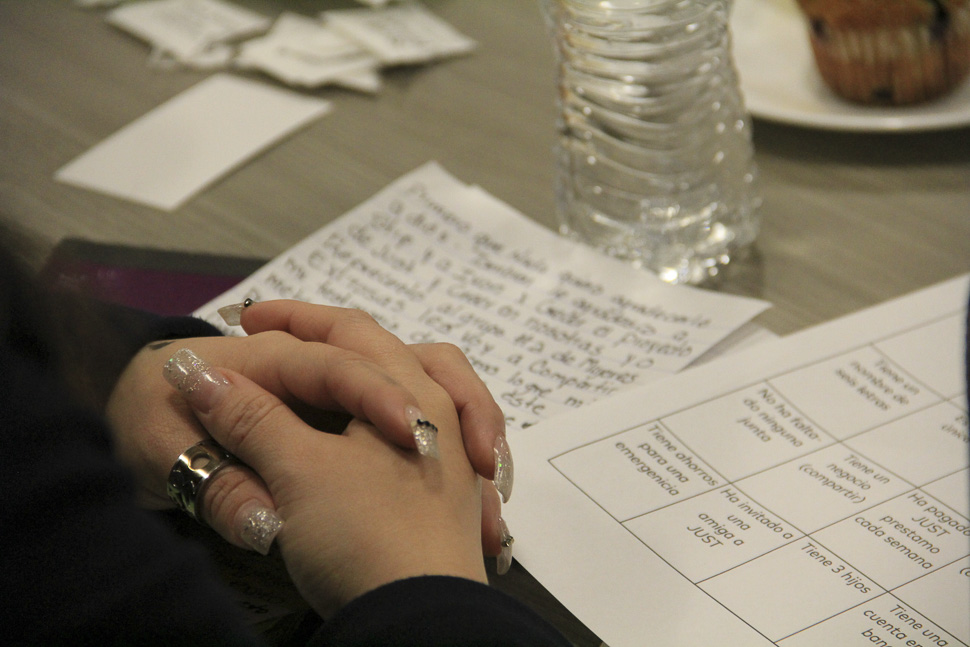

JUST provides low-income, hardworking women access to capital, coaching, and a supportive community. The intent is to alleviate poverty by helping women grow stronger businesses, build confidence, form better money habits, and increase their social capital. It’s a learn-do model: Beyond the repayment of a loan, JUST’s improved client outcomes will lead to its entrepreneurs increasing their savings.

In doing so, JUST says it hopes to move toward “a more just world.”

[Photo: Courtesy JUST]

“JUST invests in potential,” Wanta says. “We back female entrepreneurs to be leaders in their communities by providing that extra push to start or grow their businesses.”

The program is designed with real people in mind. Technology powers the 100 percent mobile solution by automating business processes, increasing transparency, and delivering a positive experience. But, at the heart of the model is the JUST Entrepreneur Trust Agent (JETA), who act as role models and facilitators to encourage others to join.

“This is very much an in-person program,” Wanta says. “Problems like poverty we believe are fundamentally human problems that require human solutions. So as much as we use technology, we think the real magic is people meeting with people.”

[Photo: Courtesy JUST]

Moving to North Texas

Wanta calls the expansion, and being located in both Austin and Dallas, “really, really strategic.”

“Dallas has already made our operations in Austin better,” he says. “It is clarity of focus today that we are going to serve thousands of deserving female entrepreneurs in North Texas and Central Texas. It’s part of proving that this work we do can happen at scale and across the state.”

The DFW move has been in the works for a while, and came to fruition in collaboration with a number of key local partners: the United Way Social Innovation Accelerator, the Embrey Family Foundation, Sapphire Foundation, Impact City, Opportunity Plus, Hirsch Family Foundation, Harold Simmons Foundation, and former members of Chiapas International.

“The first group that made it an easy decision to come to Dallas was the United Way Dallas Social Innovation Accelerator. We joined that program,” Wanta says. “That was an amazing door opener, and really a seal of approval from one of the major organizations in town. And then so many other organizations that come around, along with foundations and community partners, gave us assurance that what we were doing was in fact needed in Dallas.”

The JPMorgan Chase Foundation and The Craig and Kathryn Hall Foundation’s Bridging the Gap program also contributed significant financial commitments that will provide seed capital to future JUST entrepreneurs. Wanta says JPMorgan’s gift put JUST over the top for the funding needed to open, and The Craig and Kathryn Hall Foundation provided a grant for operations and the initial capital for the first loan.

“I believe it is critical to level the playing field in our country so that many Americans, especially women and people of color, don’t continue to face systemic barriers to start and grow new businesses,” Craig Hall, founder and chairman of HALL Group, says. “JUST’s approach to addressing this opportunity gap by investing in the unlimited potential of low-income women has had a profound impact, and we are honored to be supporting their expansion into North Texas.”

For Dallas operations, Wanta plans to hire two community directors to deliver the program in-person. He’s already hired the first one, a former JUST entrepreneur who’s now moved to Dallas to officially join the team.

As for its location—that depends on the entrepreneurs.

“In Austin, we like to think of ourselves like water. We go where there’s space and there’s openings. Because unlike a bank, we want to be where the community is. Meetings happen in many people’s homes and other meeting places that are convenient for them. We’ll do trainings at organization partners. And as we get our feet under us, we’ll continue to build relationships,” he says. “We’re really excited to be a part of the community and be an additive to all the great stuff that’s already going on. Collaborate is a central part of our philosophy.”

[Photo: Courtesy JUST]

JUST’s trust-based lending

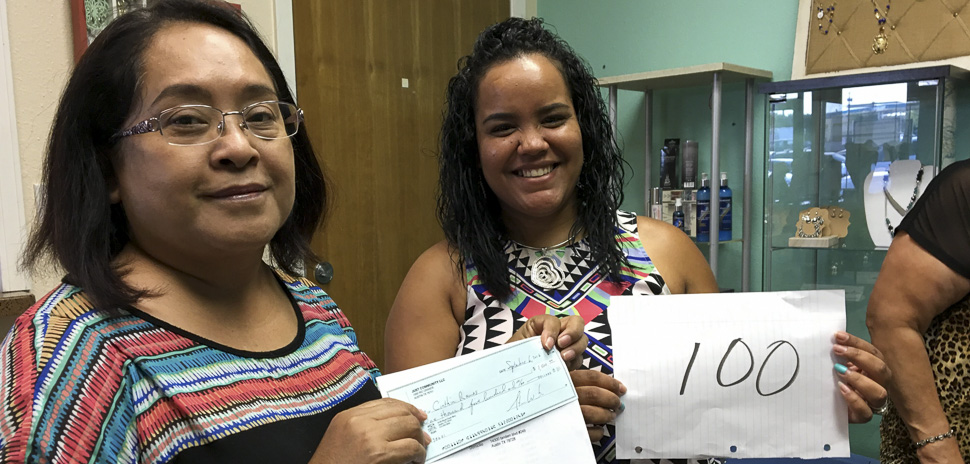

Wanta co-founded JUST back in 2016 as a spinoff of the ‘microcredit movement,’ an increasingly common approach that uses social capital to make loans based on one’s future instead of analyzing their past.

“It’s really important to make a distinction between what we think of in the United States as lending and business investing. What we really are more kin to is a ‘community organizer’ that is helping people save and earn a little bit more money by investing in a small business,” Wanta says. “There’s a model that was proven so powerful to help end poverty that it won a Nobel Peace Prize. We’ve adapted that.”

The way JUST has made its program different is by creating training for ‘active’ entrepreneurs. That means a woman is borrowing money, investing in her business, setting goals, and is part of the community.

“She then joins an eight-week leadership training program that we facilitate,” Wanta says. “This is designed to create lifelong learners and confident facilitators.” The woman can then become a JETA.

[Photo: Courtesy JUST]

JUST says 12.7 percent of people are living in poverty in the U.S. In Dallas, that number increases to 22.9 percent, with the U.S. Census Bureau citing that the majority of these people are Hispanic, African American, or female.

So in deploying trust-based lending, JUST doesn’t look at credit scores or require collateral, and has very low interest rates. Since founding, JUST has made more than 2,000 small loans to its network of 600-plus women in Central Texas, with a repayment rate of 99.3 percent. That totals more than $3.4 million.

“We realized that the program we built is powerful,” Wanta says. “Beyond repaying a loan, people are feeling in control of their lives, they are building stronger businesses, and we are seeing something really special.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.