Joseph Akintolayo says the will exists for organizations to provide more digital financial tools to their communities. But due to either a lack of technological knowhow or tight budgets, they often lack the means.

Now with $5 million in fresh funding, Deposits—the Dallas-based startup Akintolayo leads—is looking to offer plug-and-play banking features for community banks, credit unions, and other financial brands to reach more people.

“Financial services have always been a relationship business. It’s about trust, it’s about relationships. It hasn’t really been about technology until recently,” Akintolayo, Deposits’ CEO, told Dallas Innovates. “The center of gravity changed, and it presented us with an opportunity to fill this big gap.”

‘We handle all of the financial innovation’

Akintolayo co-founded Deposits in 2019 alongside COO Daniel Paramo after noticing that bigger players in the financial industry had a technological advantage over others. He also saw that many of the digital tools being developed in the financial tech space were being created for companies that already had large budgets.

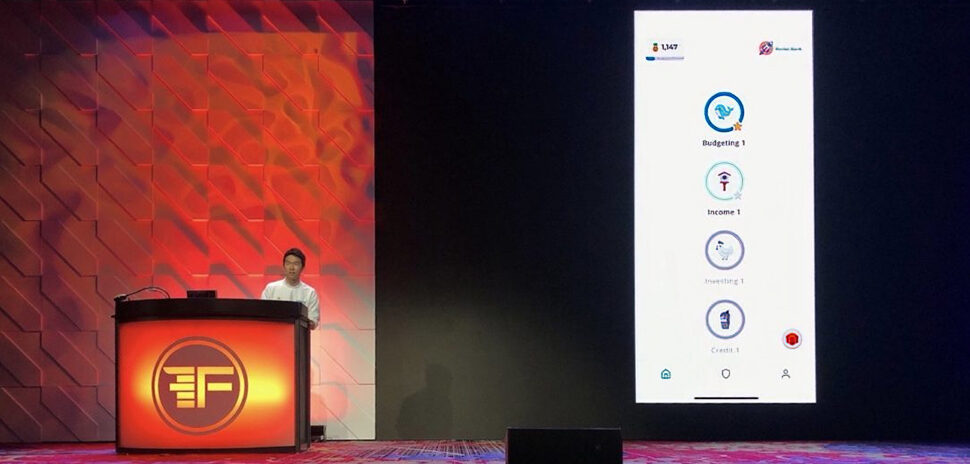

With Deposits, the two co-founders aim to level the playing field by making it easier for organizations to offer financial features. Through the company’s platform, Deposits offers what Akintolayo calls “kits”—thematic financial experiences built around common financial services customers are looking for: like money management, mobile payments, business banking, and payroll.

“We provide a set of templates and composable elements that you can use to turn into your own experience. Kind of like Shopify, Squarespace, or Wix,” Akintolayo said. “Our job is to pay attention to consumer expectations, to be as product-driven and product-led as possible. We handle all of the financial innovation, all the technology, so no one else has to.”

Already working with Visa, Mastercard, and Blue Ridge Bank

Akintolayo said Deposits’ goal is to help drive inclusivity by making digital financial solutions more accessible to those that have been historically underbanked—and to make it easier for organizations to reach them. He says Deposts does this in a streamlined way to create immediate value.

The company is already working with a number of partners, including Visa, Mastercard, and Blue Ridge Bank.

“The impact looks like saving some financial institutions from extinction; the impact looks like getting financial inclusion closer to communities,” Akintolayo said.

‘This funding is all about expanding access to financial services’

Deposits’ seed funding round was led by Austin-based early-stage venture capital firm ATX Venture Partners and joined by Cabal Fund and Lightspeed Venture Partners. With the new funding, Akintolayo said his company will build out its platform and add new services like lending to its platform, while building out its 27-person team.

Akintolayo said his team’s growth will be determined by demand. Currently, the company’s website lists 25 locally based and remote open positions in areas including product, engineering, and sales.

“This funding is all about expanding access to financial services,” Akintolayo said. “We plan to really fill that gap that remains unaddressed by the legacy banking service providers. Our platform opens the door for who can get in the game, so now all you need is a will and there’s a way. There’s still a lot of demand for embedded financial services, and there’s a big gap that’s yet to be filled.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.