Dallas-based private equity firm NGP announced the closing of NGP Sustainable Real Assets LLC with roughly $500 million of capital commitments from NGP’s dedicated energy transition fund, NGP Energy Transition IV LP, and co-investors.

The firm said that NGP SRA was formed to invest in real asset development platforms across the energy transition spectrum—including clean power, clean fuels, carbon, transportation, and critical minerals.

“Our strategy with NGP SRA combines NGP’s 35-year track record of partnership-oriented investing, having backed more than 300 development platforms across the energy sector, with our firm’s significant capital, expertise and resources dedicated to the energy transition,” NGP Managing Partner Chris Carter said in a statement.

Over more than three decades, the company has honed its investment model to uncover big opportunities in “these clean energy subsectors,” Carter said.

Phil Deutch, NGP Partner and Energy Transition Fund head, added that “NGP pioneered the investment model that now dominates traditional energy project development” and that the company takes “great pride in our reputation as value-added partners and trusted sector specialists in energy.”

NGP SRA said it invests by partnering with exceptional management teams, often at the earliest stages of company formation, and provides capital and support to help build leading energy transition platforms.

“We’re excited to commit our experience and capital to advancing energy transition projects while seeking attractive risk adjusted returns for our investors,” Deutch said.

The firm aims to fill a clear need in the market.

Sam Stoutner, NGP Partner, said NGP will” continue to see a mismatch between the supply of high-quality, shovel-ready clean energy projects, and the capital to build, finance and own those projects. In NGP SRA, we will focus on backing teams and projects earlier in their lifecycle and working with management to build scaled, diversified, derisked projects and platforms that can ultimately be handed off to lower-cost, longer-term pools of capital.”

Recent clean energy investments

NGP SRA already has closed investments in the three platform companies below and said it continues to evaluate new opportunities to add to its portfolio. NGP SRA generally targets equity commitments of $50-$150 million per investment.

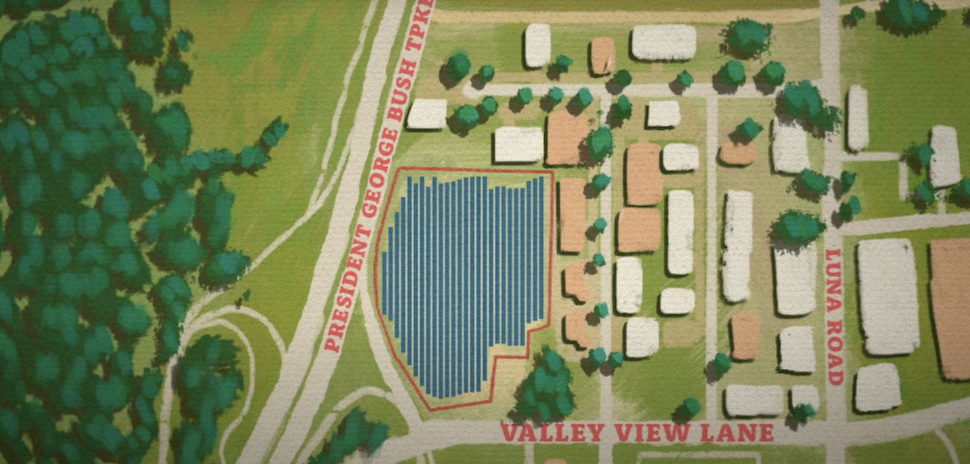

Segue Renewables II LLC: Segue invests in development-stage energy transition projects and the infrastructure enabling them. Segue provides capital and expertise to originate, de-risk, optimize, and monetize projects. Segue Renewables II is the second partnership between the Segue management team and NGP.

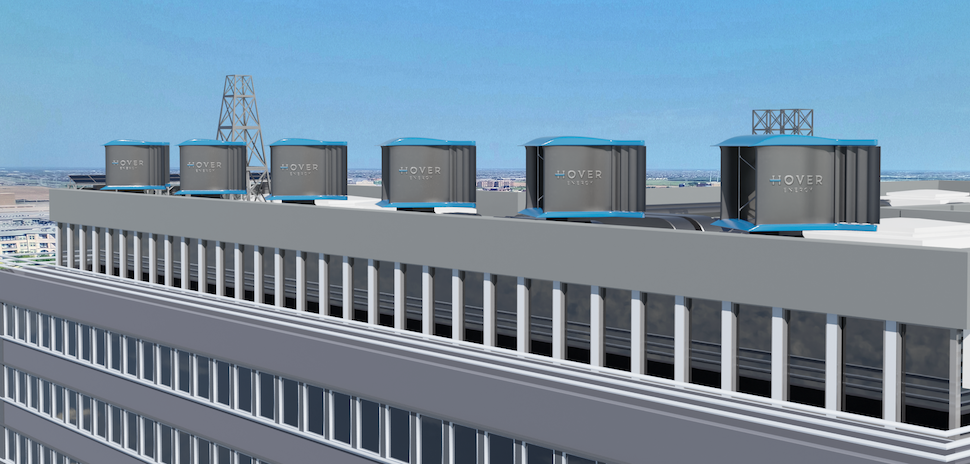

Cloverleaf Infrastructure LLC: Cloverleaf develops clean-powered, ready-to-build sites for the largest electric loads. Leveraging management’s extensive expertise in the power and data center sectors, Cloverleaf collaborates with regional U.S. utilities and data center operators to deliver scalable clean electricity through strategic investments in transmission, grid interconnection, land, onsite power generation, and electricity storage.

CO280 Solutions Inc.: CO280 is the leading developer of Carbon Dioxide Removal projects in the pulp and paper industry. The company partners with pulp and paper companies to develop, finance, own and operate carbon removal projects that deliver a new standard of permanent, verifiable, and affordable carbon removal credits to the voluntary carbon market.

Founded in 1988, NGP said it’s moving energy forward by investing in innovation and empowering energy entrepreneurs in natural resources and energy transition.

With more than $23 billion in cumulative equity commitments, the company said it backs portfolio companies focused on responsibly solving and securing the energy needs of today and leading the way to a cleaner, more reliable, and more affordable energy future.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.