For years, Dallas city officials working to address a common challenge—to enable inclusion and equitable access to employment, housing, and economic opportunities—knew they needed a new way to incentivize development in underserved areas.

Now they have it.

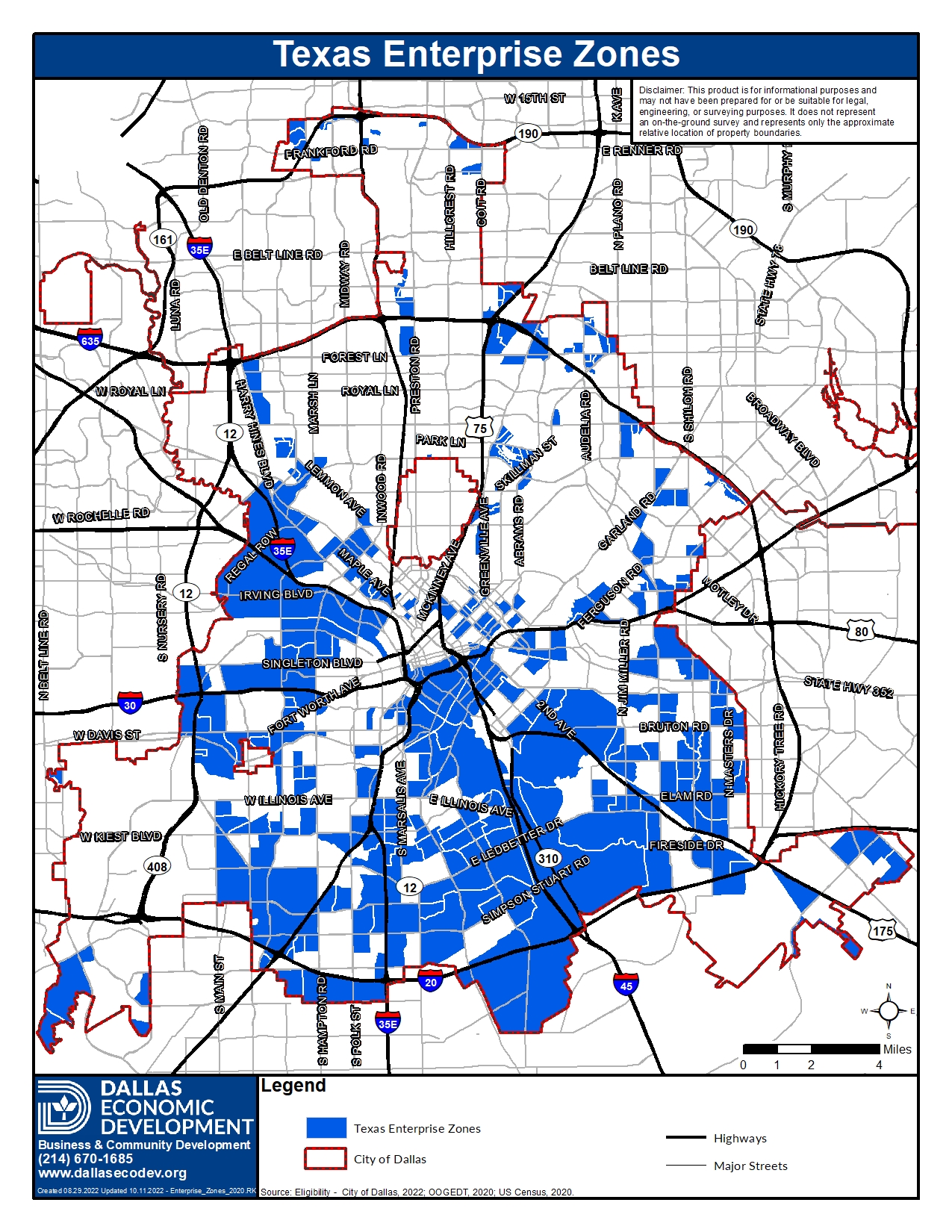

An amended Economic Development Policy and new Incentive Policy prioritizes investment in certain target areas that have been deemed “distressed” by the state. That includes the areas in royal blue on the map below.

“The Incentive Policy keeps all the existing tools that have made Dallas competitive and adds new tools that prioritize investment in these target areas that have a poverty rate of at least 20%,” said Robin Bentley, director of the Dallas Economic Development Office. “The policy also institutionalizes a living wage, streamlines the process for smaller developers, and creates a new fund to address infrastructure challenges.”

Over the long term, these measures are expected to spur new development and enhance equity for all Dallas residents.

The new Incentive Policy includes the following tools:

- As-of-Right Tax Abatements – a standardized tax abatement for projects with capital investment costs between $2-$25 million, that increase the tax base or create jobs. Developers have two choices: a 10-year, 90% abatement of net new City of Dallas real property taxes OR a 5-year 90% abatement of net new City of Dallas business personal property taxes.

- Community Development Loans and Grants – funding for projects that aim to better the overall community — including projects with non-profit developers;

- Predevelopment Loans – Predevelopment loans up to $25,000 for qualified M/WBE or community developers to help provide initial capital for things like site assessment, market studies, and feasibility analysis;

- Infrastructure Investment Fund – designed to help close the infrastructure gap by directing funding to areas most in need of upgrades, including building or updating water/sewer lines, public parks and greenspace, as well as demolition. Such funding is capitalized/amortized by the ongoing collection of windfall funds from the 19 existing tax increment financing (TIF) districts.

The new incentive policy streamlines certain awards; only administrative approval is needed for As-of-right Tax Abatements, Predevelopment Loans for projects led by certified women and minority developers and negotiated incentives at or below $1 million for qualified projects. This cuts down the average time a developer has to wait for a decision by several months.

Informational meetings for developers and residents will be held on the third Thursday of every month at 3 p.m., beginning April 20. For more information, click here.

Voices contributor Nicole Ward is a data journalist at the Dallas Regional Chamber.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.