The multifamily housing boom in North Texas over the past decade has created an environment in which the self-storage industry in the region is flourishing, according to a recent report by RentCafe, a resource for apartment-related information.

In the past decade, the Dallas region has seen roughly 200,000 new apartments enter the market. The self-storage industry stands at almost 72 million square feet in DFW, with 20 million square feet of space delivered between 2012 and 2021. That’s 28 percent of the total self-storage inventory, RentCafe said.

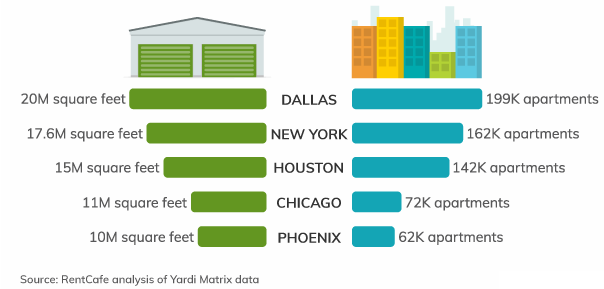

RentCafe’s research of development trends shows that self storage mirrors apartment construction in many markets nationwide. As the best market overall, Dallas-Fort Worth built the most apartments during the last decade and was also the most active metro for self-storage construction, exceeding New York, Houston, and Chicago in both respects.

According to RentCafe’s research, self-storage space grew in all 100 U.S. metros where apartment inventories expanded. But in terms of sheer numbers, Dallas is far ahead in the national race — and one of only five metro areas that built over 10 million square feet of storage space over the last decade. Three of those five also lead U.S. apartment construction, each seeing the addition of over 140,000 apartment units to their rental markets.

Dallas is the most active metro for self-storage development, according to Rentcafe. The chart shows the Top 5 metros by self storage and construction activity from 2012 to 2021. [Chart: Rentcafe]

Here are a few other highlights for the DFW market noted by Rentcafe’s self-storage division:

Self-storage construction amplified in the second half of the decade, with 2018 seeing a massive 3.5 million square feet added to the market.

Despite the COVID-19 pandemic causing a temporary slowdown in new deliveries, the pace of development remains robust in the Dallas metro area with nearly 2.4 million square feet of new storage space and 26,500 new apartments delivered in 2021.

The self-storage pipeline counts over 3.6M square feet set to be delivered in the next two years.

In terms of self-storage supply, the Dallas metro area now offers over 9 square feet per person, well above the national benchmark of 7 square feet per person.

RentCafe said that the increased demand for self-storage in North Texas, driven by the area’s high levels of in-migration paired with the lack of space, has pushed self-storage rent rates to roughly $109 for a standard 10’x10’ unit, up 4 percent year-over-year. The report said that even at that rate, DFW is still priced competitively when looking at the U.S. overall. With the exception of Houston, Dallas-Fort Worth has the cheapest street rate for self-storage of all major metros in the top 10, RentCafe said.

The self-storage sector has seen massive development in the last decade, significantly spurred by the flurry of new apartments coming online all across the country. Roughly 350M square feet of storage space and 3.1 million new apartments have been delivered nationally in the last 10 years.

The country’s top three metro areas for apartment construction of the decade— Dallas, New York, and Houston—are the most active metros for self-storage construction as well.

RentCafe said that 58 of the 100 largest metro areas are expanding their self-storage inventories at a higher speed than the national average.

Over 3.1 million new apartments in 50+ unit buildings were added nationally from 2012 to 2021, representing 20 percent of the large-scale apartment inventory, according to Yardi Matrix data. Also, apartment deliveries hit an all-time high in 2021, with no fewer than 427,000 new rentals added to the U.S. apartment market last year.

Texas remains a hotspot for urban development during the past decade, and its major metropolitan areas experienced high levels of real estate construction, bolstered by economic and population growth.

Dallas-Fort Worth-Arlington is one of the nation’s most popular relocation destinations and saw a 17 percent population growth over the past decade, which led to increased demand for both housing and self-storage. In response, DFW saw almost 200,000 new apartments and over 20 million square feet of new storage space delivered over the past decade, the most for both indicators out of the 100 metros analyzed, RentCafe said.

Construction in both sectors picked up pace during the second half of the decade, with 2018 the best year, during which over 3.6M square feet of self-storage space and nearly 30,000 new apartments were finalized.

Despite the pandemic-related setbacks that hampered the real estate market, Dallas-Fort Worth was quick to recover in terms of self storage and multifamily construction, with nearly 2.4 million square feet of new storage space and 26,500 new apartments delivered in 2021.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.