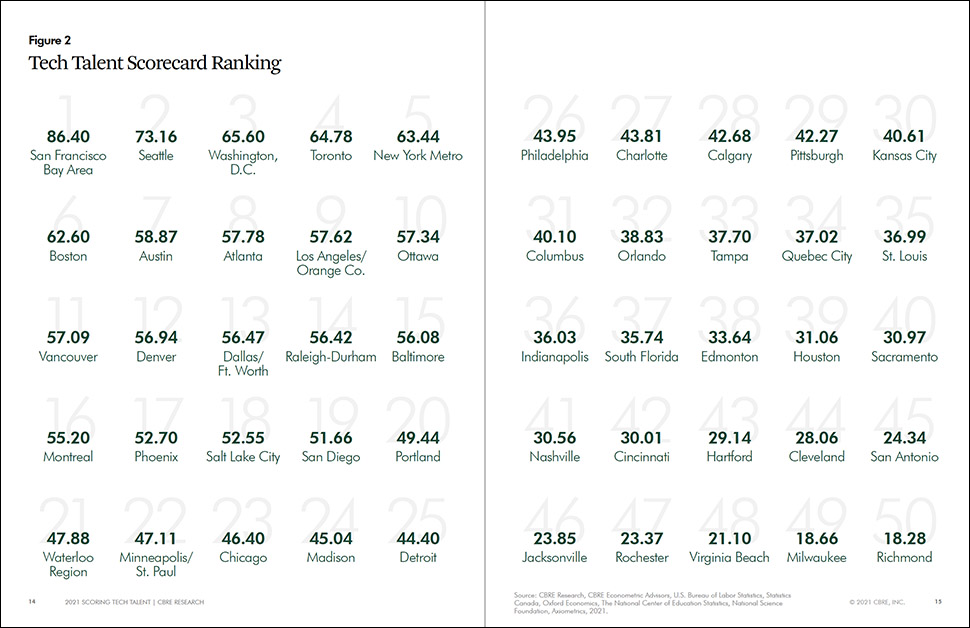

The tech talent labor pool in Dallas-Fort Worth is making waves nationally. The sixth largest in the nation with 189,200 tech workers, it’s grown 16.3 percent from 2015, says CBRE’s annual “Scoring Tech Talent” report released today. Overall, all metrics included, DFW ranked 13th out of 50 U.S. and Canadian tech markets in the report.

Dallas’ favorable business climate and relatively low cost of living have been accelerating corporate relocations to the area.

“We’re currently working with several companies looking at relocating a significant presence to Dallas for the reasons outlined in the report,” said Clay Vaughn, SVP and senior leader of CBRE’s Tech & Media Practice Group in Dallas, in a statement. “In fact, among the locations one of our companies is evaluating, Dallas ranks the highest according to studies completed by our Labor Analytics Group.”

The top five markets for tech talent overall in 2020 were the San Francisco Bay Area, Seattle, Washington, D.C., Toronto, and New York City, the report showed. You can view the report here.

Image: CBRE

Tech-friendly from talent to taxes to living costs

Vaughn points to a host of reasons why tech companies are leaving higher-priced climes for Dallas-Fort Worth.

“With the market’s significant millennial population growth, availability of very good tech talent, favorable tax structure, and relative affordability of real estate on the residential and commercial side, Dallas is proving to be tough to beat,” Vaughn said.

DFW has the 12th lowest apartment rent-to-wage ratio among the top 50 tech talent markets, the study found. The average annual apartment rent here equals 14.2 percent of the average tech talent wage. Try that in San Francisco or New York and you’ll get laughed out of the condo lobby.

A fast-growing tech workforce for years to come

Another attraction the area offers: a growing millennial tech workforce.

“Dallas-Fort Worth has solidified its place high on CBRE’s Tech Talent list for the large size of its tech talent market and the number of tech graduates produced here. However, what is just as compelling is the rate of growth for our millennial tech workforce, ensuring companies can hire locally for many years,” said Jeffrey Eiting, first VP and co-leader of CBRE’s Tech & Media Practice Group in Dallas, in a statement.

“With our competitive annual operating costs, DFW provides a combination of quality and value that sets the region up well for continued growth,” Eiting added, “as companies continue moving to Texas and implementing work-from-home and hybrid office strategies that emphasize quality of life.”

Dallas-Fort Worth stood out in the CBRE report in several other areas as well:

- Millennials aged 23 to 38 increased by 14.7 percent (230,676 people) since 2015—the ninth largest millennial population growth among big tech talent markets.

- The region creates a lot of tech graduates, ranking ninth among big tech talent markets for its number of tech-degree completions (6,672) in 2019. DFW’s tech-graduation rate has outpaced its tech-job growth since 2015, causing a surplus of 4,130 tech grads that found work in other markets.

- DFW ranks in the middle of the pack when it comes to tech company operating expenses. The average one-year cost to operate a 500-employee tech company within 75,000 square feet in DFW comes in at $46.4 million—ranking it 15th most expensive among the top 50 tech talent markets.

CBRE’s Tech Talent Scorecard Ranking [Image: CBRE]

U.S. tech talent weathered COVID well

One finding of the report was the U.S. tech market’s resilience in the face of the COVID pandemic. Tech occupations actually registered job growth of 0.8 percent in 2020, while non-tech jobs declined by 5.5 percent. The most in demand tech jobs last year? Software developers and programmers. 85,000 U.S. jobs were added to that category in 2020, a 4.8 percent growth rate from the year before.

Tech workers also expanded beyond the tech industry last year and into financial companies, professional and business services, and government.

About the report

CBRE’s “Scoring Tech Talent” report, now in its ninth year, ranks the top 50 North American markets by analyzing 13 measures of their ability to attract and develop tech talent. Key measures included tech graduation rates, tech-job concentration, tech labor pool size, and labor and real estate costs.

“Tech talent” is defined as 20 key tech professions, from software developers to systems and data managers, across all industries. Twenty-five additional North American tech talent markets were also analyzed in the report, along with 10 up-and-coming Latin American markets.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.