Dallas-based private equity firm Crux Capital has strengthened its team with two new hires—Kale Kolbe as senior associate and Christopher Herrod as analyst—in moves that bolster the firm’s capabilities in its consumer and commercial services focus areas.

The team expansion follows what Wayne Moore, managing partner of Crux Capital, described as a “killer year.” In a June interview with Mergers & Acquisitions, Moore said that in 2023, the firm completed “two add-ons, raised a restaurant holding company fund, and made a platform acquisition.”

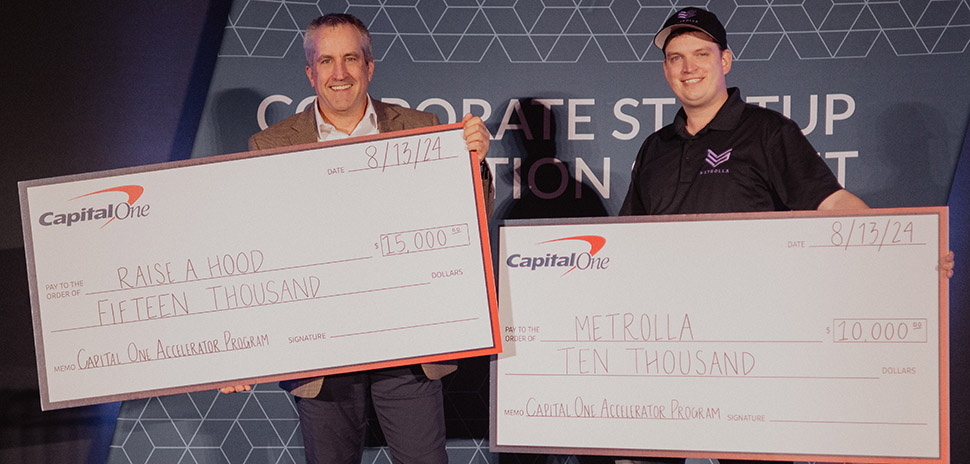

Kolbe joins Crux Capital from Kainos Capital, where he specialized in the food and consumer products sector as an associate. His experience includes working with management teams on growth initiatives and evaluating businesses in manufacturing, distribution, and branded consumer products.

“Having Kale join our team strengthens our operational expertise within the consumer sector,” Moore said in a statement. “His history of implementing value-add initiatives will be invaluable as we work to accelerate the growth of our portfolio companies.” Prior to his role at Kainos, At Crux, Kolbe will evaluate, execute, and monitor investment opportunities, collaborating with portfolio companies to drive long-term value creation.

Herrod, who comes from Cowen, where he worked on buy-side and sell-side transactions in the services sector, will support Crux Capital in identifying and evaluating investment opportunities, performing due diligence, and helping portfolio companies with growth strategies.

“Christopher’s background at Cowen gives him strong transaction experience in the services space, which aligns perfectly with one of Crux’s focus areas,” said James Kay, principal at Crux Capital. “We are confident he will be a key contributor as we expand our investment pipeline.”

Active and realized investments in growing companies

Crux Capital specializes in investing in and growing consumer and services companies, focusing on high-quality businesses where it can collaborate closely with management to build long-term value. Four of Crux’s five platform companies were founded in Texas, and the firm relocated its fifth platform company—Buff City Soap—from Memphis to Dallas.

- HTeaO: In December 2022, Crux invested in this franchisor specializing in ultra-premium tea products. HTeaO offers 24 flavors of sweetened and unsweetened iced tea and aims to expand to 500 locations by 2026.

- Superscapes: Crux added this commercial landscaping services provider to its portfolio in January 2020. Operating across Texas and Arkansas, Superscapes serves notable property owners and developers. Its work on the 1,000-acre Cypress Waters development in Dallas recently earned industry recognition for handling water rationing and soil management challenges.

- Woody’s Brands: In May 2022, Crux invested in Woody’s, a multi-unit operator of bar-restaurant concepts across Texas and Louisiana. Woody’s manages two brands: Little Woodrow’s, a neighborhood bar and “biergarten,” and Fast Eddie’s, a classic pool hall.

- Uncommon Brands: Crux’s most recent investment came in December 2023, with the firm backing Uncommon Brands, a holding company built to invest in and scale restaurant brands. Its first partnership is with Fuego Tortilla Grill, a Tex-Mex concept, with plans to add more limited-service restaurant brands.

Crux Capital has also had success with realized investments. In November 2019, the firm invested in Buff City Soap, a franchisor offering handmade, plant-based personal care products. Crux partially exited the business in May 2021 and May 2022, selling stakes to General Atlantic. Buff City Soap continues to grow, recently expanding into liquid laundry soap.

Crux Capital found Dallas the optimal base for growth

Moore, a hedge fund veteran, founded Crux Capital in Dallas about six years ago. The decision was driven by data, after Moore hired an analytics firm to conduct an in-depth review of the top 100 U.S. markets. Ultimately, Dallas’s mix of population growth, a vibrant business environment, and strategic location in the heart of Texas made it the clear choice, according to Mergers & Acquisitions

Moore emphasized that this decision wasn’t just about immediate gains; it was about setting Crux Capital up for sustainable, long-term growth in an increasingly competitive private equity landscape. “Dallas was the best place in the country to open a private equity firm,” Moore told the publication.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![Kale Kolbe, left, joins Crux Capital as a senior associate and Christopher Herrod is an Analyst for the firm. [Photo: Crux Capital]](https://s24806.pcdn.co/wp-content/uploads/2024/10/Crux-Capital-kale-kolbe-chirstopher-herrod.jpg)